FTMO is one of the leading companies in the field of prop trading.

In recent years, more and more people have become interested in prop trading. After all, prop trading companies have become a separate sector in the financial markets industry. The essence of prop trading is simple: a firm provides a trader with its own capital for trading and, in return, receives a share of the profits. This is a model with potential benefits for both parties, where the trader does not risk their own money, and the company earns money from effective managers. Previously, such opportunities were only available to professionals in banks and funds, but now, thanks to online platforms, prop trading has become available to private traders around the world.

More and more companies are appearing on the trading market offering access to large trading capital without any investment on the part of the trader. Among them, FTMO is one of the most recognizable and talked-about prop firms. It promises traders financing of up to $200,000 and a share of up to 90% of the profits, without requiring any investment in a trading account. But behind this model lies a clearly structured system of selection, risk, and motivation. In this article, we will analyze how FTMO works, what traders actually get, and what pitfalls they may encounter. Here is an honest and comprehensive review of FTMO.

FTMO was founded in Prague in 2015, when several young traders and successful entrepreneurs decided to simplify access to professional prop trading for private market participants. Initially, the Ziskejucet.cz project was called Získej účet (translated from Czech as “get an account”), and its main idea was to give talented traders the chance to manage large amounts of capital without having to invest their own money.

With the growing interest in trading with investor funds and the popularization of the prop trading model for beginners, FTMO quickly gained momentum. The company redesigned its selection process and launched the FTMO Challenge and Verification, two stages that have become the hallmark of the project. This system made it possible to select stable traders and protect the firm from excessive risks.

Within just a few years, FTMO has become one of the most recognizable prop trading companies in the world. A trader’s account with FTMO remains a demo account, but the profit it generates is used as a benchmark for paying real rewards. This approach has allowed the company to scale up without risking client funds, while offering generous terms (up to 90% of profits in favor of the trader).

Today, FTMO has hundreds of thousands of users worldwide, tens of thousands of successfully funded accounts, and a strong brand in the no-deposit trading industry. Many consider it a gateway to the world of professional prop trading.

To gain access to funding and start trading with investor money, traders must pass a two-stage selection process: the FTMO Challenge and Verification. This is the basis of the FTMO model and the main filter that separates casual players from those who are truly ready to work within the prop trading system.

FTMO Challenge – the first step

At the beginning of every trader’s journey at FTMO is the FTMO Challenge, a digital product that combines elements of a training program, a trading simulator, and a full-fledged stress test to check your skills. This is not just a trading test, but a full-fledged environment that simulates real trading conditions on financial markets, including currency pairs, indices, commodities, and cryptocurrencies. Here, traders receive a demo account that is synchronized with the real market situation and manage virtual capital, trying to achieve set goals without violating clear rules.

The main objective of the FTMO Challenge is to determine whether a trader is capable of consistently generating profits and managing risks. This is key to understanding how to become a prop trader and get the chance to work with the company’s funds. The simulation rules are based on real risk management principles used in professional investment structures. At this stage, the trader receives a demo account with the selected capital (for example, $10,000, $50,000, $100,000, or $200,000). The trader must show results while complying with drawdown limits and achieving the target profit level:

Profit target – 10% of the starting balance

Maximum daily drawdown – 5%

Maximum total shrinkage – 10%

Term – 30 calendar days

Minimum number of trading days – 4

The main thing here is not just to make money, but to do so consistently and with discipline. Violating one of the rules means automatic failure of the test. These conditions don’t just filter participants, they educate them. Even if a trader does not pass verification, the FTMO Challenge is useful as a training tool, where practical trading goes hand in hand with analytics, training videos, and access to professional applications. This makes the Challenge part of a broader strategy—to develop traders through real trading practice, but without the risk of losing real money.

In addition, FTMO offers traders access to analytical tools, training materials, and coaching. All of this is included in the Challenge and serves as preparation for the next stage—FTMO Verification, which we will discuss further below. Completing both stages opens the way to an FTMO Account, where traders can earn real money based on simulated trading.

Thus, the FTMO Challenge is not just a test, but a comprehensive system for training, filtering, and supporting traders, designed according to professional prop trading standards.

