Today’s crypto market is not just about charts and volatility. It is an information storm in which those who can quickly filter signals from noise survive. New tokens appear daily, trends change at the click of a button, and big players move the market by millions before most people even notice the movement. To avoid getting lost in this chaos, you need tools that are accurate, fast, and focused on the essentials.

Translated with DeepL.com (free version)

Screeners are filters that help you pick out the assets that are really worth checking out from hundreds of options. They sort coins by growth, volume, investor interest, and sometimes even more detailed metrics, like accumulation by big wallets or changes in open interest. A good screener saves hours of manual analysis and gives traders an advantage, especially when decisions need to be made quickly.

Translated with DeepL.com (free version)

Key Screener is one such tool. It is not a classic crypto aggregator or just a coin screener. It is a platform that aims to bring together data on trends, institutional movements, growth in interest, and key coin metrics in a single window. What’s more, it does so with an emphasis on convenience and real-world application in trading decisions. Below, we will examine how Key Screener works, what is convenient about it, where its weaknesses lie, and for whom it can truly become a useful tool.

Translated with DeepL.com (free version)

Key Screener was created in response to a real demand from traders: “Where can I find live analytics on coins, not just prices and charts?” Its creators are a team from Cryptology School (Cryptology Key), a leading educational platform for crypto and forex trading, as well as Konstantin (Kostya) Kudo, co-founder and CEO of Cryptology Key and an active trader with over 6 years of experience. They regularly conduct courses, run closed communities, and hold public AMAs, so they clearly understood the audience’s pain points in waiting for “smart data” on the go.

The platform launched in 2024, initially as an internal utility at conferences and brainstorming sessions of the Cryptology community (e.g., Incrypted Conference, Birthday Meetup). It soon evolved into a full-fledged web tool. The team combined a coin screener with analytics on large wallets and institutional flows, added an AI panel, filters for open interest and listing data — all with a focus on trader convenience.

Over time, Key Screener grew: regular updates, new data sources (DEX, CEX, on-chain, news aggregators), improved visualization, and training on how to use the tool—a mini-course and free Base Camp from Kostya Kudo and the team—were added. Thus, Key Screener has evolved from an internal prototype into a powerful public platform that combines analytics, training, and community.

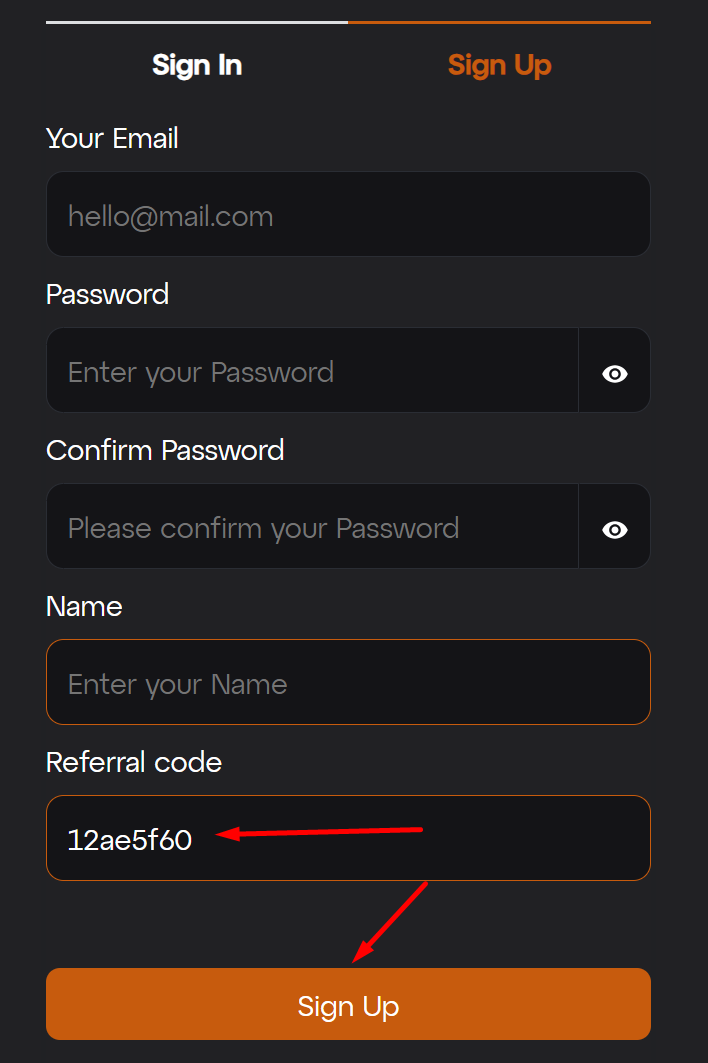

To get started, you must complete the mandatory registration process. Go to the Key Screener official website via our referral link

