MEXC (formerly known as MXC) is a centralized cryptocurrency exchange (CEX) founded in 2018. MEXC strives to provide convenience and security for its users while offering a variety of opportunities for trading and investing in cryptocurrencies.

Key features and services of MEXC: spot trading (the ability to trade a variety of cryptocurrency pairs and a convenient interface for market analysis and trading), margin trading (providing leverage to increase profit potential and different leverage levels for different trading pairs), futures and derivatives (high leverage futures trading and a wide selection of contracts for various assets), financial products (betting, cryptocurrency lending, and participation in various investment products to earn passive income), security (multi-level account protection), educational resources.

Currently, the exchange serves more than 170 countries and has a user base of over 10 million. The exchange has a significant trading volume—more than $1.5 billion per day—which allows traders to execute orders quickly and efficiently. The exchange ranks 11th on Coinmarketcap’s list of trading platforms. On MEXC, we have the opportunity to trade 2,491 different coins, while on Binance there are only about 350. In this respect, MEXC clearly outperforms the market leader. And this is how it attracts its audience! In addition, this trading platform attracts those who value anonymity, as it allows withdrawals of up to 8 BTC per day without verification. This is a fairly large amount by current standards.

The MEHS exchange was established in 2018 by a group of professionals with experience in blockchain, finance, and technology. The leaders and inspirers of this wonderful team were Metin Mehmet Durgun and John Cheng Ju. The team included specialists with experience working in large international companies and financial institutions, which allowed them to create a platform with a high level of security and performance.

In its first months of operation, MEXC actively developed its infrastructure and expanded its list of supported cryptocurrencies. Just three months after its launch, the platform released its proprietary MX token.

In 2019, MEXC began offering additional services such as futures and margin trading. This attracted a wider range of traders to the platform, including institutional investors.

The exchange was initially registered in Singapore, which is one of the major hubs for fintech companies and blockchain projects thanks to its favorable regulations and access to investment. But in 2020, as part of its global expansion, MEXC opened offices in various regions around the world, including the US, Europe, and Asia, to better serve its users and comply with local regulations.

In 2021, the exchange underwent rebranding and changed its name from MXC to MEXC Global. This step was aimed at strengthening the brand’s international image and recognition. An important milestone was the introduction of global partnership programs and participation in international cryptocurrency events.

A little later, the exchange also began providing staking services and participation in IDO (Initial DEX Offering). MEXC management is still actively investing in technological development, implementing advanced solutions to ensure security and increase the speed of trading operations.

MEXC strives to provide convenience and security for its users while offering a variety of opportunities for trading and investing in cryptocurrencies. Security on this platform is a critical aspect.

Here are the main measures implemented by MEXC to ensure user safety:

Go to the official MEXC website https://promote.mexc.com/a/Feebacker

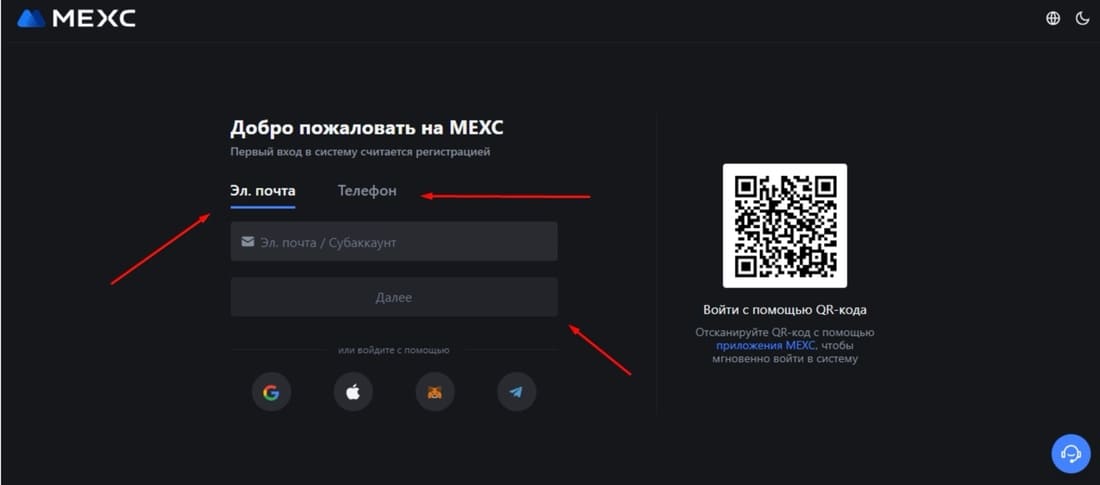

Click on the “Register” button in the upper right corner of the page.

