The world of cryptocurrencies is growing, and with it, the desire to automate trading. Automatic cryptocurrency trading has long ceased to be entertainment only for techies. Trading bots on Telegram have become a working tool for catching pumps, managing altcoins, and locking in profits without constantly staring at charts. They help you quickly buy and sell tokens, control risk, and take profits even from your phone, when speed is everything. The main thing is to choose a bot that really works and doesn’t scam you out of your money.

Translated with DeepL.com (free version)

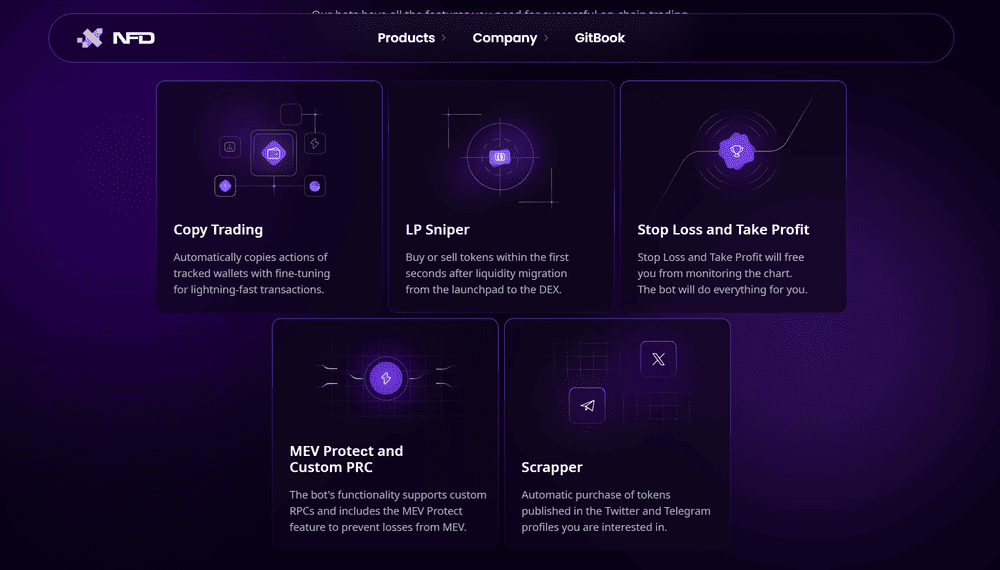

NFD Trade Bots (https://t.me/nfd_bep20_trade_bot?start=FEEBACKER) is a line of trading bots for automated trading on various blockchains. The company has solutions for every major network: Tron Chain, BSC Chain, SUI Chain, BASE Chain, APE Chain, XRP Chain, and Bera Chain. These bots help you buy tokens by contract, place limit orders, use trailing stops, monitor PnL, and withdraw profits in just a few clicks. If you want to automate trading and do it conveniently, NFD Trade Bots may be the solution for you. In this review, we will analyze how they work, what opportunities they offer, and what risks there are for real trading. In addition, below you will find detailed instructions on how to register and use the NFD BNB Trade Bot.

NFD Trade Bots emerged as a solution for traders who lacked speed and convenience when working with altcoins on DEX. The project’s founders started with the idea of creating a bot for fast trading on the TRX Chain when they noticed that many users were losing profits due to lengthy manual operations when buying and selling tokens. The CEO of the NFD team is a certain Leo (https://x.com/Leo_NFD?t=DO2e2o9RL39e6GDTldOwOA&s=09), who does not yet want to show his face in public. The rest of the project team remains completely behind the scenes at this time. The first version was NFD Tron Trade Bot, which allowed users to buy tokens under contract and sell them with a single click, bypassing complex interfaces.

After a successful launch and stable use in the community, the team expanded the line by developing bots for other popular networks for traders: Tron Chain, SUI Chain, BASE Chain, APE Chain, XRP Chain, and Bera Chain. Each new bot brought improvements: the ability to set trailing stops, set limit sales, track PnL, quickly receive notifications about order execution and errors, and integrate token analytics. The developers focused on keeping the bots simple even for beginners, but providing the necessary functionality for active trading of pumps and altcoins in networks where speed is important.

Today, NFD Trade Bots is evolving as a unified ecosystem of tools for automated token trading on Telegram, offering traders the ability to manage their positions on different blockchains in a single familiar format. The project continues to receive updates, improving security, order logic, and integration with new networks so that users can lock in profits and manage risks without unnecessary red tape.

