More and more crypto traders are moving away from cluttered charts and complex interfaces to simple, fast, and automated solutions—Telegram bots. These tools turn your smartphone into a full-fledged trading terminal: you can snipe tokens, track wallets, copy whale trades, and launch trades with just a couple of taps. Fast execution, native integration with Telegram, and no need to open dozens of tabs have made bots an important part of the crypto enthusiast’s arsenal.

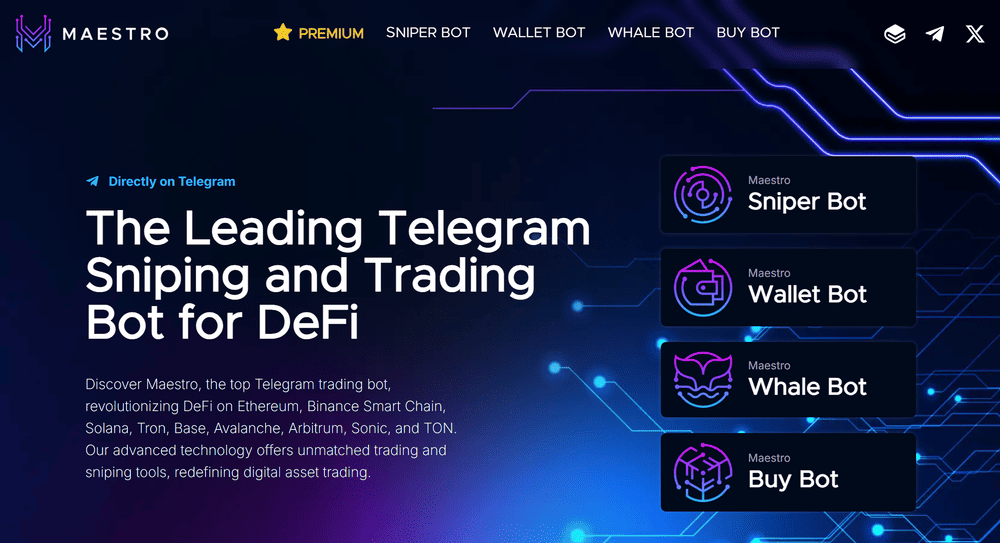

One of the most advanced players in this niche is Maestro Bots. It is a multifunctional Telegram bot that combines a sniper, copy trading, analytics, protection against fraudsters, and support for multiple blockchains. In recent months, it has become particularly popular among DeFi traders, offering access to powerful tools right in the chat. In this review, we will analyze how Maestro Bot works, what it can do, how secure it is, and who should really use it.

The Maestro Bots platform was launched in early 2023 as an experiment by DeFi trading enthusiasts who wanted to simplify the process of buying tokens on decentralized exchanges. Amidst frenzied volatility and constant scam listings, the team focused on the essentials: transaction speed and user protection. Telegram was chosen as the main interface, eliminating the need to install separate applications, as everything works directly in your favorite messenger.

The first versions of Maestro were focused on Ethereum and BSC, providing basic sniper and wallet monitoring. However, with growing demand, the bot quickly gained functionality: anti-rug modules, copy trading, multi-chain support (Solana, Arbitrum, Base, Avalanche, etc.), and advanced analytics were added. The turning point came after an incident in October 2023, when a vulnerability led to the theft of approximately 280 ETH. The team quickly closed the breach, returned more than what was stolen to users, and thereby strengthened the community’s trust. Since then, Maestro has established itself as one of the most reliable and flexible trading bots in the crypto space.

Abbas Abou Daya is the founder and CEO of Gearlay Technologies Inc., the company behind the development of Maestro Bots. He is an engineer with extensive experience in Web3 and high-load solutions: he has developed anti-scam algorithms, scaled a trading bot to 100,000 users, and implemented patented transaction simulation methods. He previously worked as an engineer at Arista Networks. Today, he leads the Maestro team with a focus on creating the most effective Telegram bot for trading in DeFi.