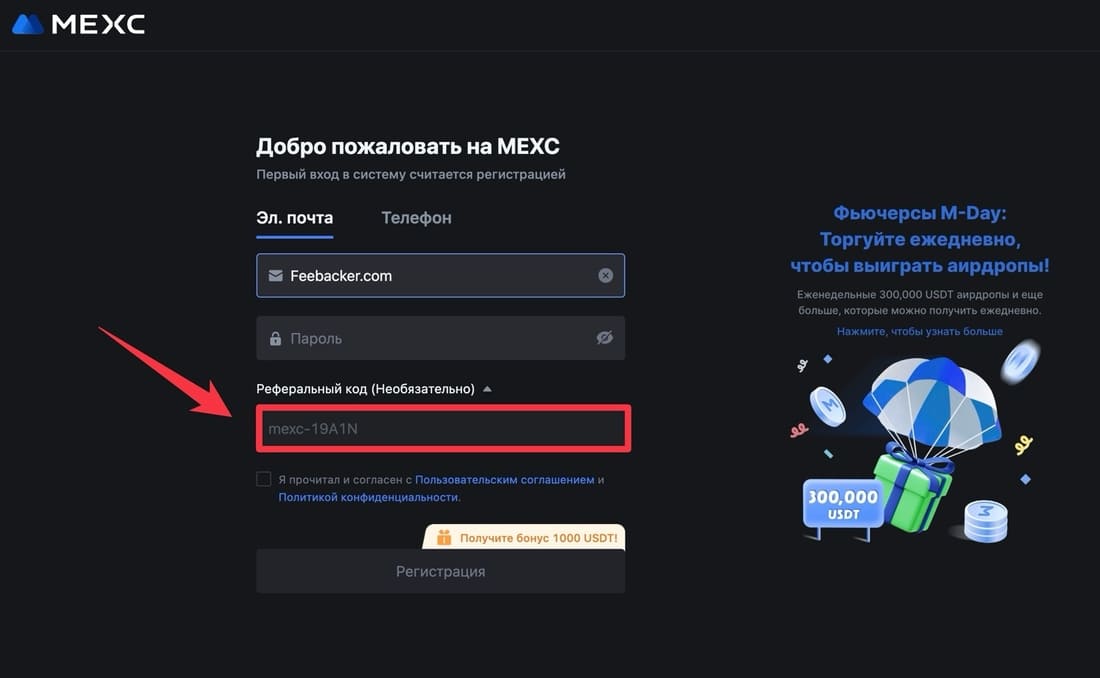

Select the registration method: via email or phone number. Enter your email address or phone number, then confirm by clicking “Next.”

Now let’s create a strong password. Check the referral code “mexc-19A1N”.

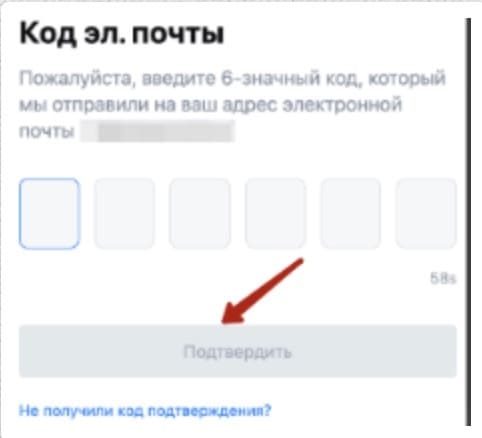

Accept the terms of use for the platform and click “Register.” When registering via email, confirm your email address by entering the code sent to your email.

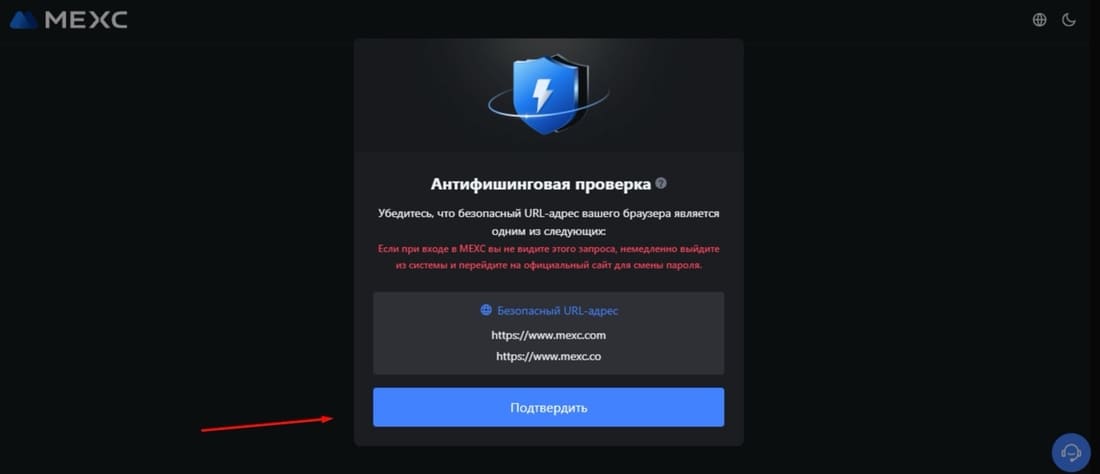

Next, the platform offers an “Anti-phishing check.” If everything is in order, click the “Confirm” button.

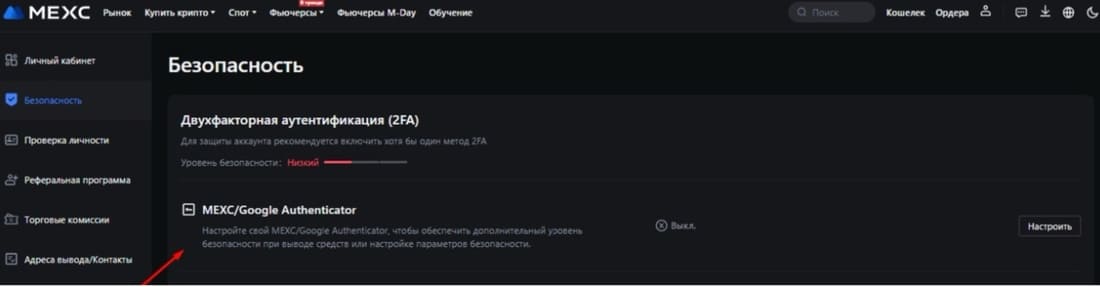

After successful registration, it is strongly recommended to set up two-factor authentication for increased security. Go to the “Security” section in your account settings. Follow the instructions to set up 2FA (Google Authenticator or SMS authentication).