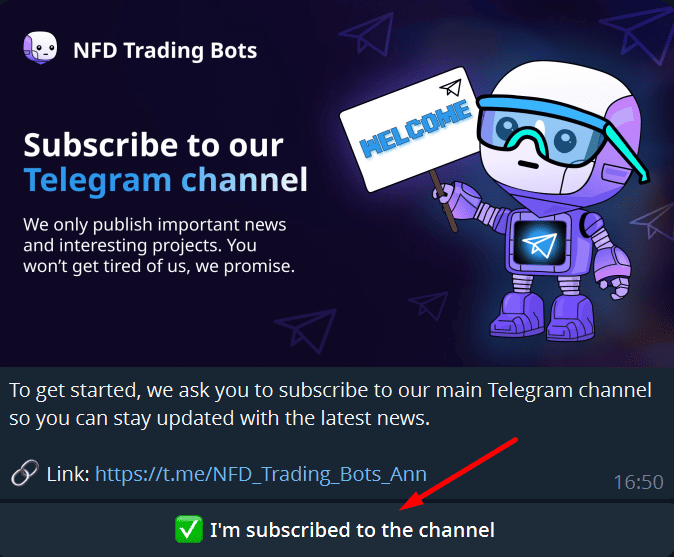

To start working with this tool, go to the bot @nfd_bep20_trade_bot https://t.me/nfd_bep20_trade_bot?start=FEEBACKER and click the “Start” button. The bot will then ask you to join the main Telegram channel. Join the channel and click “I am subscribed to the channel.” Please note that it is impossible to trick the bot and not subscribe to the channel — we have tested this.

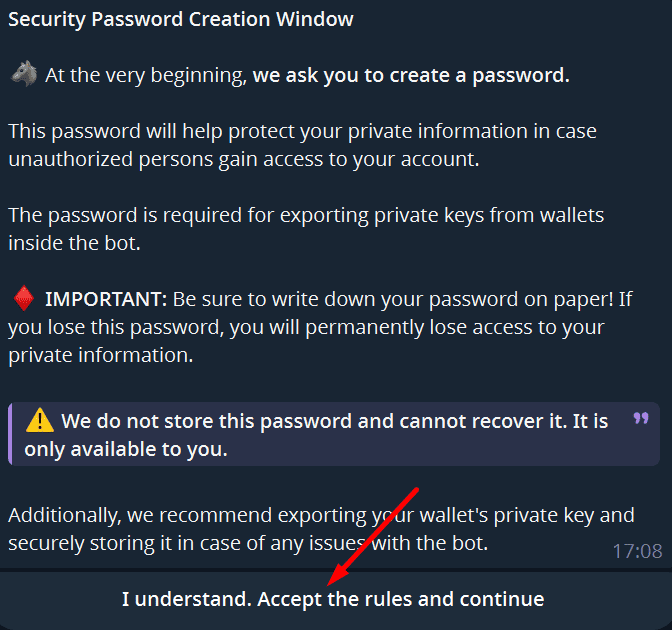

Next, we will learn how to create and store a password, as well as export private keys. Click on the “I understand. Accept the rules and continue” button.

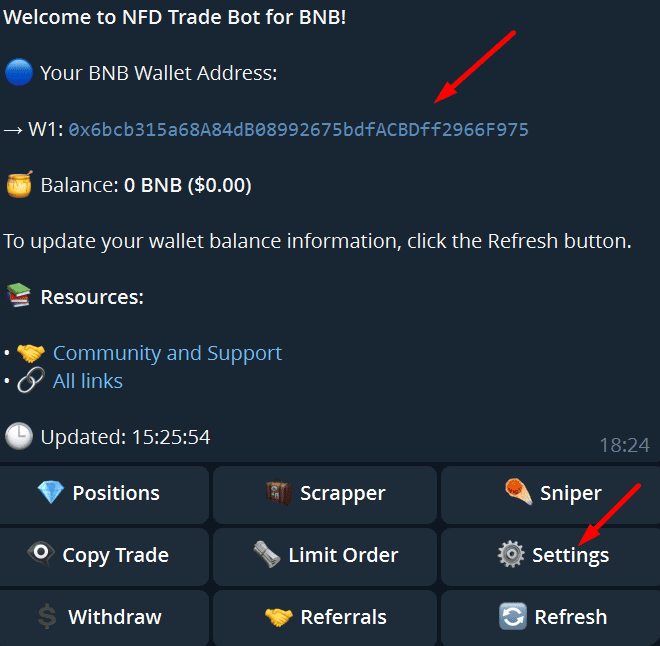

Now, create a strong password, enter it directly into the chat, and send it to the bot. The bot will ask you to confirm the password—enter it again. After that, we will be taken to the NFD BNB Trade Bot main menu. Here, we can copy the wallet address to which we need to transfer BNB for trading. Here, we also click the “Settings” button to go to the settings.

