Proprietary trading is a model in which a trader works for the company’s capital and receives a percentage of the profit. More and more platforms are popping up on the market offering a “challenge”—a test that, if passed, gives you access to manage capital worth up to hundreds of thousands of dollars. For experienced and ambitious traders, this is a real way to scale up trading without risking their own money.

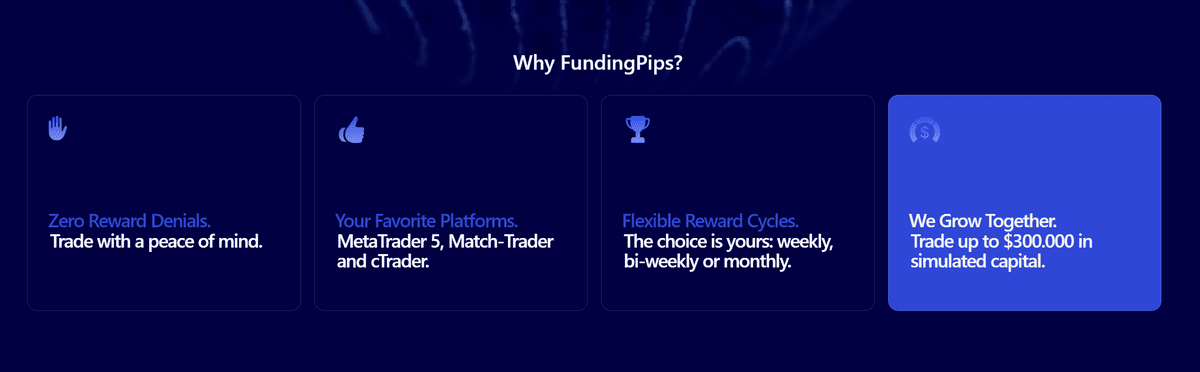

Among the many similar services, FundingPips.com stands out. It is a rapidly growing prop firm that promises traders loyal conditions, transparent rules, and high payouts. In this article, we will take a look at how FundingPips works, what its features are, and whether it is worth trying prop trading 2025 on this platform.

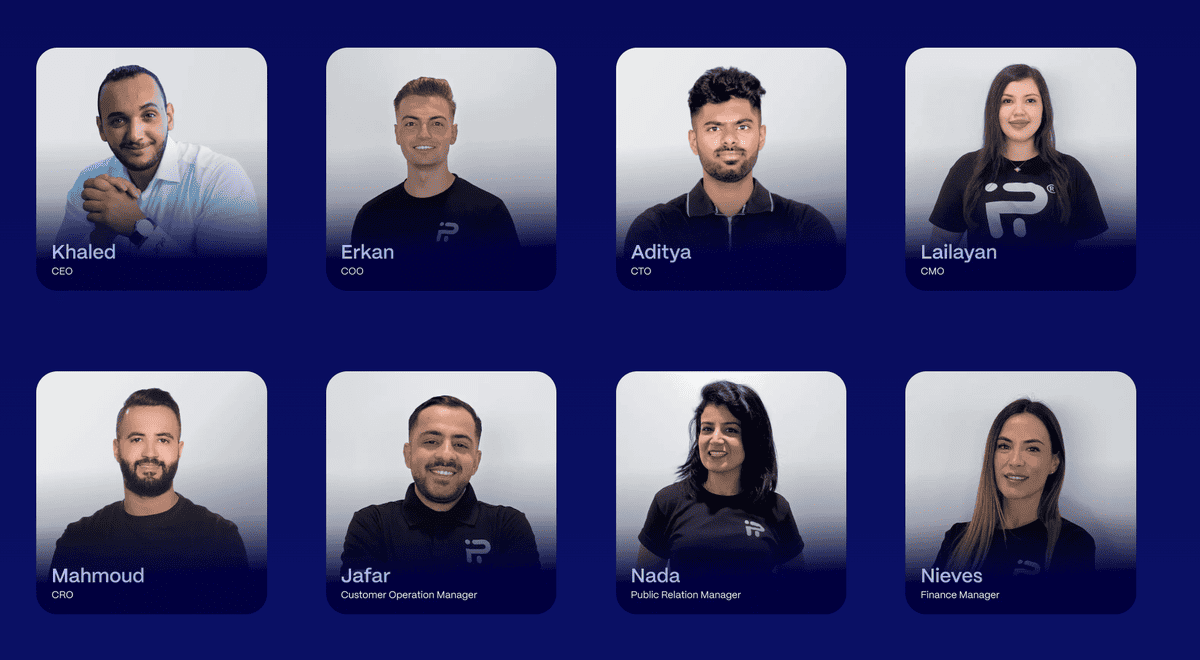

FundingPips is a private trading firm operating under the legal name ANKH PROP – FZCO, registered on August 25, 2022, in Dubai, UAE. The company’s headquarters are located in the IFZA Business Park, Suite No. 19448-001. The CEO is Khaled Ayesh, under whose leadership the firm entered the market with the ambitious goal of making prop trading accessible, fair, and profitable for retail traders around the world.