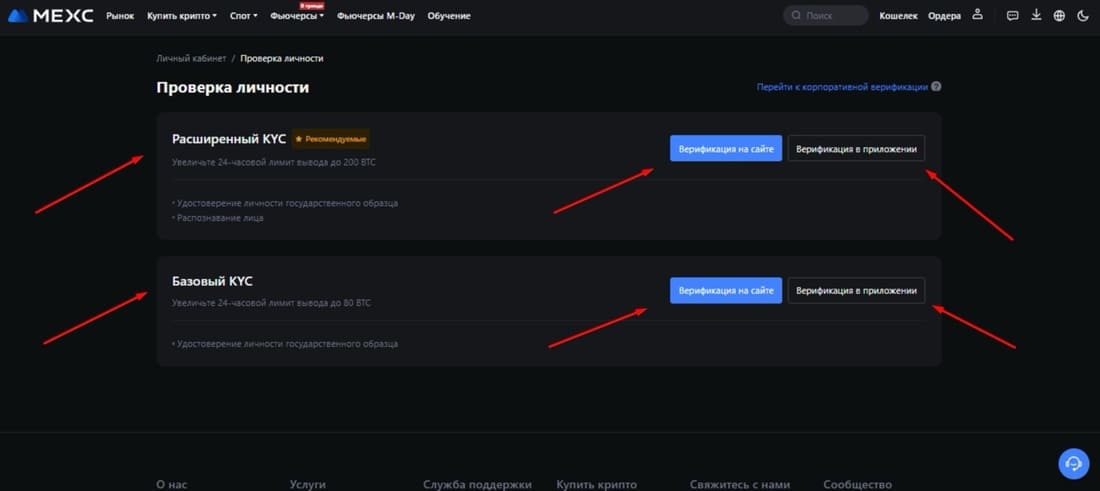

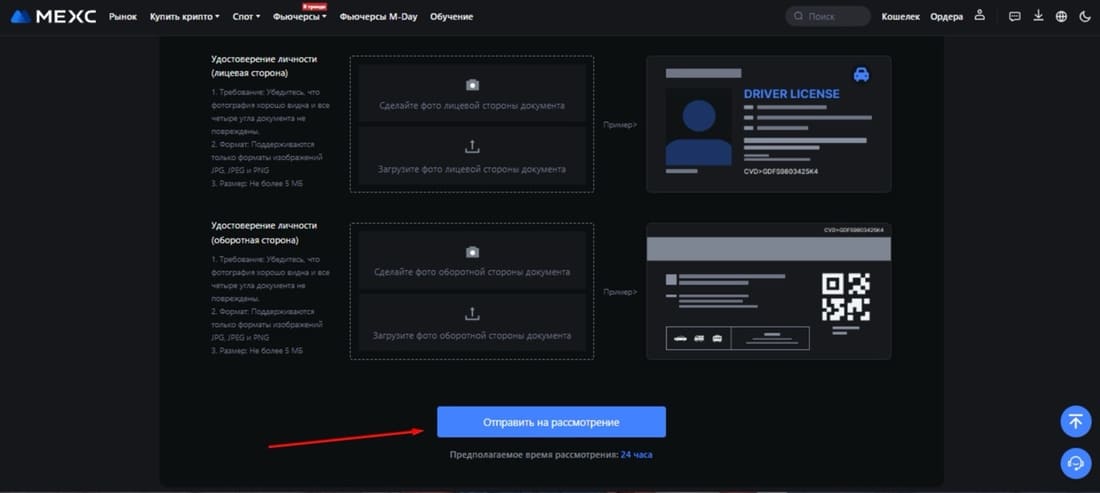

After that, we recommend that you complete verification, even though it is not mandatory on this platform. Hover your mouse cursor over your avatar in the upper right corner of your MEXC personal account and click “Identity Verification.” Select the type of verification you need, “Advanced KUS” or “Basic KUS,” and choose whether you want to complete verification on the website or in the app.

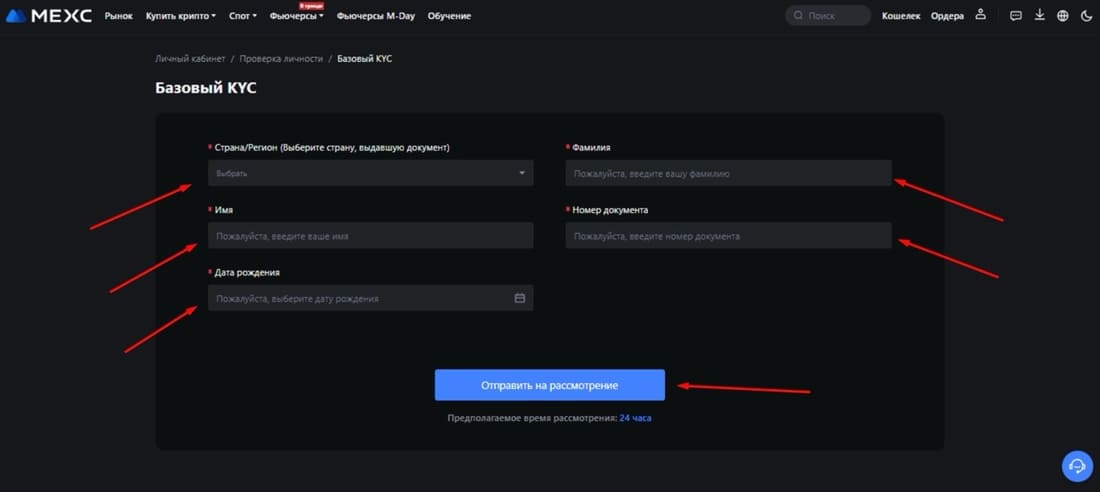

Fill in all the required fields, including: country, first name, last name, date of birth, document number. Click “Submit for review.”

Upload a scan or photo of one of the following documents: passport, national ID card, driver’s license. Make sure the images are clear and all details are clearly visible. Click the “Submit for review” button.

If you select “Advanced KUS,” we will also take a selfie holding the selected document next to your face so that the exchange can verify that the document is ours.

We receive a notification about the verification result via email or in our personal account. If the verification is successful, the account will be updated, and we can safely use all the exchange’s features.

First, top up your account on the platform. For security reasons, enable two-factor authentication first.