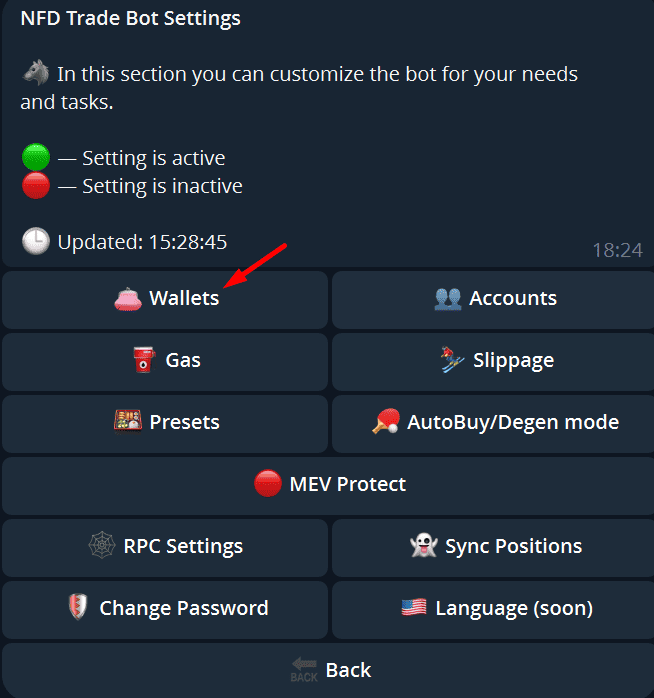

Let’s start by saving our private key and setting up our wallets. To do this, click “Wallets” in the settings menu.

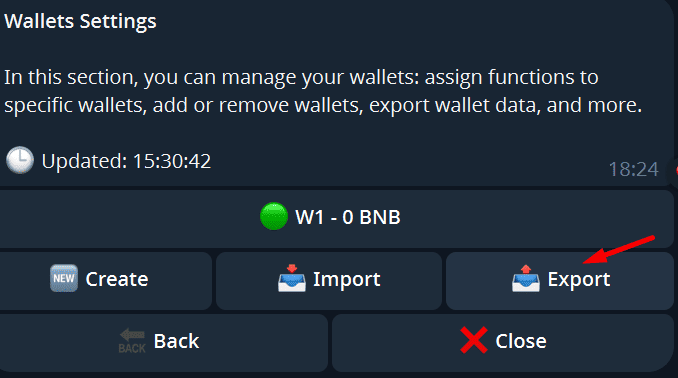

This section contains several useful options: activation, deactivation, and setting up a wallet for specific operations (by default, for copying trades, for sniping, for executing limit orders), the ability to create a new wallet, import a wallet, and export a wallet. Click “Export” to save your private key.

The system will ask you to enter your password. Then select the specific wallet for which you need the key and click on it. After that, the bot will send you the private key and seed phrase for the desired wallet. The message will be automatically deleted after 10 seconds, so don’t waste any time!

Gas

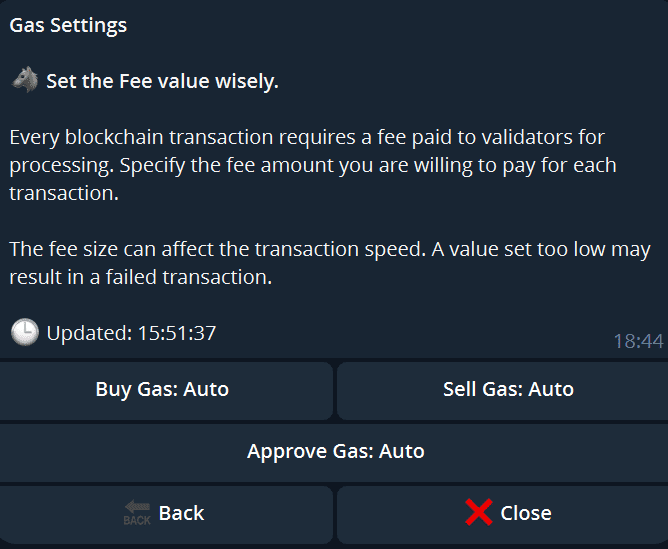

The next item in the settings menu is “GAS.” Click on it. In NFD Trade Bots, you can flexibly manage gas consumption so that your trades don’t get stuck in the mempool and don’t go through at inflated prices. There, you can set different gas values for buying, selling, and confirming tokens. Usually, the default settings are sufficient, but during high-profile token launches or heavy network traffic, it is worth increasing the gas to ensure that your transactions are processed faster than others.