Since its launch, FundingPips has positioned itself as a platform created by traders for traders. This is not just a slogan; the firm genuinely strives to simplify access to trading capital by removing unnecessary bureaucracy, restrictive conditions, and opaque rules that traders often encounter at other prop firms.

In 2023-2024, the platform underwent active development:

FundingPips continues to grow rapidly, focusing on fast registration, fair terms, and transparent payments. The company has quickly earned a reputation as a platform where you can trade for serious amounts (up to $200,000).

One of FundingPips’ strengths is its flexibility in choosing a cooperation model. The platform offers several financing options so that traders can choose the optimal format depending on their experience, trading strategy, and goals. FundingPips offers traders four financing formats. There are both classic two-stage challenges and one-stage models for those who want to access capital faster. And for those who are most confident in themselves, there is an option with instant funding, where no verification is required at all. This choice allows you to adapt to different trading styles and levels of experience. Below, we will examine each of the programs separately.

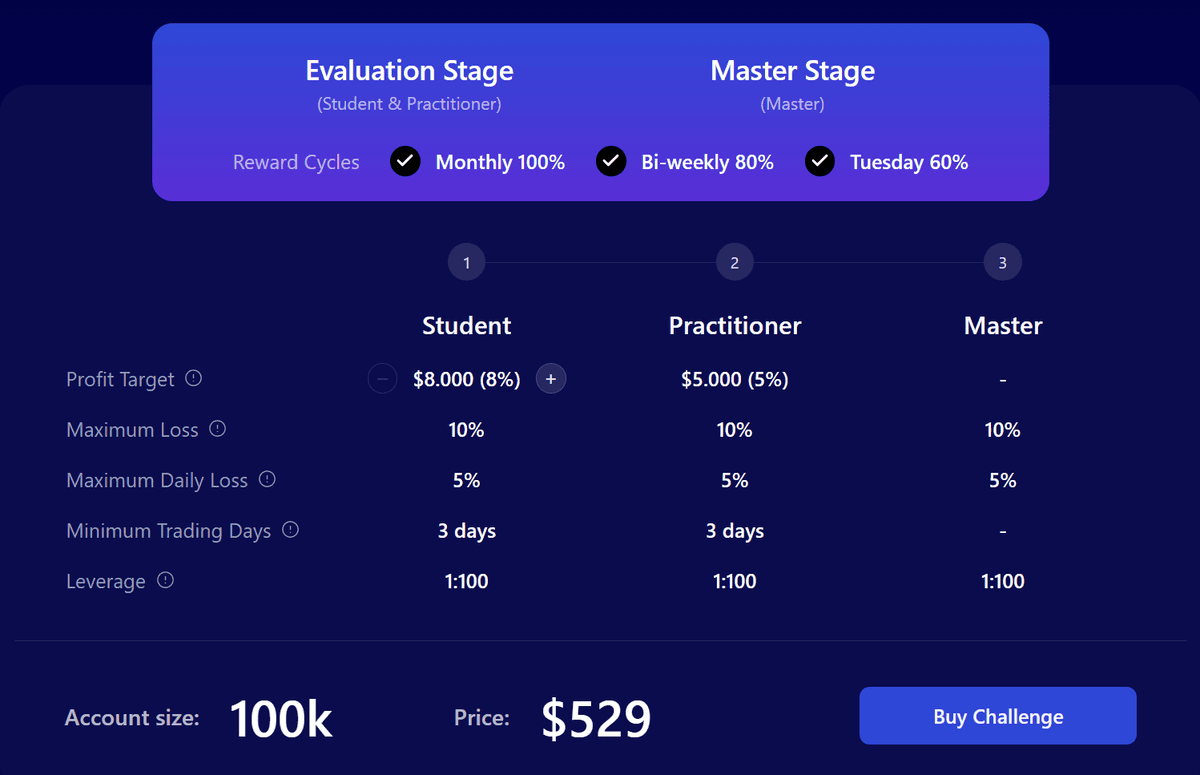

2-Step FundingPips is a classic funding scheme where traders must demonstrate stable trading in two stages with fixed targets and risk limits. This model includes three stages: Student, Practitioner, and Master—the latter being a pre-funded account. The cost of purchasing a package ranges from $36 for an account size of $5,000 to $529 for an account with a balance of $100,000. The conditions for each stage are outlined below.