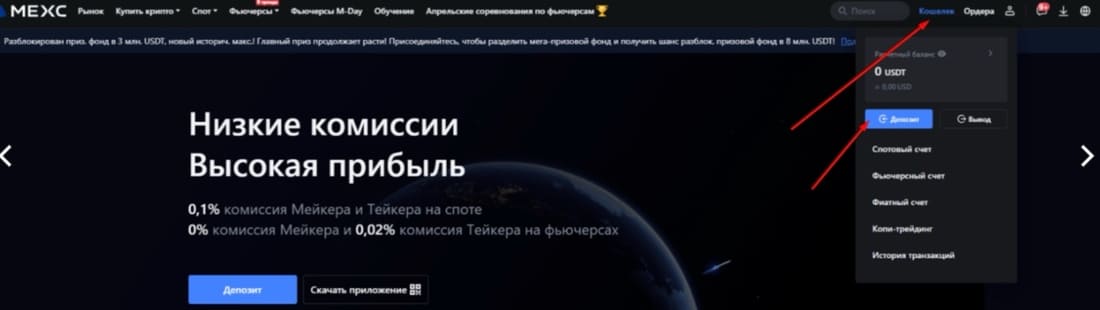

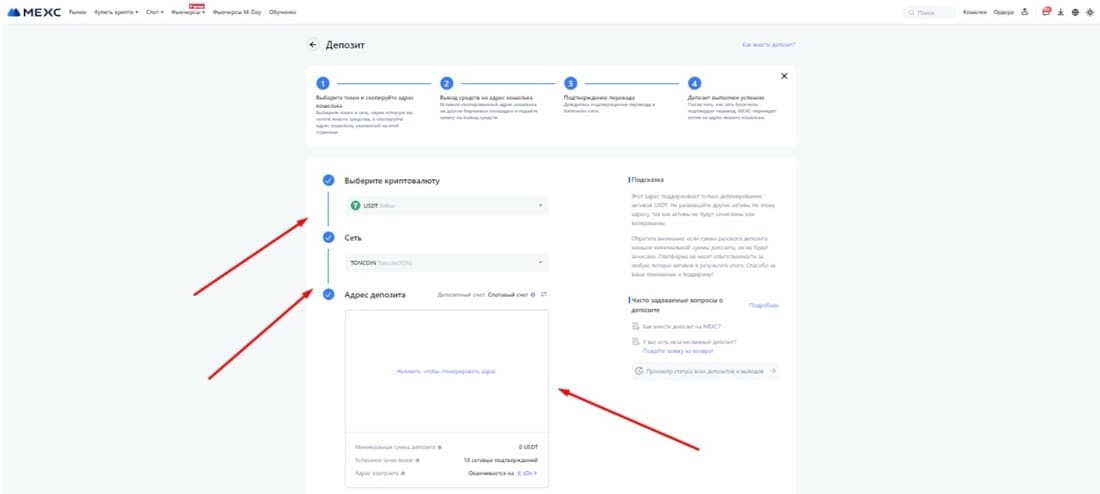

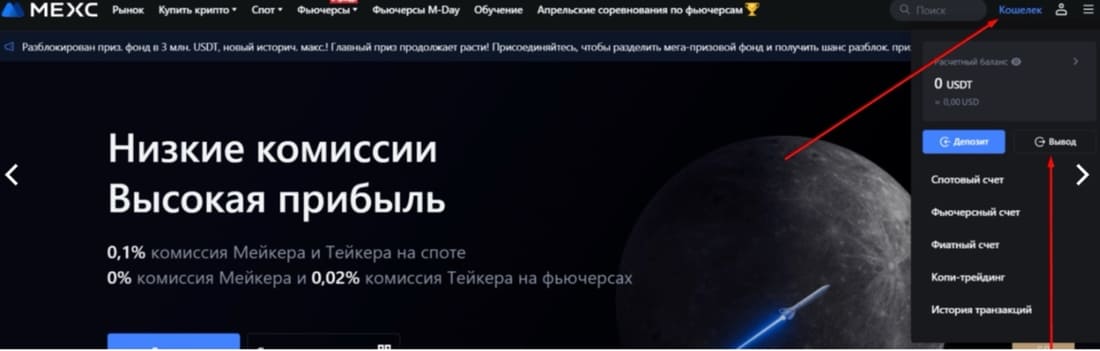

For those who have crypto in their wallet, select the “Wallet” section in the upper right corner of the main page and click “Deposit” in the upper right corner.

Select the currency and blockchain network. Be careful when choosing the network, because if you transfer funds to the wrong network, they will not reach your account.

The system will generate a unique address for the deposit of the selected cryptocurrency. Copy this address. The time it takes for funds to be credited to your MEXC account depends on the network load of the selected cryptocurrency. You can track the status of your deposit in the “Deposit History” section. Please note the minimum deposit amount for each cryptocurrency. If the amount is less than the minimum, the funds may not be credited to your account. MEXC does not charge any fees for account deposits, but there may be fees on the sending wallet or exchange side.

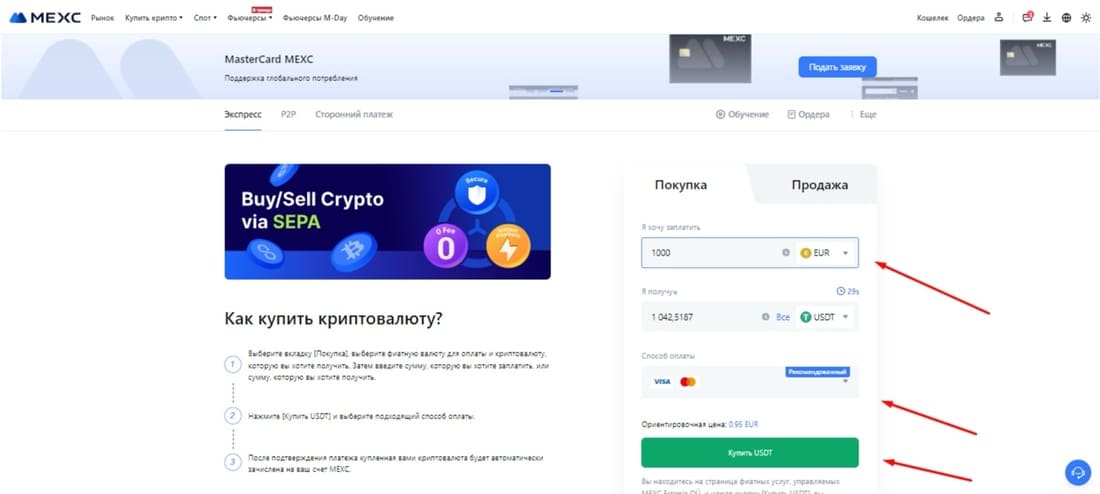

If you don’t have any cryptocurrency yet, click “Buy Crypto” at the top.

If you select the “Express” method, this is a purchase made with a bank card. Select the currency, amount, and payment method.

After payment confirmation, the purchased cryptocurrency will be automatically credited to our MEXC account.