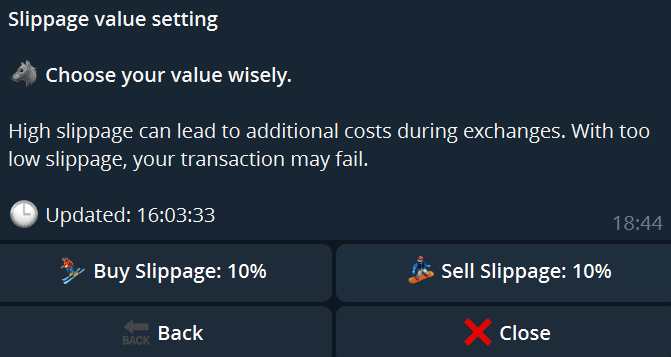

Slippage

At NFD Trade Bots, we can manually set slippage so that our trades go through when needed and don’t fail due to price fluctuations. To configure this, go to “Slippage” in the settings menu. Slippage is the acceptable deviation of the token price from the declared price at which the bot will still execute the trade. If the price goes beyond the limits, the bot will cancel the transaction and save the funds. Use slippage wisely: for liquid tokens, set 3-5%, and for tokens that can quickly fly away in a pump, set 15-20% if you need to enter as quickly as possible, but always understand the risks.

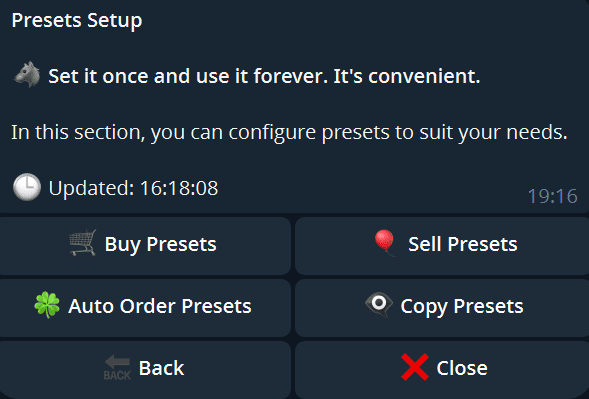

Presets

At NFD Trade Bots, we can set up presets so that we no longer have to waste time on the same settings for each trade. This makes trading much easier, especially when the market is volatile and you need to act quickly rather than fiddle with settings. Once we set up the presets, the bot will automatically apply them to all operations: purchases, sales, auto-orders, and copy trading.

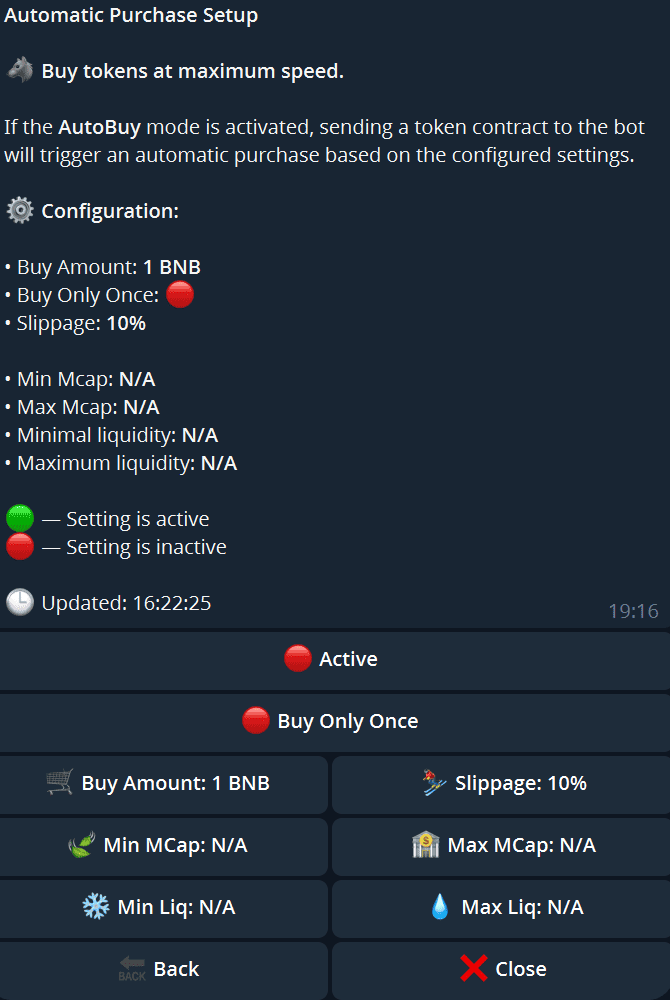

Auto Buy (Degen Mode)

At NFD Trade Bots, we have an Auto Buy mode (Degen Mode) to buy tokens as quickly as possible without wasting time on confirmations and manual parameter entry. When this mode is enabled, simply send the token contract to the bot, and it will immediately buy it on pre-set terms. Before using it, we configure the purchase amount, slippage, minimum and maximum market capitalization of the token, and minimum and maximum liquidity. If the token we send to the bot does not meet these conditions, the bot will simply not buy it and will issue a notification. After configuring the parameters, click the “Activate Auto Buy (Degen Mode)” button. If desired, enable “Buy Only Once” — in this case, the bot will buy the same token only once, even if we send it the same contract again.