Today, Maestro is not just a sniper bot, but a full-fledged DeFi ecosystem that has grown from a single tool into a whole set of auxiliary bots that solve various trader tasks directly in Telegram. Here is a brief overview of the constituent modules:

– Sniper Bot – a key tool that automatically buys tokens when adding liquidity, with protection against scams, front-running, and MEV;

– Wallet Bot – real-time monitoring of up to several of your wallets with notifications about transactions and balance changes (supports Ethereum, Binance Smart Chain, and Arbitrum networks);

– Whale Bot – tracking the activity of large multimillion-dollar wallets, signals on inflows and outflows;

– Buy Bot – allows investors and token teams to track purchases, sales, and price changes for up to two tokens for free. It is fast, flexible, and convenient, making it the ideal tool for active crypto communities.

One of Maestro’s latest updates added a powerful upgrade to the Scraper tool — it can now pull data even from private Telegram channels, chats, and groups, including those active on networks such as Base and Solana. This is not just a marketing gimmick. Scraper allows Maestro bots to collect signals, insights, and token mentions from closed sources that are difficult to access manually. This way, you can configure the bot to automatically react to information that a regular user would not even see. For a trader, this is a competitive advantage. With this feature, Maestro becomes not just a sniper, but a full-fledged intelligence system that works in the background and delivers potentially profitable signals from the depths of crypto circles.

All of this works as a single system, where each bot complements the others and covers the entire DeFi trading cycle: from monitoring and analysis to automatic execution of trades. Management is carried out via the official website maestrobots.com, where you can connect, choose a plan, configure bots, and find up-to-date guides, documentation, and support.

In this article, we will take a detailed look at the ecosystem’s main tool—the Maestro bot for sniping. Below, we will show you how to launch, configure, and use it.

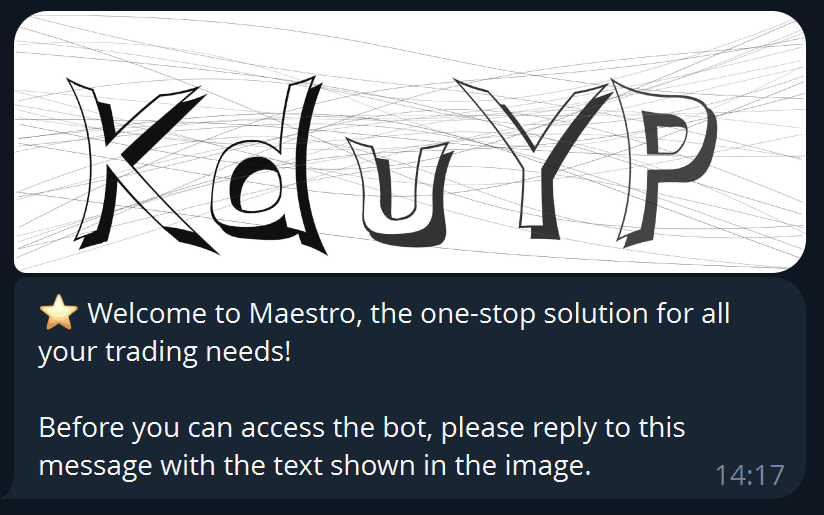

Go to the @Maestro bot (https://t.me/maestro?start=r-ph_bona) using our link and click the “Start” button at the bottom. The Maestro bot will immediately ask you to solve a captcha—nothing complicated, just respond with the same letters (case sensitive) as in the image.