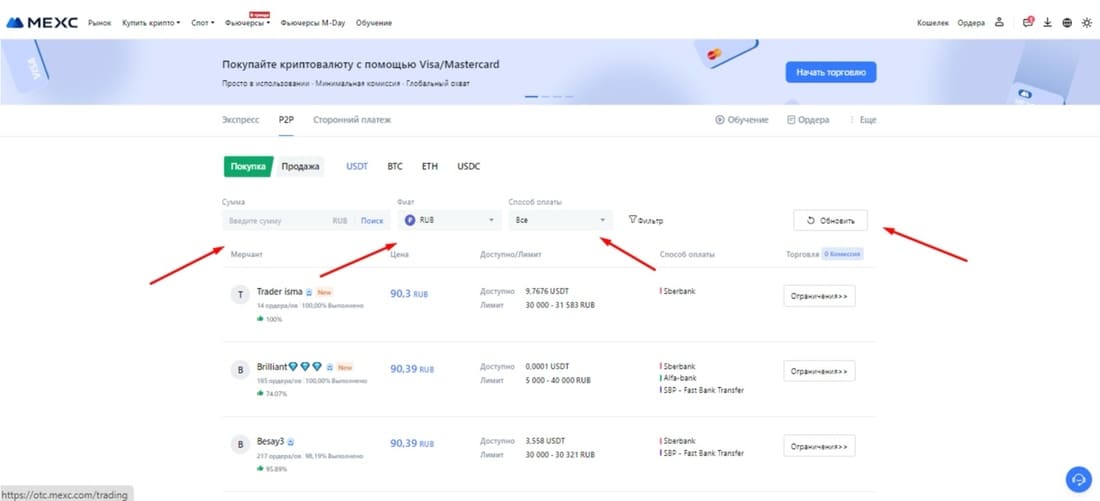

Another popular method in the “Buy Crypto” section is P2P. Select the “P2P” section, then select the ads you want for buying or selling cryptocurrency. You can also place your own ad here.

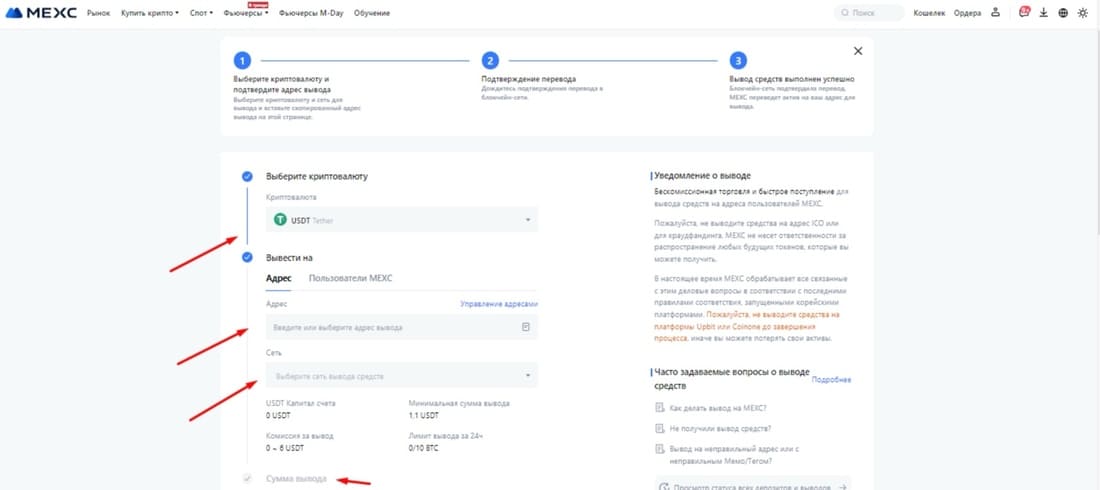

Withdrawing funds from MEXC requires several steps and careful attention to avoid mistakes and ensure the security of our funds. Below are detailed instructions and important aspects to consider when withdrawing funds from MEXC.

Log in to your account and go to “Wallet” in the upper right corner, then select the “Withdraw” section.

In this section, find the desired cryptocurrency in the list and click on it. Enter the address of the wallet to which you want to withdraw funds and select the blockchain network. If the selected cryptocurrency requires a Memo or Tag, fill it in. Also, fill in the amount. Click the “Send” button.

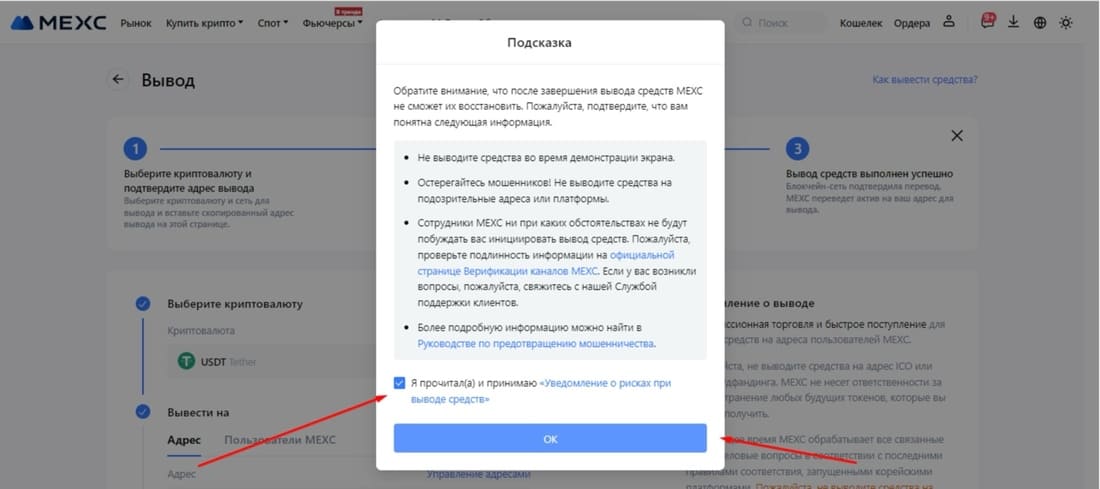

We receive a message about the risks involved in withdrawing funds, click “OK.”

To confirm the withdrawal, you will need to complete two-factor authentication (2FA).