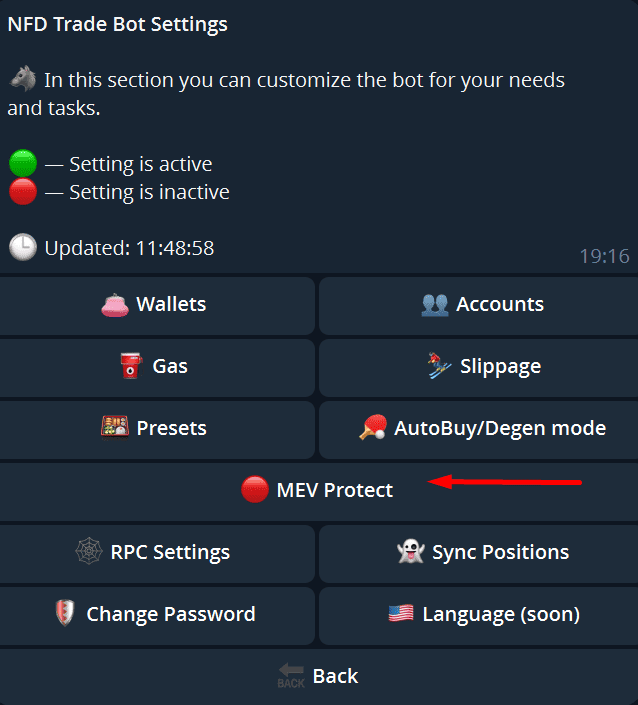

MEV Protect

In NFD Trade Bot, we can enable MEV Protect—protection against bots that hunt for our transactions when we buy or sell tokens. MEV (Maximal Extractable Value) is the maximum profit that miners or special MEV bots can extract by monitoring the mempool and manipulating the order of transactions. Simply click on “MEV Protect” in the settings to enable or disable this option. Using MEV Protect in NFD Trade Bots gives us an advantage and peace of mind when every second counts and the market is full of bots that want to take a cut of our profits.

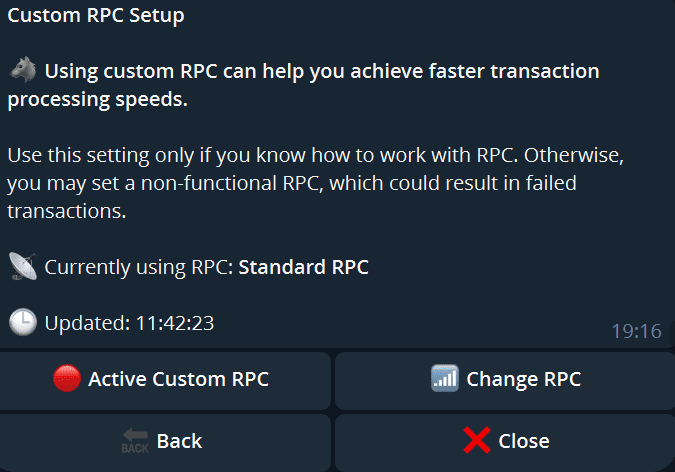

RPC Settings

To work with blockchains, NFD Trade Bots use RPC (Remote Procedure Call) — special access points through which the bot sends transactions and receives data about balance, prices, and network status. By default, the bot uses standard RPCs, which are suitable for most users. But if we want more stability or speed, we can connect our own RPC nodes. Go to the “RPC Settings” section in the settings menu. Click “Change RPC”. Send your RPC endpoint to the bot. Click “Activate Custom RPC” to activate the new node. If you want to return to the default settings, simply click “Activate Custom RPC” again, and the bot will switch to the default RPC.

Sync Positions

In NFD Trade Bots, we have a “Sync Positions” feature that helps synchronize data between the bot and our wallet so that the positions we hold are correctly displayed in the bot interface. This is necessary if we bought tokens outside the bot (via DEX, other wallets), but want to see them in the bot interface and manage them, or if some positions disappeared from the bot interface after a crash or cleanup, and we need to return them to the list. To do this, simply click the “Sync Positions” button in the settings. Once completed, the bot will send a notification about the number of positions added. If the positions were purchased outside the bot, the NFD BNB Trade Bot will be able to display them but will not be able to calculate PnL for these positions.