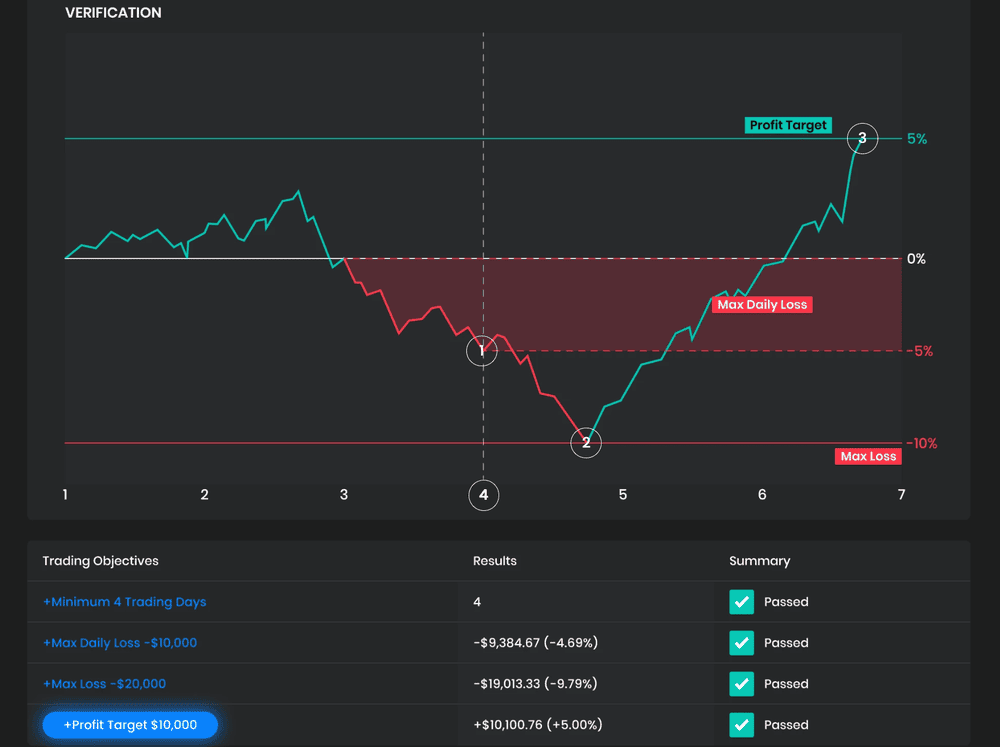

If a trader successfully passes the testing stage, they move on to the second stage—FTMO Verification. This stage is very similar to the first, but with less stringent requirements. The main difference is a lower profit target, which removes some of the pressure and allows the trader to focus on stability and discipline in trading.

Main conditions of FTMO Verification:

Profit target – 5% of the initial balance

Maximum daily drawdown – 5%

Maximum total shrinkage – 10%

Term – 60 calendar days

Minimum trading days – 4

The goal of this stage is simple: to confirm that success in the FTMO Challenge is not a fluke. The company checks whether a trader is capable of working within the specified limits in the long term without violating risk management rules. In this sense, Verification serves as a kind of confirmation of a trader’s professional suitability for prop trading with investor money.

It is important to understand that FTMO Verification is the final filter before obtaining an FTMO Account, i.e., access to real cash rewards for trading. If the trader complies with all the rules again, they receive a funded account from FTMO and move into the company’s prop trader category.

Even at this stage, FTMO continues to perform an educational function. Trade analysis, support, access to training materials and platforms—all of this remains available to participants. Even if a trader does not pass Verification, they take away experience, practice, and knowledge, approaching their next attempt better prepared. In this way, the administration emphasizes that the company’s mission is not only profit, but also the development of clients as informed traders. Therefore, the FTMO Verification process itself is both a test and training, and the final step towards the opportunity to trade without investment for real payouts.