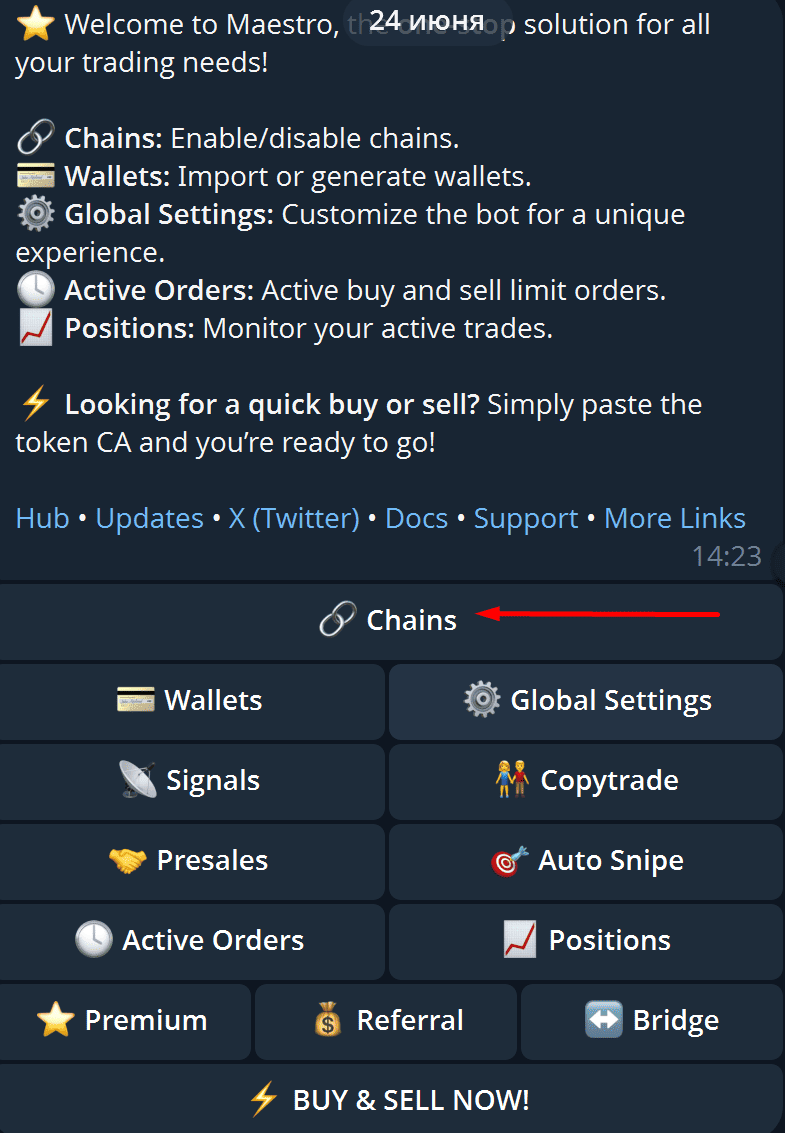

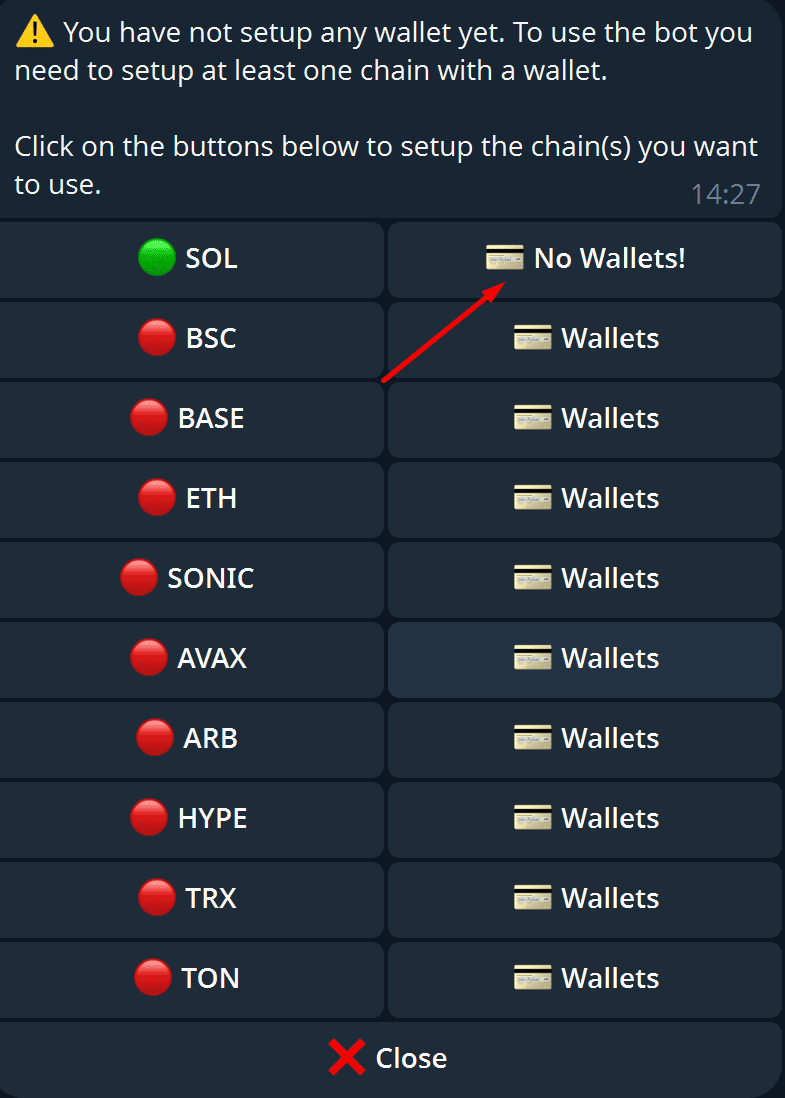

After that, to start the bot, use the “/start” command or select the desired command from the “Menu” at the bottom left. Now, let’s immediately select which blockchains we want to use. To do this, click the “Chains” button. Currently, the bot supports ten chains: BNB Smart Chain (BSC), Ethereum, Arbitrum, Base, Avalanche, Sonic, Tron (TRX), TON, HYPE, and Solana.

Since this is our first time here, the bot immediately warns us that we need at least one connected wallet to use it. All networks with green circles are active, but this can be changed with a simple click. We can immediately remove the networks that we are not going to use yet. For example, we leave Solana and then click on the “No Wallets” button on the right to go to the wallet settings.

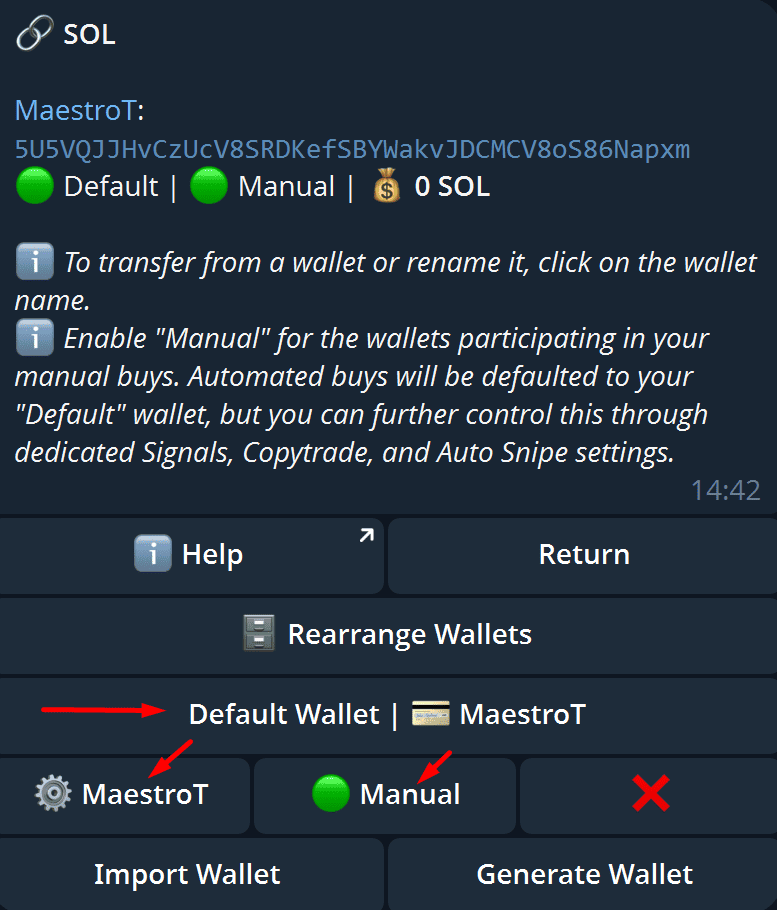

In the next step, click “Import Wallet” if you want to import your wallet by entering the seed phrase. Or click “Generate Wallet” if you want the system to create a new wallet for you.

If you decide to create a new wallet, enter its “Name” in the next step. After that, the Maestro bot will send you a message with a private key, wallet address, and seed phrase. You need to save all this information and delete the message. Please note that this message cannot be regenerated. By repeating the same steps, we can add up to 3 wallets on each network for the free version of the bot. After purchasing “Premium,” the limit will be 10 wallets.

After connecting the first wallet, we will see two modes: “Manual” and “Default Wallet.”

– Manual is an option that can be enabled or disabled separately for each wallet with a single click. If enabled, this wallet participates in manual purchases, including multi-purchases. When a wallet is added for the first time, Manual mode is enabled automatically, and at least one such wallet must always be active.