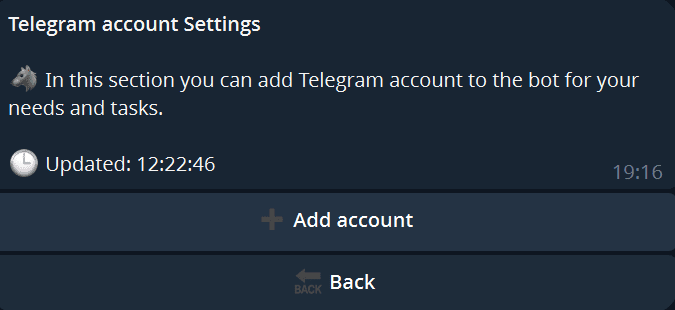

Accounts

In the settings section of NFD Trade Bot, there is an “Accounts” feature that allows you to connect your personal Telegram accounts to the bot. Click “Add Account,” enter your account phone number, enter the confirmation code, and you’re done. This feature is used to work with the Scrapper tool, which allows you to parse contract addresses from private groups that our accounts are members of. Why add a second account? The administration does not recommend using your main account for this feature. There is a risk that Telegram will perceive the activity as suspicious and block the account for unusual actions.

Once you have finalized your settings and topped up your account, you can start trading.

Manual purchase

At NFD Trade Bots, we can purchase tokens manually by sending the token contract directly to the bot from any page. The bot will determine the network itself, so there is no need to switch blockchains in advance before sending.

If Auto Buy (Degen Mode) is enabled, the purchase will happen instantly based on the settings you’ve chosen. If it’s disabled, the token’s trading menu will pop up.

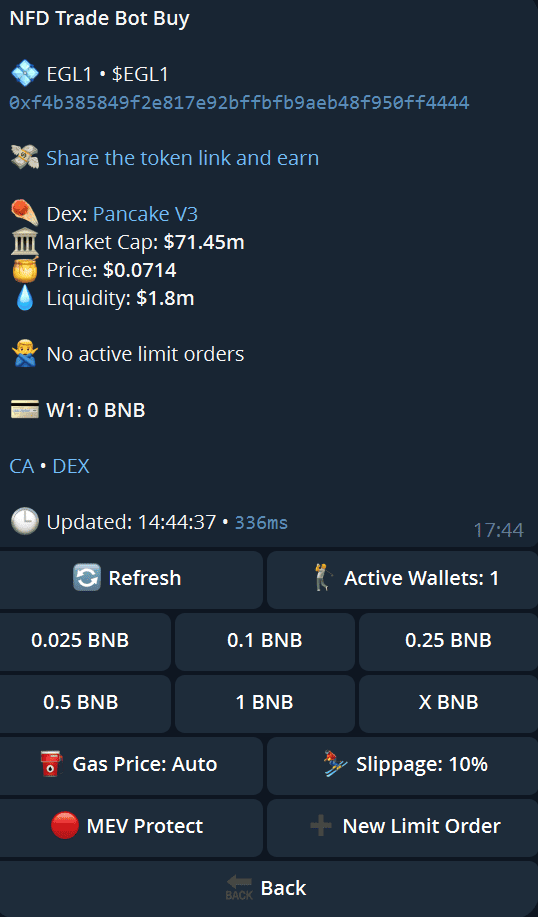

What we see in the trading menu:

– Token name and ticker;

– Contract address;

– DEX, where the token is traded;

– Market capitalization;

– Current price;

– Available liquidity;

– Status of limit orders for the token.

A link with a referral code is also displayed: we can share the token link via a bot, and if other users make purchases via our link, they become our referrals.

At the bottom of the screen, we see the settings buttons, which can be preset via “Presets”:

– Gas Price – set the gas price (default is auto, can be changed manually).

– Slippage – specify the acceptable percentage of price deviation.

– MEV Protect – enable protection against front running and sandwich attacks.

After configuring the parameters, use the quick purchase buttons, which display the amounts (these can also be configured in “Presets”). If you need to purchase a non-standard amount, use the “X BNB” button to enter it manually. After the purchase, the bot will display a window with transaction information, including the entry price and fees spent.

If the token is already in the wallet, after sending the contract, the bot will suggest:

– Go to the token sale menu.

– Generate a PNL card for the position.

– Hide the position from the list of open positions.

If we have set Take Profit and Stop Loss in advance, they are activated automatically. You can monitor your position via the “Positions” menu. If you do not want to buy a token immediately or want to sell an already open position at your price, you can place a Limit Order, specifying the price and terms of the transaction. This feature helps you lock in profits, reduce losses, and buy tokens only when the price matches your strategies. Click “New Limit Order” in the token trading menu, then select and gradually configure the order you need. Limit orders in NFD Trade Bots are a tool for those who want to earn systematically, lock in profits according to plan, and minimize risks without constantly sitting at the monitor.