The withdrawal request will be processed, and you can track the withdrawal status in the “Recent Withdrawals” section. The processing time for withdrawals depends on the cryptocurrency network and can take from a few minutes to several hours. Please note that MEXC charges a fee for each withdrawal transaction. The fee amount depends on the selected cryptocurrency and is specified when submitting a withdrawal request.

Spot trading on the MEXC exchange is the process of buying and selling cryptocurrency using real assets. This form of trading involves transactions being carried out directly between buyers and sellers, with all settlements taking place immediately after the transaction is completed.

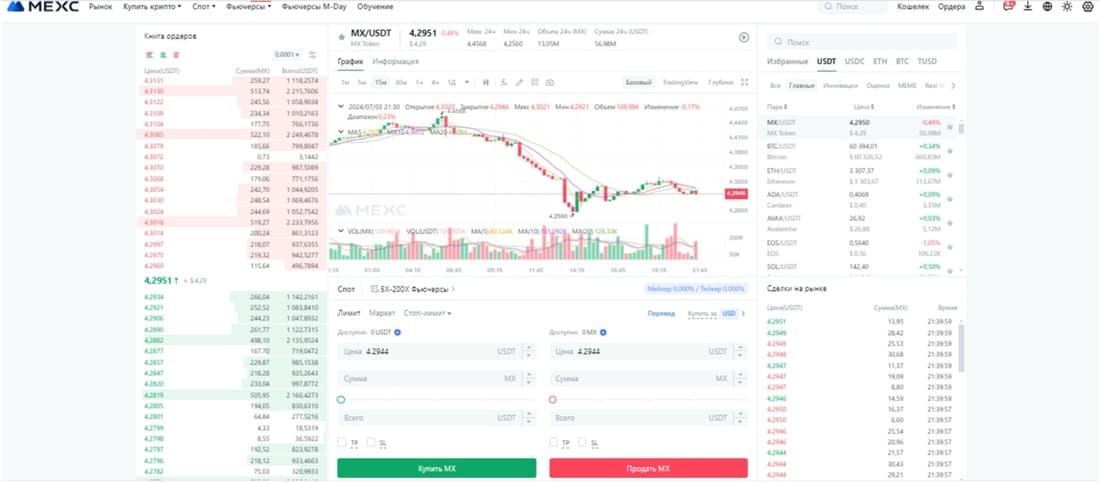

The main spot trading interface includes charts, an order book, transaction history, and an order placement panel. Charts provide a visualization of current and historical prices for selected trading pairs. The order book shows current buy and sell orders. The transaction history displays the latest completed transactions for the selected trading pair.

The MEXC spot market offers several types of orders:

– A limit order allows you to set a specific price at which you want to buy or sell an asset. The transaction will only be executed if the market reaches this price.

– Market order, executed at the current market price. This type of order is used for immediate execution of a transaction.

– Stop order, allows you to set the activation price. Once the market reaches this price, the order becomes a market or limit order.

– A limited stop order combines elements of a stop order and a limit order. Once the order is activated at the set price, it becomes a limit order.

Step-by-step guide to spot trading:

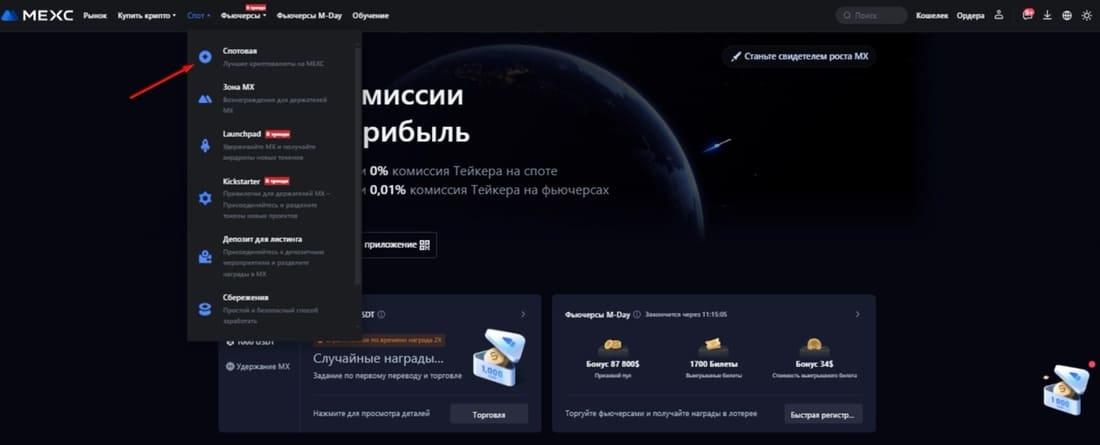

Go to the spot trading section by hovering over “Spot” in the top menu. Select “Spot” from the drop-down menu.

In the upper left corner of the interface, select the trading pair you want to trade. For example, MX/USDT. Use charts and technical analysis tools to assess the current market situation and determine the best entry and exit points. At the bottom of the screen, select the order type (limit, market, stop order). Enter the price (if it is a limit order) and the amount of cryptocurrency you want to buy or sell. Click “Buy” or “Sell” to place an order.

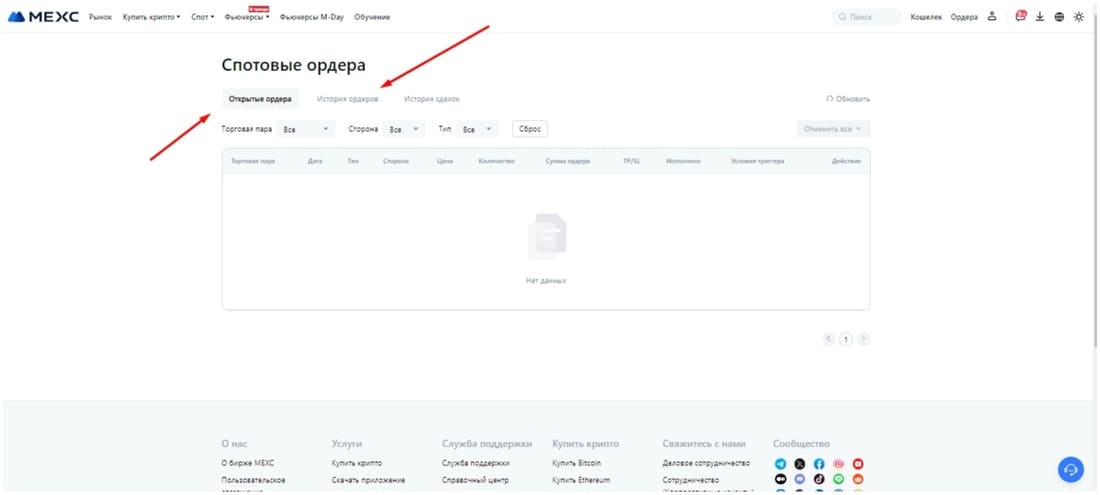

In the upper right corner of the “Orders” menu, information about active orders will be displayed in the “Open Orders” section, and completed transactions can be viewed in the “Order History” section. If desired, you can cancel any open order before it is executed. To do this, go to the “Open Orders” section and select the order you want to cancel.