https://app.key-screener.com/en/login?refCode=12ae5f60

. Don’t forget that registering via the link gives you a number of undeniable advantages when purchasing a service package in the future ($15 cashback upon request when purchasing an annual subscription). Fill out the registration form: enter your email address, password twice, and nickname. Check that “12ae5f60” is written in the “Referral Code” field, then click the orange “Sign Up” button below.

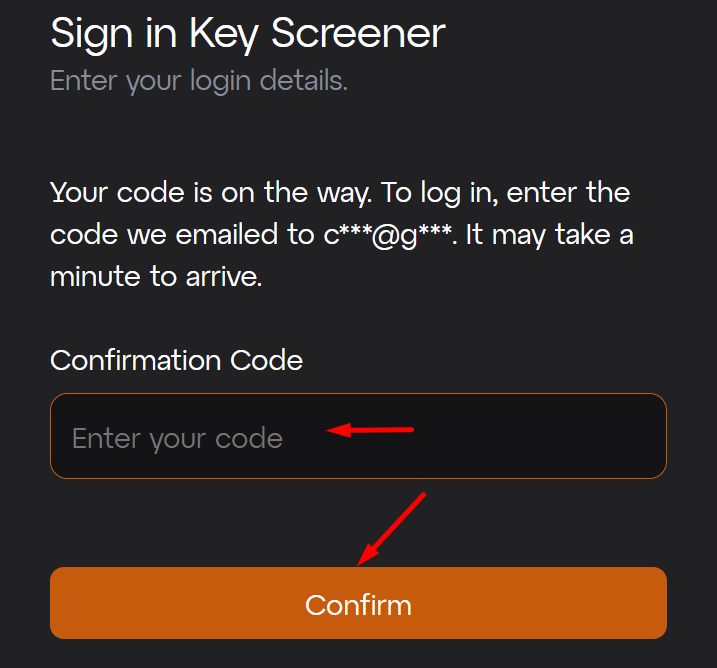

Next, go to your email and copy the confirmation code. Paste this code into the appropriate field and click the “Confirm” button to confirm.

The system will then ask you to accept cookies—click “Rejected non-essential Cookies.” In the next step, the system offers a 5-step tutorial on the interface, which will help you familiarize yourself with the layout of the blocks on the dashboard.