NFD Trade Bots Scrapper

Scrapper in NFD Trade Bots is a module for automatically purchasing tokens as soon as their contracts are published on Twitter or Telegram. We configure who to track, and the bot instantly purchases tokens according to the specified parameters, giving us the advantage of getting into new coins before others.

In the main menu, select “Scrapper,” then click “Add Next Task.” Available options: Twitter, Telegram, and AFK Mode. Features: track up to 5 accounts simultaneously, tasks reset every 7 days, track tweets, retweets, bio updates, and replies.

Settings:

– Task name.

– Max Traded Tokens – limit on the number of tokens that can be purchased (unlimited by default).

– Purchase amount per transaction.

– Gas adjustment.

– Slippage.

– MEV Protect.

– Capitalization limits (Min MCap / Max MCap).

– Limit orders for auto-sales.

After configuration, activate the task by clicking the “Active” button. If you need to create a similar task for another account, use “Duplicate Task.”

At NFD Trade Bots, we can automatically copy trades from other wallets, turning their experience into our passive income tool. This feature is suitable for those who want to catch new tokens and pumps by following “smart money” without constantly monitoring chats and charts.

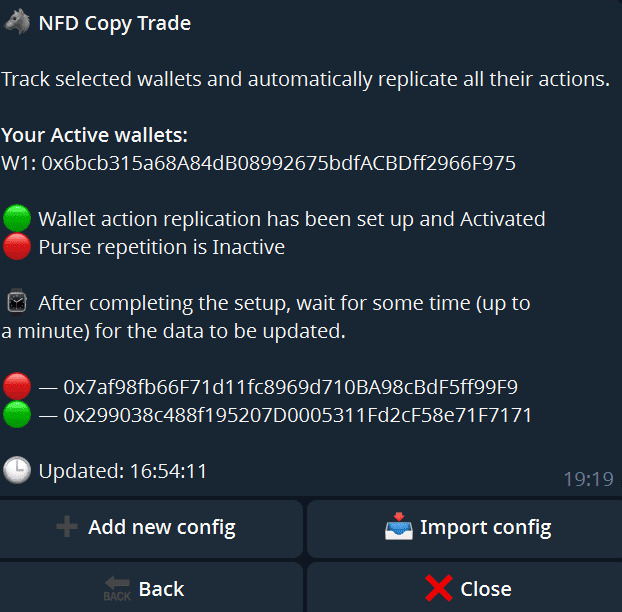

Access the section via the main menu by clicking the “Copy Trade” button. Next, click “Add New Config” to create a copy task. Here, you can also import a configuration by ID if you have a ready-made template.

The bot will ask us:

– The address of the wallet we want to track.

– The name of the task, so that we can easily distinguish between different strategies.

In the next step, the system will display the configuration menu, where we can configure:

– The maximum number of tokens that the bot will purchase within the scope of the task.

– Follow Sells – the bot will sell tokens when the tracked wallet sells them.

– Buy Only Once – the bot will purchase each token only once, even if the wallet makes repeat purchases.

– Max Buy – the limit on the total cost of copying a single wallet.

– Buy Exact – the bot buys exactly the same amount as the tracked wallet.

– Buy % – the bot buys at a percentage proportional to our balance.

– Buy Fixed Amount – the bot buys for a fixed amount with each purchase.

– Min Trigger Buy and Max Trigger Buy – the bot buys tokens only if the purchase amount of the tracked wallet is within our range.

– Min MCap and Max MCap – the bot buys a token only if its market capitalization is within the specified range.

– Slippage when buying and selling.

– MEV Protect for protection against front running and sandwich attacks.

– Gas Price, set manually or automatic mode.

– Blacklist: if we want to exclude certain tokens, we add them to the blacklist, and the bot will not buy them even when purchasing with a tracked wallet.

– Limits Order – to sell tokens automatically on our terms after purchasing them as part of copy trading.

Once you have finished configuring, click the “Active” button to start the task. From this same page, you can export the configuration by ID or link to share or save the settings. . In the future, we can start or stop all copy tasks with a single click from the “Copy Trading” menu.