At this stage, you need to demonstrate your ability to control risk and increase profits. There are no time restrictions, only a requirement for a minimum of 3 active trading days.

The conditions become slightly less stringent: the target profit is lower, but the risk rules remain the same. This stage serves to confirm that the first result was not accidental.

If both stages are successfully completed, the trader receives Master status and access to a real account with profit distribution.

At this stage, the trader is already working with real conditions, receives a percentage of the profit (up to 90%) and can scale up while managing risks and maintaining stability.

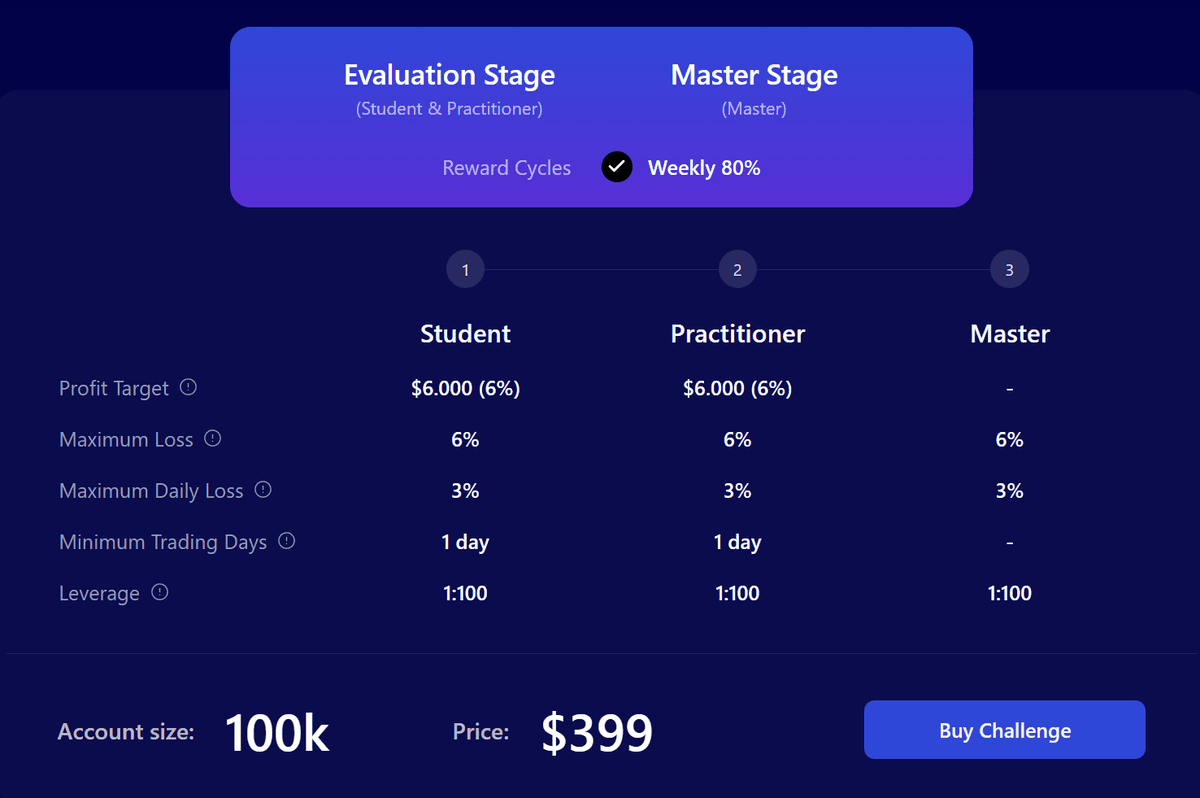

2-Step FundingPips Pro is a two-step model designed for more conservative traders who prefer to trade with lower risk and smaller profit targets. The conditions are stricter than in the standard model, but this allows traders to demonstrate a more realistic and sustainable trading style, which is highly valued at the funded stage. The cost of purchasing a package ranges from $29 for an account size of $5,000 to $399 for an account with a balance of $100,000. The conditions for each stage are outlined below.

This stage is designed so that traders can demonstrate their ability to manage risk in a restrained but effective manner. The minimum limit of one trading day makes this stage passable in just a couple of successful sessions, without the pressure of deadlines.

Unlike the standard model, the target profit here does not decrease, which makes the second phase slightly more demanding. However, the requirements for risk and duration remain the same, simplifying the repetition of the strategy from the first stage.

After successfully completing both phases, the trader receives a Master account with real profit distribution:

2-Step FundingPips Pro is suitable for those who know how to work in a “low risk – steady profit” style. This model is for those who value control and discipline more than aggressive returns.