– Default Wallet is the main wallet for automatic transactions on the selected network. Only one such wallet can be set for each network. It is used for transactions initiated via signals, Copytrade, Auto Snipe, and presales. It can also be changed with a single click. The cool thing is that you can always configure which wallets will participate in each automatic purchase.

To replenish your wallet, simply copy its address and send coins using your preferred method. To withdraw funds from a specific wallet, use the button with the gear icon and the name of your wallet.

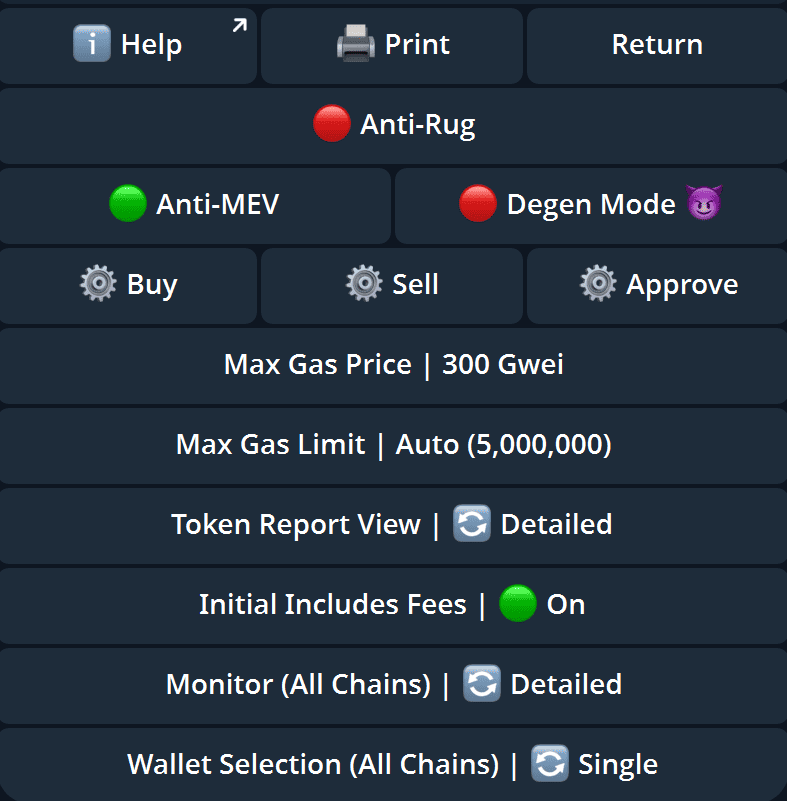

By clicking on the “Global Settings” button in the main menu, we access the bot’s main settings. Maestro offers flexible security and performance parameters that can be adjusted to suit your trading style.

Below are the key settings you should know about:

– Anti-Rug (not available on networks without a public mempool). This feature attempts to protect against the most common scams: liquidity withdrawal, trading lockouts, tax increases, hidden token issuance, and other rug pulls. If activated, the bot will automatically monitor the mempool and, upon noticing a suspicious transaction, will attempt to sell your tokens before the scam transaction takes effect. Protection only works with public transactions. If the scam is sent privately, the bot will not be able to react in advance. The bot will also raise the gas price for the sale to outrun the scammers.

– Anti-MEV. On the Ethereum network, it is enabled by default and cannot be disabled. All transactions are sent through private relays to avoid MEV attacks. On the Solana network, it can be enabled manually. Transactions will be routed through secure relays (Jito or NextBlock).

– Degen Mode. By default, the bot blocks automatic token purchases if they appear suspicious (honeypot, blacklists, strange liquidity). But if you are consciously willing to take the risk, enable Degen mode with a click. It will remove the blocks but leave the warnings.

– Max Gas Price. Set the maximum price for gas that the bot can use in automatic trades, whether Anti-Rug or Copytrade. If a higher limit than the set limit is required for safe execution, such a transaction will be blocked. Does not affect manual trades, signals, or snipes.

– Max Gas Limit. Control the maximum amount of gas the bot can spend. You can leave the automatic selection or manually set a limit to exclude tokens with excessive gas consumption. If the limit is exceeded, the transaction is canceled.

– Token Report View. Default setting for how token reports are displayed. Can be set individually for each network.