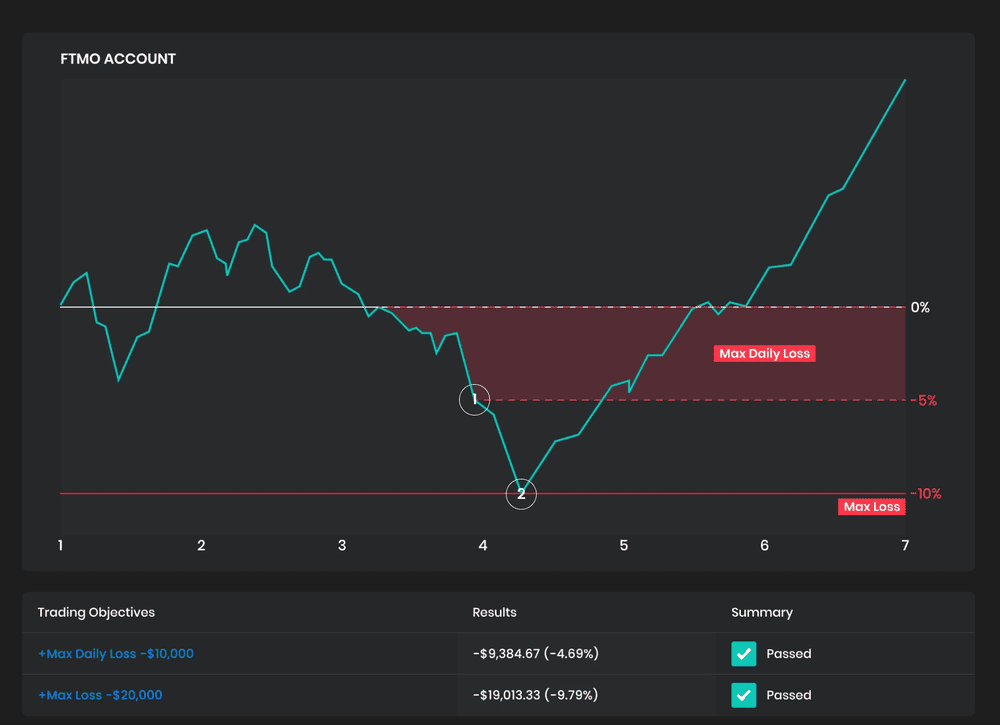

After successfully completing the FTMO Challenge and Verification, traders gain access to an FTMO Account, where they can start trading without investment but with the opportunity to earn real financial profits. This is the key goal of the entire selection process and the reason why thousands of traders around the world try their hand at prop trading.

It is important to understand that an FTMO Account is also a demo account. The trader still works in a simulated trading environment, but all of their trades and results are tracked by the company. If a trader earns virtual profits, FTMO pays them real money, up to 90% of their earnings, keeping 10% as a commission for risk, support, and the platform. Please note that along with the first reward, the trader will be refunded the fee for participating in the FTMO Challenge.

Trading conditions on an FTMO Account:

Although the platform gives traders freedom in choosing strategies, FTMO Accounts are subject to strict rules, violation of which may result in account suspension and loss of funded trader status. These restrictions are related not only to risk management but also to ensuring the integrity and stability of the platform. Prop trading companies, especially those such as FTMO, are required to adhere to strict discipline to ensure the stability of the entire system.

Key FTMO rules and restrictions:

FTMO positions itself as one of the best prop trading companies, and its task is to select traders who know how to work within the rules. Such restrictions are not just strict rules, but part of a professional environment where risk management is more important than profit. Compliance with them is a prerequisite for receiving payments from FTMO and continuing a career in prop trading without investment.

On the other hand, it is important to understand that all these restrictions are under the complete control of the FTMO administration, and in some cases, they may not be applied in the trader’s best interests. There have been situations where accounts have been blocked due to controversial interpretations of news restrictions or technical drawdowns that traders considered invalid. There is also a lack of transparency in how trading styles are monitored and interpreted, especially in cases of suspected arbitrage or copying. This creates the impression that the rules, although formally transparent, can be used to the advantage of the company rather than the trader, especially in borderline situations.

One of the frequently asked questions is: Does FTMO pay or not, and where does the money come from if a trader trades on a demo account? Answer: FTMO uses a compensation model in which the trader’s profit serves as a signal, and the company either emulates a successful strategy in real markets or simply pays for it as a result of selection. Either way, payments are part of FTMO’s operating budget, not a redistribution of funds among participants.

Thanks to this model, traders get all the benefits of trading with large capital without investment, without risk, but with real payouts. This makes the FTMO Account a unique opportunity for both novice and experienced traders who need a platform with transparent conditions and no pressure from brokers or investors.

One of the advantages of FTMO is flexibility in choosing a trading platform. The company supports several popular terminals, allowing traders to use familiar tools and strategies. This is especially important for those who want to become prop traders without investment, but still maintain a comfortable working environment.

Supported trading terminals:

MetaTrader 4 (MT4) is a classic among forex traders. It is simple, fast, and compatible with most trading advisors (experts). FTMO offers accounts with different liquidity providers based on MT4, allowing you to accurately simulate real market conditions.