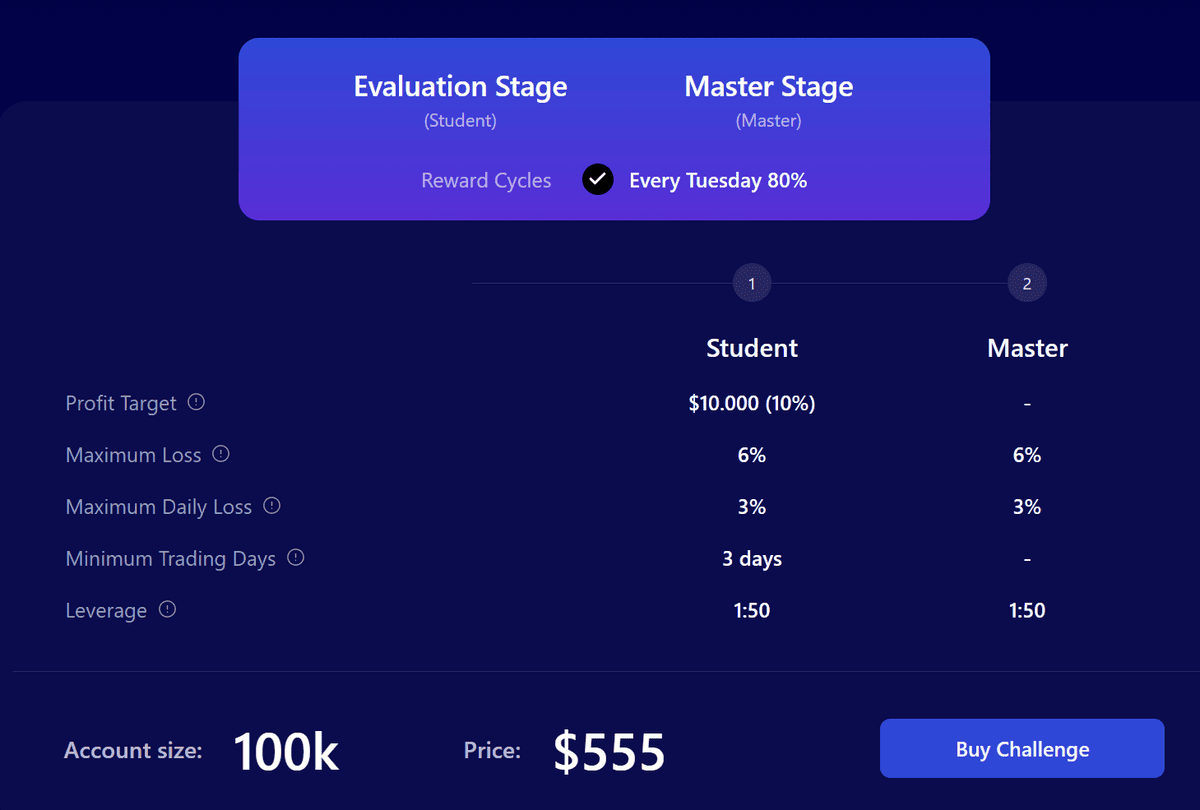

The 1-Step Evaluation model is the most direct path to funding. No re-evaluation stages, no multi-step bureaucracy. Traders need to demonstrate stability and results in just one stage to access a real account.

The trader is given unlimited time to fulfill the conditions, but at least three trading days must be completed. The main thing is not to exceed the risk limits and achieve a 10% increase in the starting balance. The leverage here is reduced to 1:50 to encourage a more thoughtful approach to risk.

After successfully completing the assessment, the trader gains access to a real account with conditions similar to those of the assessment stage.

1-Step Evaluation is a compromise between speed and discipline. It is suitable for those who want to quickly obtain financing but are willing to work under conditions of limited leverage and a strict risk model.