– Trade Monitor. Sets the default view for the trade monitor, applies to all blockchains at once.

– Initial Includes Fees. This means that your initial cost on the trading monitor includes gas and any other fees. Your PnL is calculated based on the initial cost, so it will change if you include or exclude fees for your initial purchase amount.

Maestro turns Telegram into a full-fledged trading platform where transactions can be carried out as easily as messaging. The bot supports both manual trading based on the Uniswap or PancakeSwap principle and automatic token purchases based on a contract simply inserted into the chat. This allows you to instantly respond to new listings, signals, or contracts from trading channels without leaving the Telegram interface.

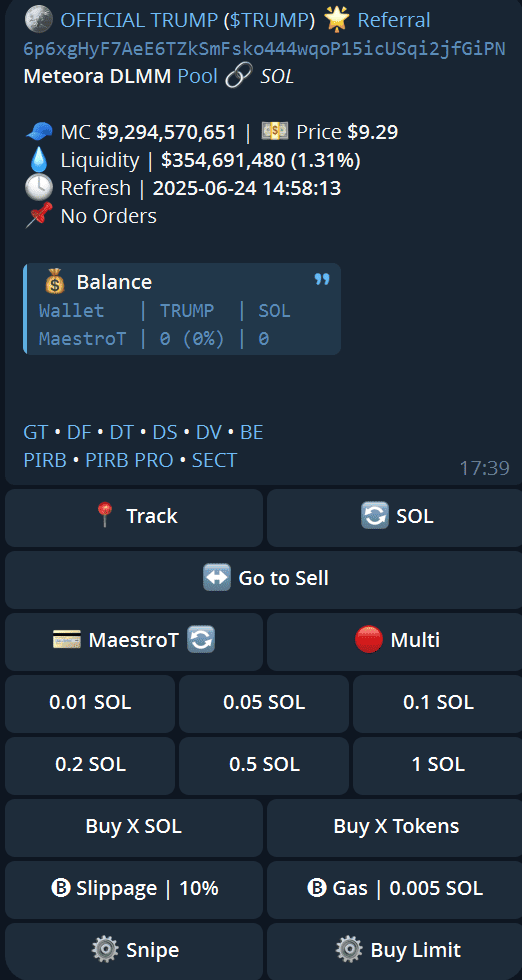

In Maestro, simply paste the token’s smart contract address into the chat with the bot to open the “Token Report” — a detailed token card where you can not only study information, but also trade immediately. This tool allows you to:

– Buy and sell tokens manually;

– Place limit orders to buy or sell;

– Configure automatic actions based on signals;

– Use multi-wallet trading.

The token card is divided into two main modes—buying and selling—between which you can switch by pressing the “Go to Sell” or “Go to Buy” buttons.

Purchase mode:

– “Track” starts monitoring the token without purchasing it. It shows activity across all wallets where this token is held and provides quick access to actions (buy, sell, limits).

– “SOL” – if the token is traded on multiple networks, the button switches between them.

– “MaestroT” (the name of your wallet) – permission to work with the token for selected wallets.

– “Multi” drop-down menu where wallets for manual purchase are selected. By default, only those marked as “Manual” are active.

– “Buy X” command to purchase a token for a specified amount in the selected currency.

– “Buy X Tokens” is a direct input of the number of tokens to purchase.

– “Slippage” – you can set slippage separately for purchases and sales directly from this panel.

– “Gas” is a gas setting for a specific token if you want to change it only for the current session.

– “Snipe” – activates auto-snipe for the selected target.

– “Buy Limit” – setting limit orders for buying.

If you want to get into a token at the earliest blocks, without manual hassle and the risk of missing the moment, Auto Snipe in Maestro is exactly what you need. It is a full-fledged automatic sniping system running on Ethereum, BSC, Base, and Solana, capable of taking starting blocks with virtually no user involvement.

In classic chains with a public mempool (ETH, BSC), the bot finds the necessary launch transaction in the mempool and builds the purchase immediately in the zero block. Even if the launch was hidden, the bot reacts to the mining event, instantly executing the snipe. The result is that you enter the transaction at an early stage without wasting time on manual analysis and clicks. All of this works privately, which protects against MEV and sandwich attacks.