Market liquidity affects the speed of order execution and the ability to execute large trades without significant price changes. MEXC charges a commission for each trade. The commission amount depends on the trading volume and the user’s account level (for example, VIP status can reduce commissions). Spot trading involves risks, including market volatility and the possibility of losses. It is important to conduct thorough analysis and manage risks. MEXC provides a wide range of tools and indicators for technical analysis, including moving averages, RSI, MACD, and others.

Margin trading on MEXC allows traders to trade with leverage to trade larger volumes of cryptocurrencies than they have in their account. This increases potential profits, but also increases risks. MEXC provides various leverage levels for margin trading. To borrow funds, you must have a certain amount of your own funds as collateral.

A margin requirement is the minimum level of equity that must be maintained in an account to avoid liquidation of a position. If the value of the assets in the account falls below this level, the position may be liquidated. The platform automatically closes your position to prevent further losses and repay borrowed funds.

Margin trading on MEXC involves high risks due to the possibility of significant losses. When using leverage, losses may exceed your initial investment. Interest is charged on borrowed funds, which is added to your liabilities. Trading fees may be higher compared to spot trading. It is important to set stop-losses to limit losses. Using technical analysis and monitoring the market will help you make more informed decisions. The platform may liquidate your position if the value of your capital falls below a certain level. Liquidation protects the platform from loan defaults.

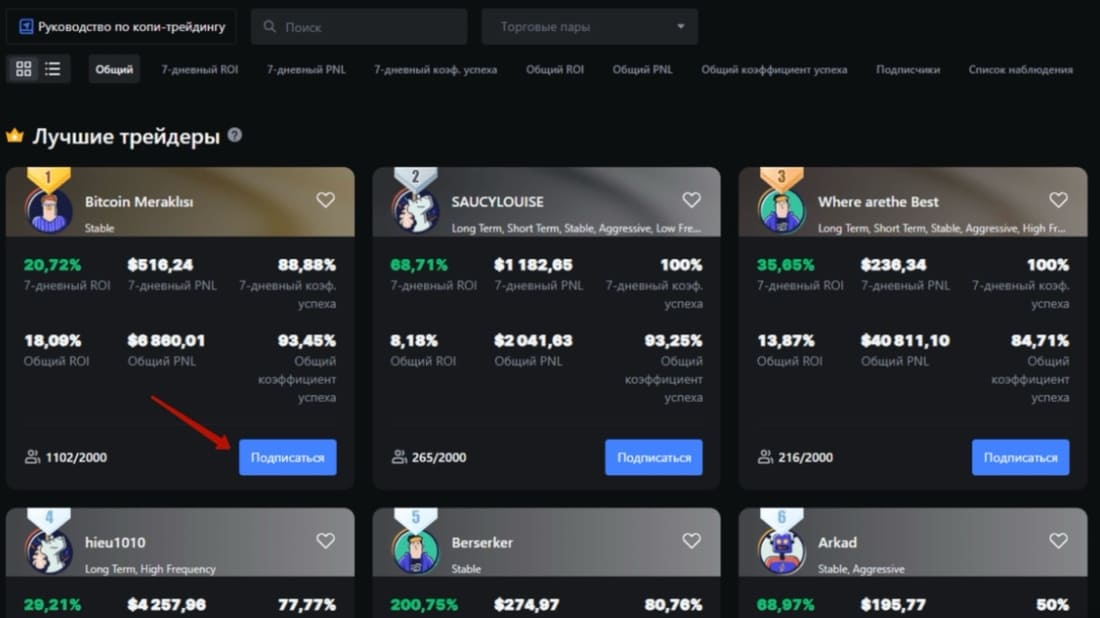

Copy trading on the MEXC exchange allows customers to automatically copy the trades of experienced traders, enabling them to make a profit without having in-depth knowledge of the market or trading experience.

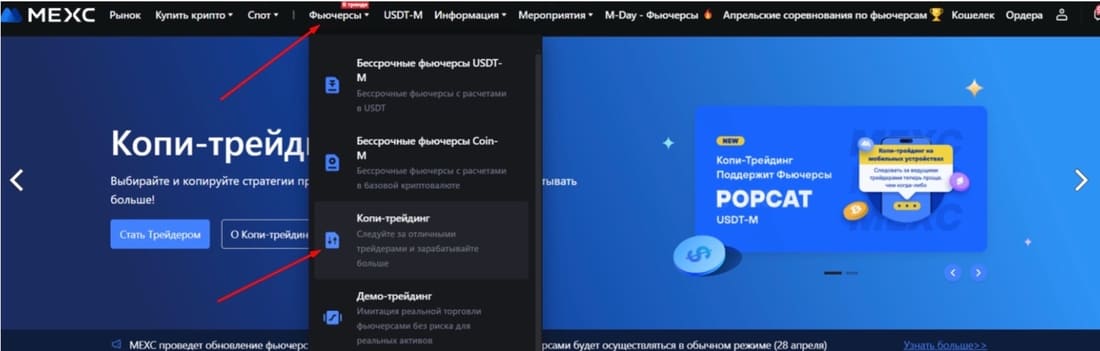

Hover your mouse cursor over “Futures” in the top menu of your personal account, then select “Copy Trading” from the drop-down list.

The next step is to select the trader whose trades we want to copy. We can view their trading history, profitability, risk level, and other indicators.