Instant Financing – FundingPips Zero Evaluation

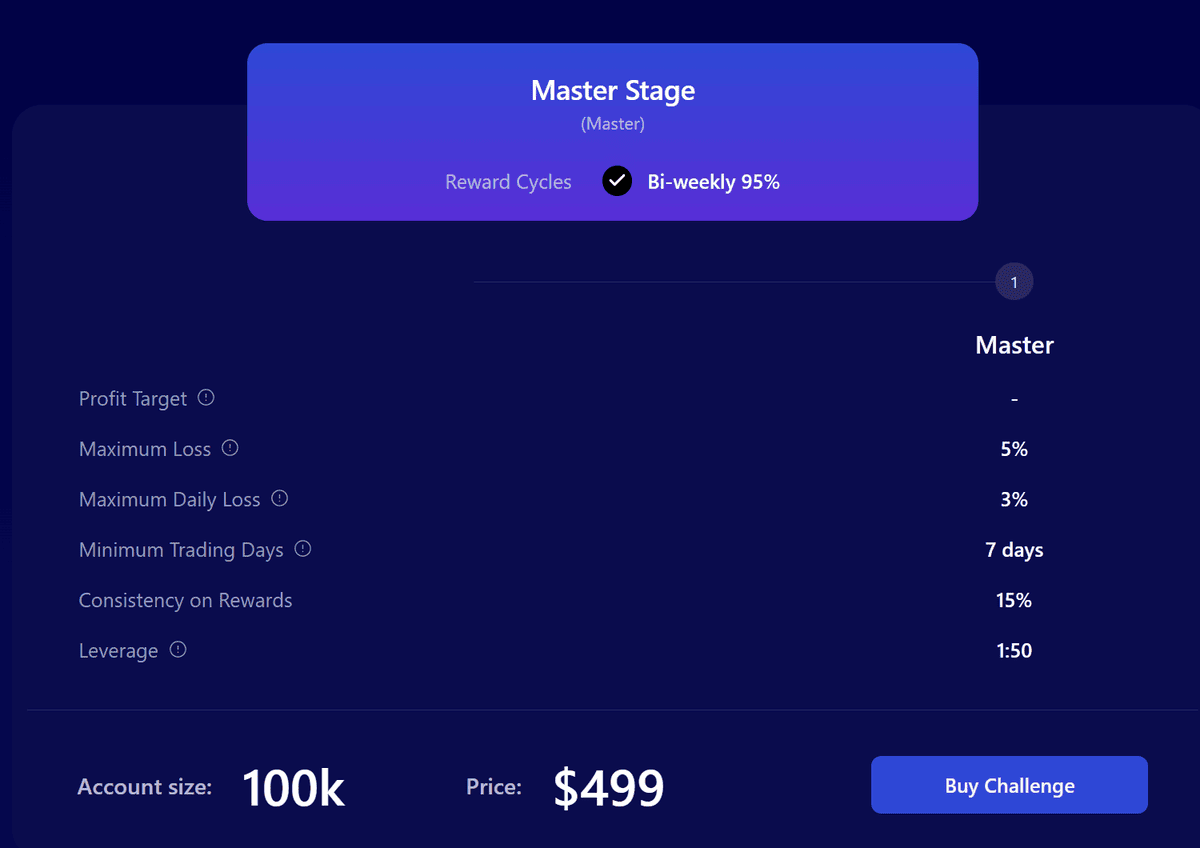

Zero Evaluation is a program in which traders immediately gain access to a real account, bypassing any selection phases. This format is for experienced and confident traders who are ready to take responsibility for their results from day one. The cost of purchasing a package ranges from $69 for an account size of $5,000 to $499 for an account with a balance of $100,000.

Master (Funded account immediately)

FundingPips Zero Evaluation may seem like a very attractive package, as you can get funding without a challenge. But there are stricter risk limits here, and the system is designed to prevent aggressive or one-off gains. The Consistency Rule is key. To be eligible for payment, a maximum of 15% of total profits can be made in a single day. This rules out the “one-hit wonder” strategy and requires consistent trading. In addition, leverage is limited here to curb excessive strain on the deposit and encourage conservative strategies.

FundingPips Zero Evaluation is an excellent choice for those who don’t want to waste time on verification but are willing to follow risk management rules and demonstrate consistent trading from day one.

FundingPips offers flexible formats for obtaining capital, but in return requires strict adherence to risk management and market behavior rules. Violation of these rules may result in account cancellation, restricted access, or a complete ban. The platform openly declares that its goal is to create a stable, professional trading community, rather than encourage chaotic speculation.

What is considered a violation – Toxic Trading

FundingPips actively combats toxic trading styles that undermine both the stability of the firm itself and the personal results of traders. Here are the key signs of toxic behavior:

Over-Leveraging. Using maximum or full margin leverage without an objective reason, especially on one or two trades. On master accounts, the loss on a single trade should not exceed 3% of the balance.

Consequences for toxic trade

If a trader is observed engaging in toxic behavior, the platform may apply the following sanctions:

FundingPips emphasizes that its goal is to help traders grow as professionals, not just achieve results. Their model is based on trading flow analysis: high-quality statistics help not only to select the best traders, but also to maintain business stability. Therefore, discipline and transparency are essential.

FundingPips.com supports three trading terminals, making the platform convenient for traders with different preferences. You can choose the interface you are most comfortable working with, whether it’s the classic MT5, the modern Match Trader, or the advanced cTrader.