Auto Snipe doesn’t just click “Buy.” It analyzes contract parameters in real time:

– Deadblock Detection – identifies dangerous blocks where blacklists or temporary commissions may be present.

– Tax Thresholds – you set the maximum allowable commission for buying or selling. If the contract violates it, the bot waits until it decreases.

– Max Buy Check – if your volume exceeds the contract limit, the bot will automatically reduce the amount so that the transaction is not rejected.

– Private Backup Snipes – if your snipe didn’t make it into the main bundle, the bot will send a backup private transaction so that you still get as close to the start as possible.

Solana Auto Snipe is fully compatible with Raydium V4. The bot monitors the pool, detects the launch moment, and completes the purchase. It operates reliably and without user intervention.

Auto Snipe does what is impossible to do manually: it catches complex starts, adapts to each contract, and makes maximum use of blockbuilders and private channels. It is a real tool for those who hunt for Xs in the very first seconds.

Maestro Bot works without a subscription for most users, but charges a 1% commission on successful transactions executed through the sniper, whether it be a purchase, sale, or participation in a presale. Regular transfers between wallets are not subject to commission.

On Solana, everything is simple: the commission is built right into the transaction and is withheld immediately upon execution. On other networks, the bot works differently. It does not deduct the commission from each transaction directly, but keeps track of it. As soon as the accumulated commission debt exceeds: 0.01 ETH / BNB / AVAX / METIS, or 0.5 TON, the bot automatically withdraws this amount in one go. And always from the wallet with the largest balance in the required network. At the same time, the write-off never exceeds 10% of the largest wallet, so as not to interfere with trading and drain liquidity. Commissions are calculated at the Telegram user level, not for each wallet separately.

For those who trade seriously and require not just convenience from a bot, but speed, depth, and priority, Maestro offers a paid Premium subscription. This is not just advanced features — it is a separate level of access to professional tools, closed channels, and maximum efficiency. The subscription costs $200 per month. Everything is connected directly within the bot via the “premium” command — quickly and without external services.

What Premium offers:

– Maestro Pro Bot – a separate version of the bot with enhanced transaction execution speed.

– Launch Simulator – token launch simulator: shows taxes, dead blocks, and wallet limits even before trading starts.

– trending — a team that displays a list of the hottest tokens over the last 6 hours, before and after launch.

– Trade Monitor for 96 hours (instead of 36 hours for basic accounts).

– Up to 30 simultaneous transactions monitored (compared to 10 for standard accounts).

– 10 wallets for each chain (1 main + 9 additional).

– 10 copytrade wallets for each network (compared to 5 for regular wallets).

– 10 simultaneous auto-snipes per chain (twice as many as usual).

– The Hits indicator, which shows how many users have already inserted the same contract into the bot (an important hype indicator).

– The exclusive Maestro Yacht Club — a chat room with experienced traders, insiders, and discussions in a small circle.

– Priority support. Premium users receive assistance first.

Maestro is a powerful tool for those who want to trade tokens in DeFi quickly, flexibly, and without complicated interfaces. But like any tool, it has its strengths and weaknesses.

Pros

Cons

Maestro Bot is not just a Telegram bot, but a full-fledged tool for DeFi trading that combines automation, analytics, and flexibility in a single interface. It is suitable for both beginners who want to try their hand at decentralized trading and experienced snipers looking for a few seconds of advantage at token launches.

Maestro wins out thanks to its speed, built-in protections, and convenience: everything is at your fingertips, from wallet monitoring and alerts to multi-wallet manual trading. Its strengths remain its support for multiple networks and fair commission policy. And after the incident in 2023, the team proved that it is ready to take responsibility and quickly protect its users.

However, it is a powerful tool, and like any powerful tool, it has a learning curve. You need to understand it, configure it, and pay attention to the settings. And the premium price of $200 per month is not for everyone.

The conclusion is simple: if you want to go beyond “buy-sell” on Uniswap and use strategies, filters, auto-trades, and signal reactions, then Maestro bot is worth trying. The main thing is to start small, test it on separate wallets, and keep your wits about you, because the bot gives you an advantage but does not eliminate the risks of crypto.

Write or call us. We will help you quickly re-register your accounts. Enjoy a new level of trading with cashback every month.

You are used to trusting professionals in your everyday life. Trust us with your interactions with exchanges. You won't want to go back to trading without Feebacker.com.