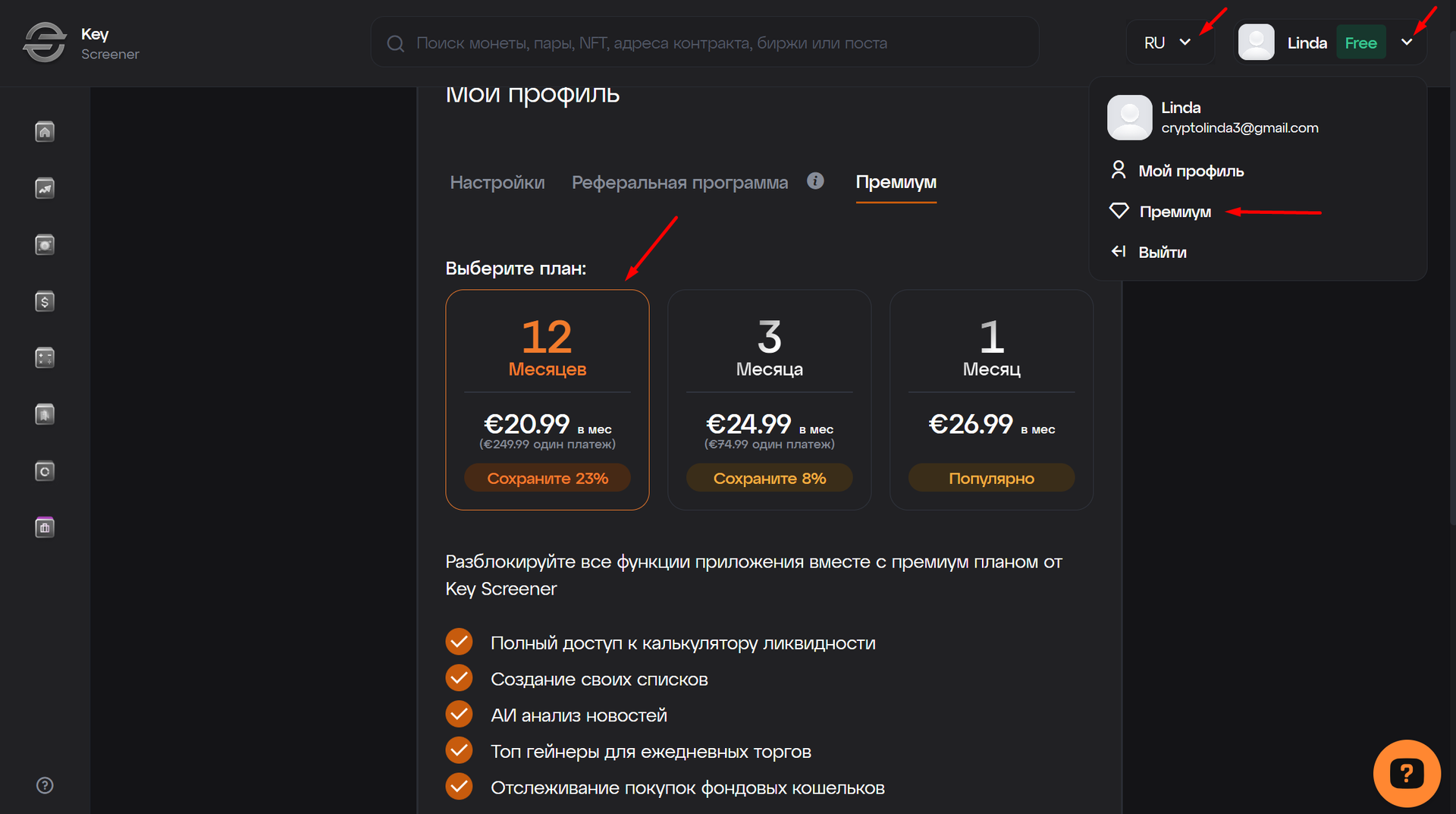

After that, you can change the language to Russian in the upper right corner. And a little to the right of the avatar icon, click “Premium” if you want to purchase a package and work with the platform without restrictions. As previously reported, when you purchase an annual subscription, you will receive a cashback of $15. Unfortunately, you can only purchase a package with a debit card, but it is possible that a cryptocurrency payment option will be added later. An annual subscription gives owners the following benefits:

Here, in the adjacent tab, you can go to the “Referral Program” section to copy your link and start earning by inviting partners to join the platform.

Key Screener is not just a data display, but a trader’s dashboard where everything is tailored for decision-making. The platform combines several key tools: from screeners and projections to portfolio tracking and whale activity monitoring. Each block here is a separate level of information filtering, allowing you to find signals before others. Below, we will examine how the main functions of the service work and how they can be used in real trading and market analysis.