A classic for most traders. FundingPips provides access to MT5 on all popular devices. To log in, use the account number and password provided on the FundingPips dashboard. There are two modes: Master Access – full control (trading, position management) and Investor Access – view only.

Suitable for traders who value transparency, market depth (Level 2), and a non-standard interface. If you already have a cTrader account, the system will automatically load your data. If not, you need to create an ID via email and confirm it.

FundingPips uses its own custom version of Match Trader, available only through the account dashboard:

Match Trader is a lightweight, fast terminal with native integration into the FundingPips ecosystem, making it particularly convenient for beginners or those who want to avoid using third-party platforms.

It is important to understand that all terminals operate with a single password and login specified in your personal account. Support for all platforms implies identical trading conditions: leverage, limits, and execution type. Trading is only possible through the specified versions of the applications. Logging in through third-party or generic versions may not work correctly.

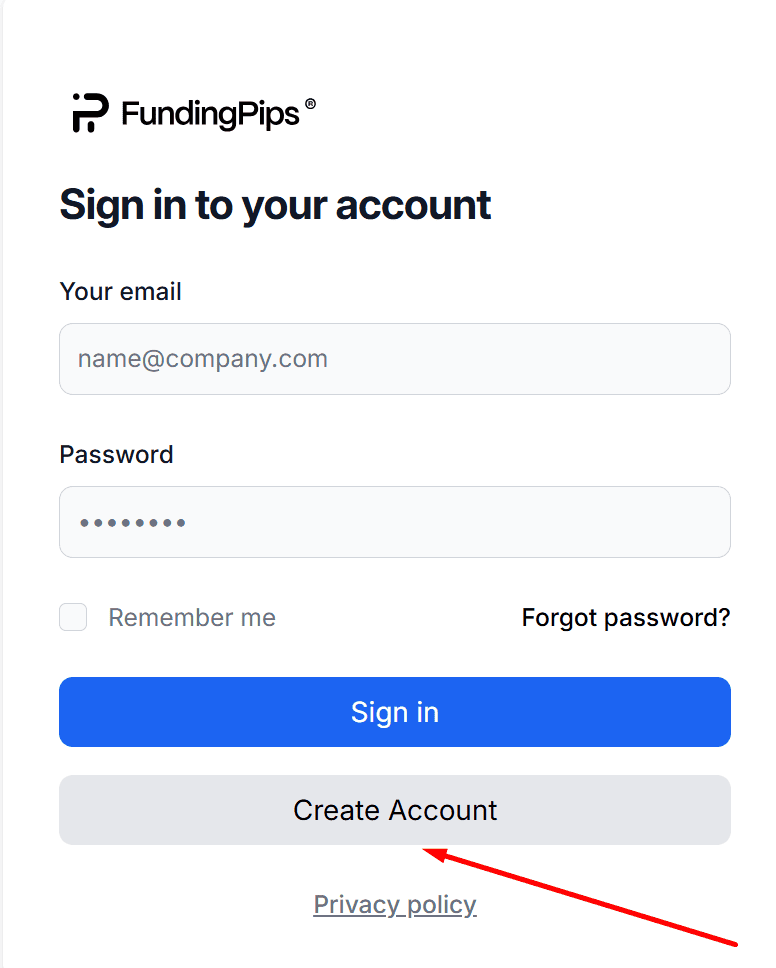

To begin the registration process, go to the official FundingPips website via our referral link (remember that registering via our link gives the account owner many bonuses and advantages). Without filling out the login form, click the “Create Account” button.