MetaTrader 5 (MT5) is a more modern version of the platform with enhanced functionality: price feed, more timeframes, improved performance. It is especially popular among traders working with stocks and indices.

cTrader is an alternative to MetaTrader with a focus on order execution accuracy and in-depth analytics. It is suitable for those who use more advanced strategies and want to fine-tune every element of their trading.

DXtrade is a modern multi-asset platform with advanced capabilities for analysis, order management, and risk management. It supports trading in currencies, CFDs, cryptocurrencies, and other instruments. It features a flexible interface and high adaptability to different trading styles. It is suitable for both retail and institutional traders who value performance and modern UX.

All terminals use demo accounts synchronized with real market quotes, allowing you to simulate real trading. Access to the terminals is granted immediately after activating the FTMO Challenge. Please note that traders can choose their platform at the start and can only change it if they retry. Trading is possible from mobile devices and tablets (especially in MT4/MT5).

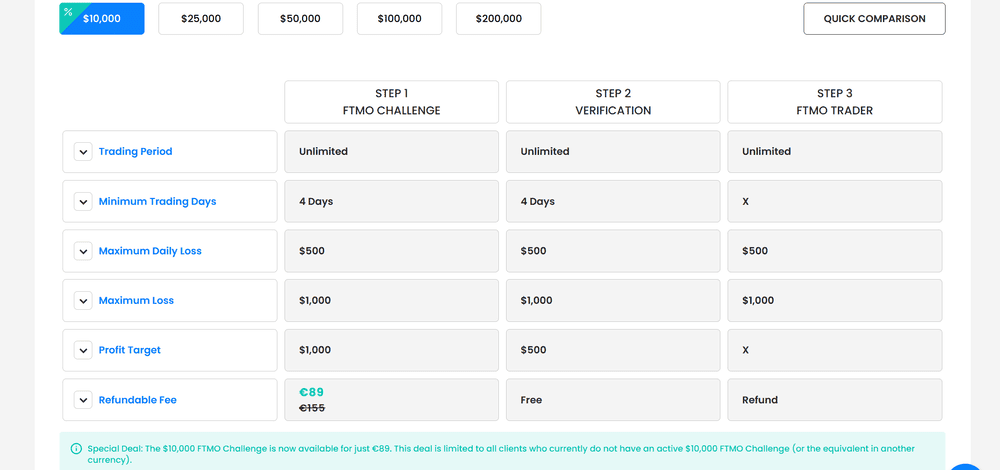

Full participation in this prop trading company begins with payment of the FTMO Challenge fee—the only mandatory contribution that traders make out of their own pocket. After completing all stages, there are no additional payments. FTMO does not charge trading commissions and does not require investments in the account, which distinguishes it from brokers and pseudo-props.

Prices depend on the amount of capital the trader wants to work with. It is important to understand that the payment is a one-time fee, and if you successfully pass both stages, FTMO will refund the cost of the Challenge to your first payout.

Current FTMO rates (as of May 2025):

Balance Price Profit Drawdown Term

$10,000 $155 10% 5%/10% 30 days

$25000 $250 10% 5%/10% 30 days

$50000 $345 10% 5%/10% 30 days

$100000 €540 10% 5%/10% 30 days

$200000 €1,080 10% 5%/10% 30 days

Please note! Currently, when you register using our referral link, you will receive a discount on the first tariff: $89 instead of $155. Plus, we will refund an additional 6% of the cost of any package upon your request.

What is included in the rate:

It is important to note that one payment for a package equals one attempt. A repeat attempt requires a new payment.