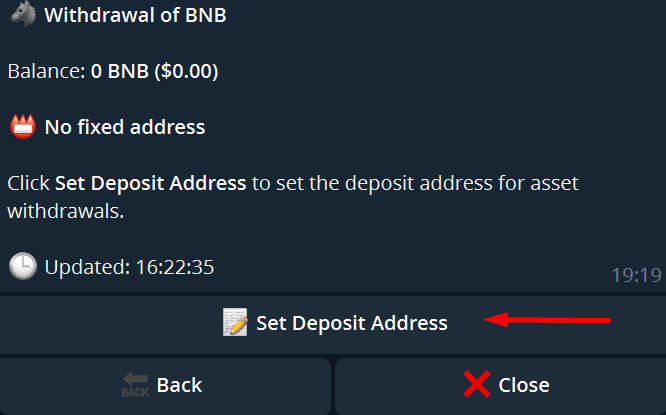

At NFD Trade Bots, we can withdraw native tokens from the bot’s wallet at any time when we need to lock in profits or transfer funds to storage. To do this, click “Withdraw” on the main screen. First, the bot will ask for the “Set Deposit Address” — this is the wallet address to which we want to send the tokens. Then we specify the amount we want to withdraw and confirm the transaction. The bot will automatically send the funds to the specified address.

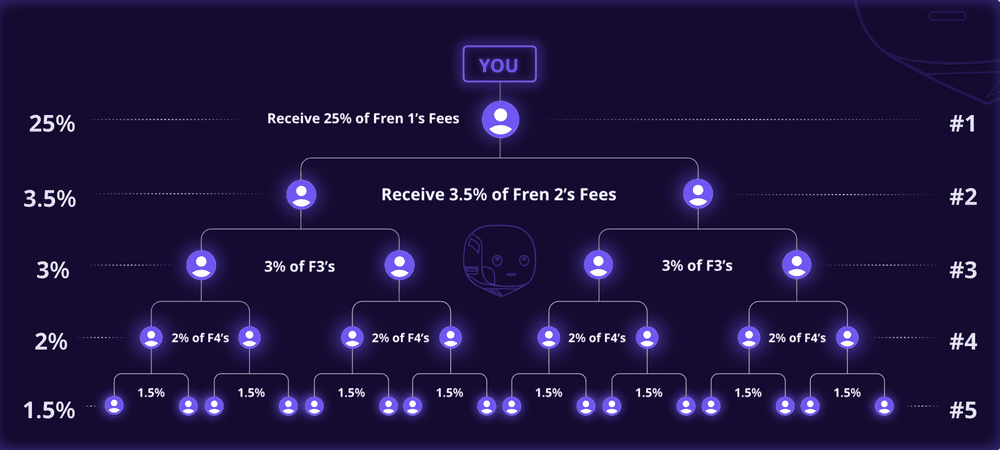

NFD Trade Bots has a built-in referral system that allows you to earn up to 35% commission on transactions made by invited users. This is an excellent tool for active traders, influencers, bloggers, and alpha chat administrators.

NFD Trade Bots has a 5-level reward system:

– Level 1: 25% commission

– Level 2: 3.5%

– Level 3: 3%

– Level 4: 2%

– Level 5: 1.5%.

To start earning, go to the “Referrals” section in the bot menu. Copy the link that the bot generates for you. In the same section, you can see how many users you have invited and how much BNB you have earned from referrals. The referral system in NFD Trade Bots is a convenient way to create a steady source of income by monetizing your audience and activity in the crypto community.

Before using NFD Trade Bots, it is important to understand its real strengths and weaknesses in order to use the tool effectively and without illusions.

Pros

Cons

NFD Trade Bots is a working tool for those who want to get more out of the market while saving time and nerves. We see that the bot gives a real advantage in speed: Auto Buy, Scrapper, and Copy Trading allow you to enter trades where slow hands cannot keep up. Limit orders and automatic take-profits eliminate the need to keep an eye on charts around the clock, allowing you to trade in a clear system rather than on emotions.

Support for multiple networks, slippage settings, MEV Protect, flexible gas and capitalization limits make the bot a versatile tool for different strategies — from aggressive pump hunting to measured trading based on alpha chat signals.

At the same time, it is important to remember the risks:

– Any automation requires discipline and an understanding that the bot only executes the algorithms we have programmed.

– Transferring a seed or private key is always a risk, so we use separate wallets and do not store large amounts unnecessarily.

– The market remains unpredictable, and a bot will not protect you from your own mistakes in assessing a token or market situation.

If your goal is to trade actively, automate routine tasks, and speed up transactions, a bot can handle these tasks effectively. It’s not a magic wand, but if you understand the risks and control your actions, a bot can become part of your systematic work in crypto. It provides speed and flexibility, but requires attention, configuration, and adherence to basic crypto security hygiene.

Write or call us. We will help you quickly re-register your accounts. Enjoy a new level of trading with cashback every month.

You are used to trusting professionals in your everyday life. Trust us with your interactions with exchanges. You won't want to go back to trading without Feebacker.com.