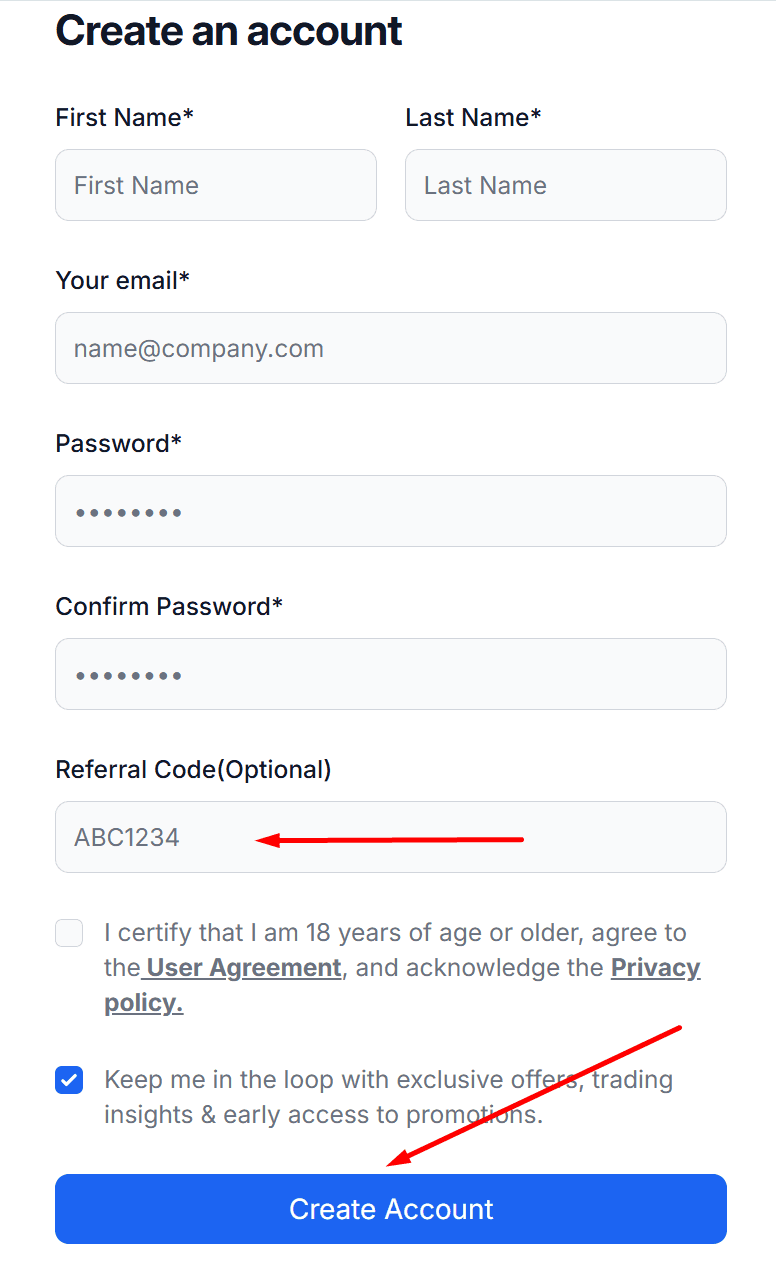

In the next step, fill out the registration form: enter your first name, last name, email address, and password twice. To receive bonuses, check that “******” is entered in the “Referral code” field. Agree to the terms and conditions of the public offer agreement. You can uncheck the box below about promotional offers to avoid spam. Then click the blue “Create Account” button below.