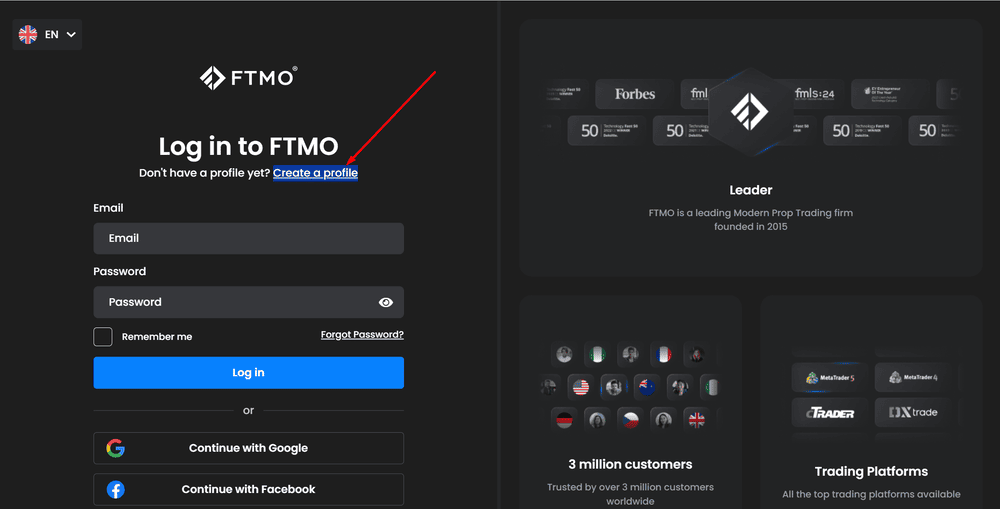

Go to the official FTMO website via our referral link, which offers a number of undeniable advantages. We offer a 6% refund on your first purchase of a service package on the platform. Unfortunately, there is no Russian localization on the website, so we work with the English version. Now click on the “Create a profile” button.

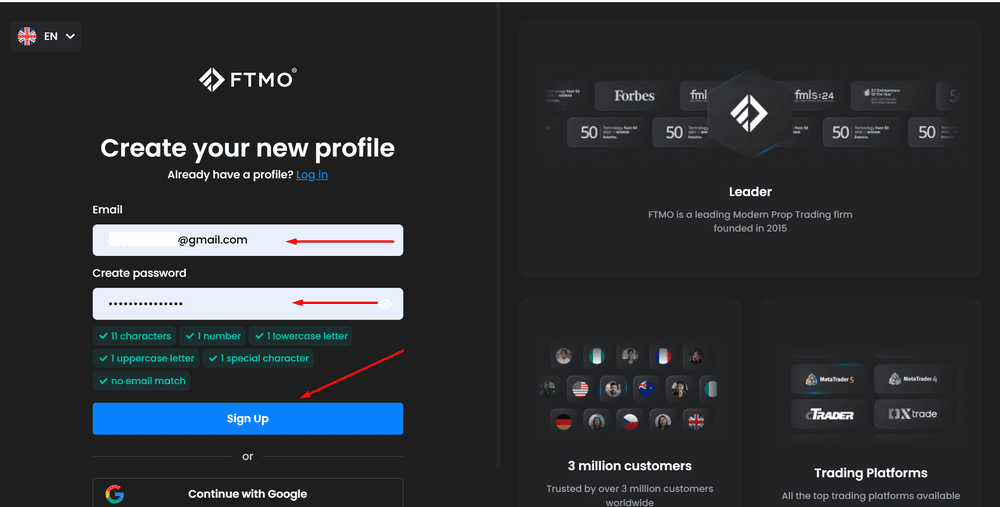

На следующем этапе вводим адрес нашей электронной почты, придумываем надежный пароль и кликаем кнопку “Sign Up”. Кроме того, можно зайти используя данные Google, Facebook или Apple.