Specify the amount you want to allocate for copying trades and set risk management parameters. Activate the copy trading function. All trades of the selected trader will be automatically copied in real time. Monitor the results of copy trading in the corresponding section of the platform. If necessary, change the parameters or stop copy trading at any time.

It is important to remember that even experienced traders can make mistakes, which will lead to losses. It is necessary to regularly monitor the results of copy trading and adjust the parameters if necessary. Copy trading on MEXC is a convenient and effective way to participate in the cryptocurrency market, especially for novice traders or those who do not have enough time to trade on their own. However, like any investment activity, copy trading requires caution and a careful approach to selecting signal providers and managing risks.

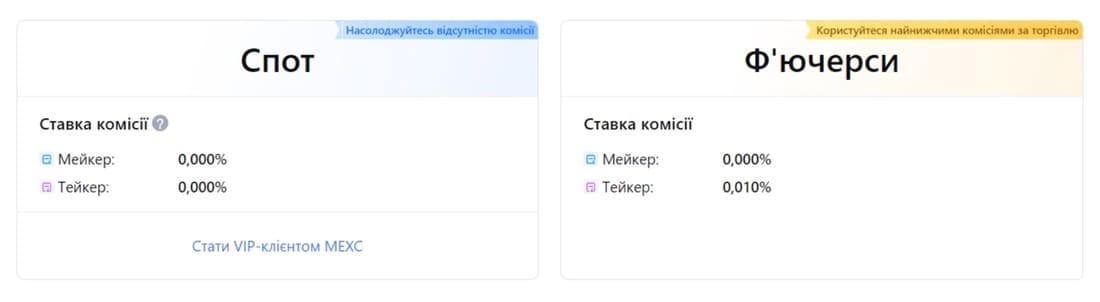

Fees on the MEXC exchange may vary depending on the type of transaction, user activity level, and participation in the VIP program.

Standard commissions for trading cryptocurrencies on MEXC are divided into commissions for makers and takers. Makers are users who place limit orders that add liquidity to the market. The commission for makers is usually lower. Takers are users who execute orders, reducing liquidity in the market. The commission for takers is usually higher.

Recently, the MEXC administration has significantly reduced trading commissions, apparently in order to lure traders away from other trading platforms. It is difficult to say how long such low commissions will last.

Commissions on the spot market:

Commission for takers: 0.20% Separate commissions also apply to futures trading for makers and takers. These commissions may vary depending on the trading volume and leverage used.

There are no fees for depositing funds, and withdrawal fees vary depending on the specific cryptocurrency.

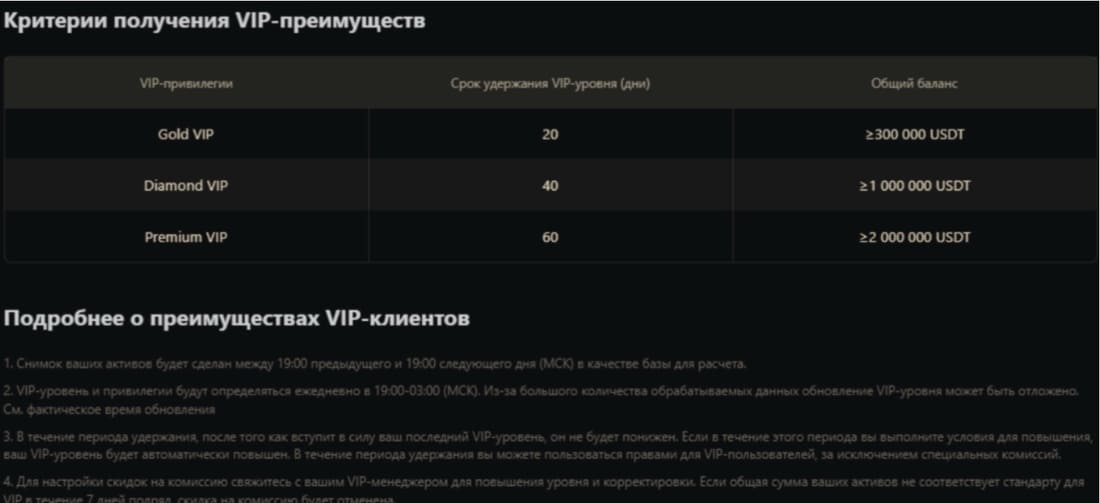

The VIP program on MEXC is designed for active traders and offers various levels of privileges, including reduced fees and additional services. VIP level is determined based on the user’s trading volume and/or account balance.

Benefits of the VIP program:

MEXC’s fees are very competitive, and participating in the VIP program can significantly reduce trading costs. Users are advised to familiarize themselves with the current fee rates and VIP program terms and conditions in order to manage their trading costs as effectively as possible.

MEXC is a reliable and user-friendly cryptocurrency exchange suitable for both beginners and experienced traders. The exchange offers a wide range of assets, competitive fees, and high liquidity, making it an attractive choice for cryptocurrency trading.

With its multi-level security system, user-friendly interface, and extensive educational resources, MEXC provides all the tools you need to successfully trade and invest in cryptocurrencies.

MEXC offers over 2,000 trading pairs, making it one of the most versatile exchanges on the market. The exchange consistently ranks in the top 20 in terms of trading volume, ensuring fast order execution and tight spreads. High liquidity also contributes to reduced volatility and increased stability in trading operations. DDOS attack protection system and advanced data encryption technologies. Intuitive interface, available on both the web platform and mobile apps for iOS and Android. The platform provides a wide range of tools for analysis and trading, including charts, indicators, and trading signals. The exchange offers users a variety of educational materials, including webinars, articles, video tutorials, and guides.

The VIP program provides participants with additional privileges, such as reduced commissions and personal managers. To take full advantage of the platform’s functionality, including withdrawing large amounts and accessing certain trading instruments, you must complete the KYC (Know Your Customer) procedure. However, even without verification, you can withdraw up to 8 Bitcoins per day, so many people can trade without providing their details.

Write or call us. We will help you quickly re-register your accounts. Enjoy a new level of trading with cashback every month.

You are used to trusting professionals in your everyday life. Trust us with your interactions with exchanges. You won't want to go back to trading without Feebacker.com.