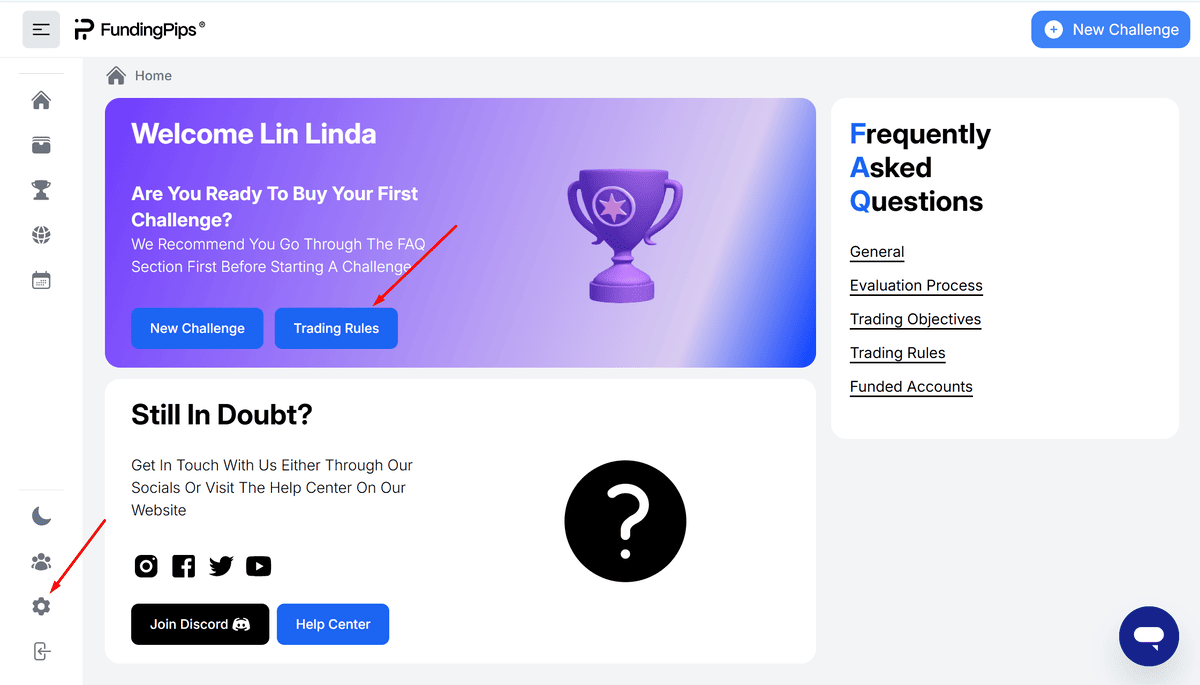

Now you need to confirm your email address. To do this, simply follow the link in the email. Then log in to your FundingPips personal account with your email and password. You can check the “Remember me” box so you don’t have to do this regularly. When you log in for the first time, the system sends a welcome message. We recommend that you immediately click on “Trading Rules” and carefully read the rules before paying for the package. You can also go to the settings in the left navigation bar by clicking on the gear icon. Fill in your current profile details in the “Profile” section and click the “Update” button to proceed to the second stage of verification (KYC). Please note that even though we can pay for the package without verification, after completing the challenge, the system will still require you to go through KYC, so it is better to complete this procedure right away to avoid unpleasant surprises later. Next, in the “Security” section, you can enable two-factor authentication to increase the security level of your account.

Like any prop trading platform, FundingPips is not perfect. But it has a number of strengths that set it apart from its competitors, as well as a few things to consider before getting started.

Pros

All major program types are available: two-stage classic and Pro, one-stage model, and instant financing. This provides flexibility—you can choose a strategy that suits your trading style.

After payment, access to the account is granted almost immediately. There is no need to wait for manual confirmation or undergo verification for several days.

Support for MT5, cTrader, and their own Match Trader is a big plus. You can choose the platform that suits you best, without being limited to a single solution.

All terms and conditions are clearly stated, with no fine print or hidden pitfalls. Maximum and daily drawdowns are fixed, limits are known in advance, and the consistency rule applies only where specified.

On funded accounts, traders can start making profits within a week of starting to trade—without delays or red tape.

One of the most generous distribution models on the market. Experienced traders can really earn significant amounts.

Instead of catching traders on formalities, FundingPips focuses on truly dangerous styles: arbitrage, risk overload, trading without a strategy.

The personal account is intuitive, with quick access to account data, rules, terminals, and payments.

Cons

Most real accounts have a leverage ratio of 1:50, which may be inconvenient for traders who are used to more aggressive trading.

Models such as Zero Evaluation apply the Consistency Rule (no more than 15% profit per day) — a restriction that can hinder traders with sharp spikes in profitability.

For conservative traders accustomed to MT4, this may be a disadvantage—only MT5 and alternative platforms are available.

Although it is stated that “Tier 1 liquidity” is used, the name of the specific broker or provider is not disclosed.

On the one hand, this is good—everything is transparent. On the other hand, false alarms sometimes occur, and the lack of live support can delay the resolution of the situation.

The platform expressly prohibits such approaches, which limits the use of certain algorithms and trading systems.

FundingPips is a mature, next-generation prop trading platform that emphasizes fair terms, transparent rules, and flexibility for traders. Unlike many competitors, there is no excessive bureaucracy, unpredictable restrictions, or ambiguous rules.

The platform offers several cooperation options: from two-stage models to a one-stage format and even instant financing without any verification. This allows you to choose an approach that suits your level of experience and trading style. FundingPips is also technically advanced—traders can work not only through MetaTrader 5, but also through cTrader or Match Trader, including mobile and web versions. This is rare for the market, where many firms are still limited to MT4 or MT5.

The payment terms are among the most loyal in the industry: traders can withdraw profits just seven days after starting to trade on a financed account, and the profit share reaches 90%. At the same time, FundingPips clearly defines its boundaries: the platform does not tolerate toxic trading, aggressive schemes, arbitrage, or risk manipulation. This approach is not aimed at mass appeal, but at selecting stable and systematic traders with whom long-term cooperation can be established.

It is important to understand that FundingPips is not for everyone. Here, you cannot increase your account balance, trade your entire deposit, or place everything on a single trade. Moderate leverage, limits on daily profits, and mandatory risk management rules require discipline and strategy. The platform is not for impulsive players or those looking for easy money.

Overall, FundingPips can be recommended as one of the most balanced and transparent prop firms on the market in 2025. If you understand why risk management is necessary, know how to maintain stability, and want to scale your trading on the basis of partnership rather than survival, then this platform will give you that opportunity.

Write or call us. We will help you quickly re-register your accounts. Enjoy a new level of trading with cashback every month.

You are used to trusting professionals in your everyday life. Trust us with your interactions with exchanges. You won't want to go back to trading without Feebacker.com.