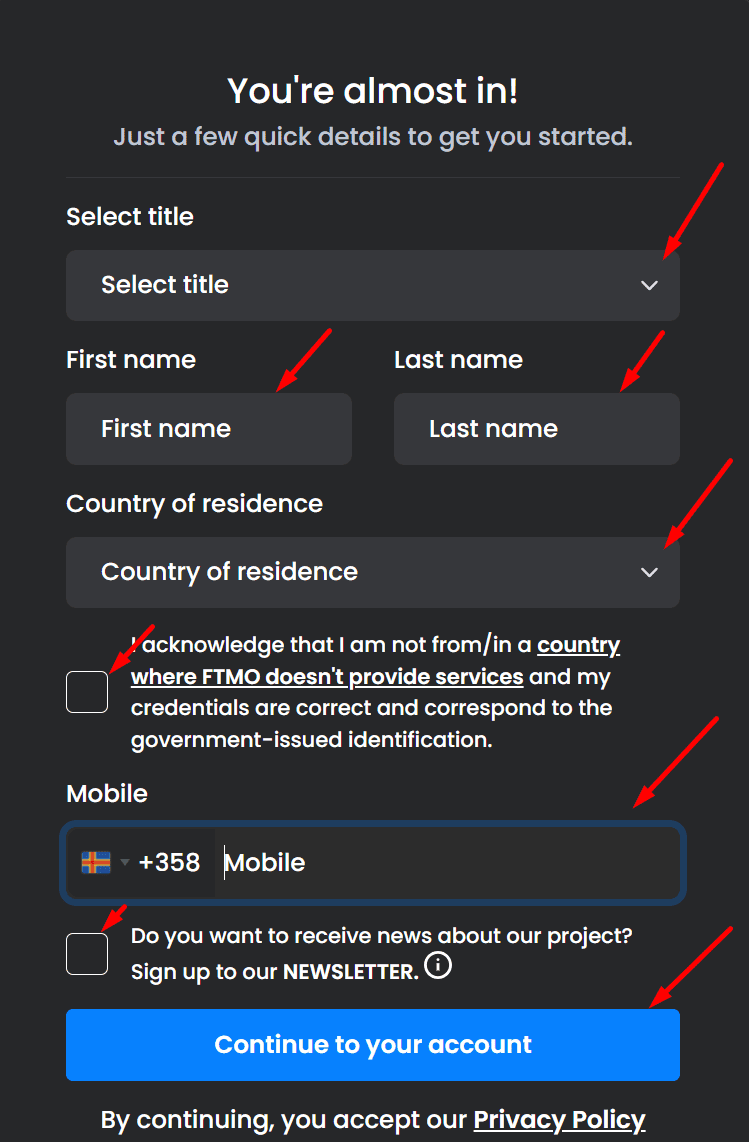

Next, fill in your personal details… Select your gender and nationality from the drop-down list, enter your first and last name. Tick the box to confirm that your details are correct and that the company’s terms and conditions do not conflict with the laws of your country. Enter your mobile phone number. You do not need to check the last box, as it confirms your consent to receive offers from FTMO. Below, click the blue “Continue to your account” button.

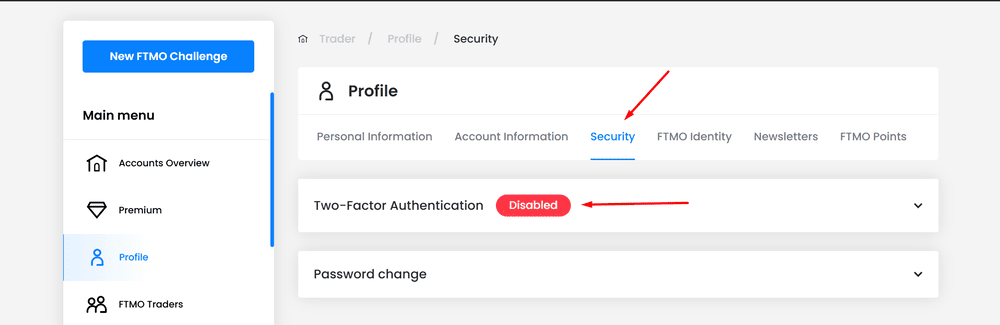

Now go to the email address you provided during registration. Find the email from FTMO and click on the blue “VERIFY EMAIL” button to confirm your registration. The system will then automatically redirect you to your FTMO personal account. You can enable two-factor authentication (2FA) in your account settings to increase security.

Before embarking on your journey with FTMO, it is important to soberly assess not only the opportunities but also the limitations. Despite attractive conditions, high profit margins, and access to large capital, FTMO remains a structure with strict rules and its own internal logic. Below are the main advantages and disadvantages of FTMO, which will help you understand whether this format is right for you.

Pros:

Minuses:

FTMO remains one of the most popular and reliable prop trading companies on the market. It offers traders a real opportunity to earn money without investment, while providing access to analytics, training, and support. The FTMO Challenge and Verification selection structure is designed to identify stable and disciplined participants.

Но важно понимать, что FTMO – это не кнопка “бабло”, а платформа с жёсткими правилами, высокой конкуренцией и рисками дисквалификации за малейшее нарушение. Счета демо, выплаты реальные, но только если вы умеете торговать стабильно и соблюдать условия. Для новичков FTMO может стать отличной тренировкой с обратной связью и образовательной поддержкой. Для опытных трейдеров – это шанс масштабировать свою торговлю без капитала. Главное подходить к процессу профессионально и не ждать лёгких денег.

Write or call us. We will help you quickly re-register your accounts. Enjoy a new level of trading with cashback every month.

You are used to trusting professionals in your everyday life. Trust us with your interactions with exchanges. You won't want to go back to trading without Feebacker.com.