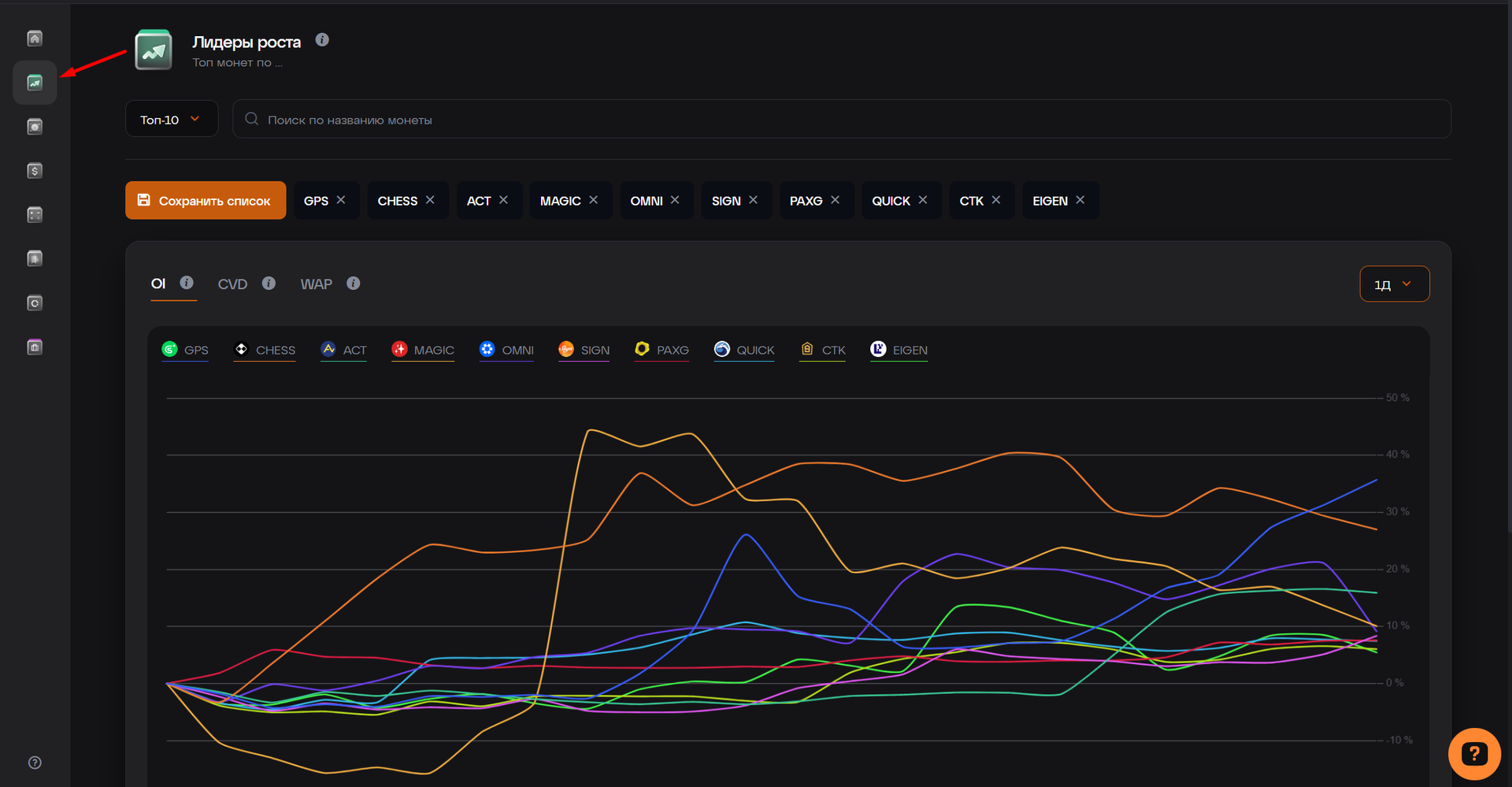

The “Growth Leaders” section in Key Screener is a tool that allows you to quickly find cryptocurrencies with the highest growth dynamics, sorted by sector, capitalization, and key metrics. It is not just a list of what has grown, but a detailed filter that allows you to see where the movement is really happening and why it is happening.

What you can do in this section

In the main area, we see a graph—this is the “Linear Projection,” the key metric of the section, which is based on data on:

Based on this data, a linear projection is constructed—a trend that allows you to track deviations, anomalies, and leading signals. The projection can be filtered by periods: 1 day, 7 days, or 30 days, to understand both short-term impulses and long-term trends.

This chart allows you to quickly identify trending assets. You can see which coins are leading the growth in specific sectors and capitalization, and why. This helps you find potential entry points before they appear in the news.

In addition, the tool helps identify market anomalies. If an asset’s OI or CVD rises sharply without a price increase, this is cause for concern. Such signals often precede a reversal or surge. Key Screener allows you to see this visually, quickly, and in the right context.

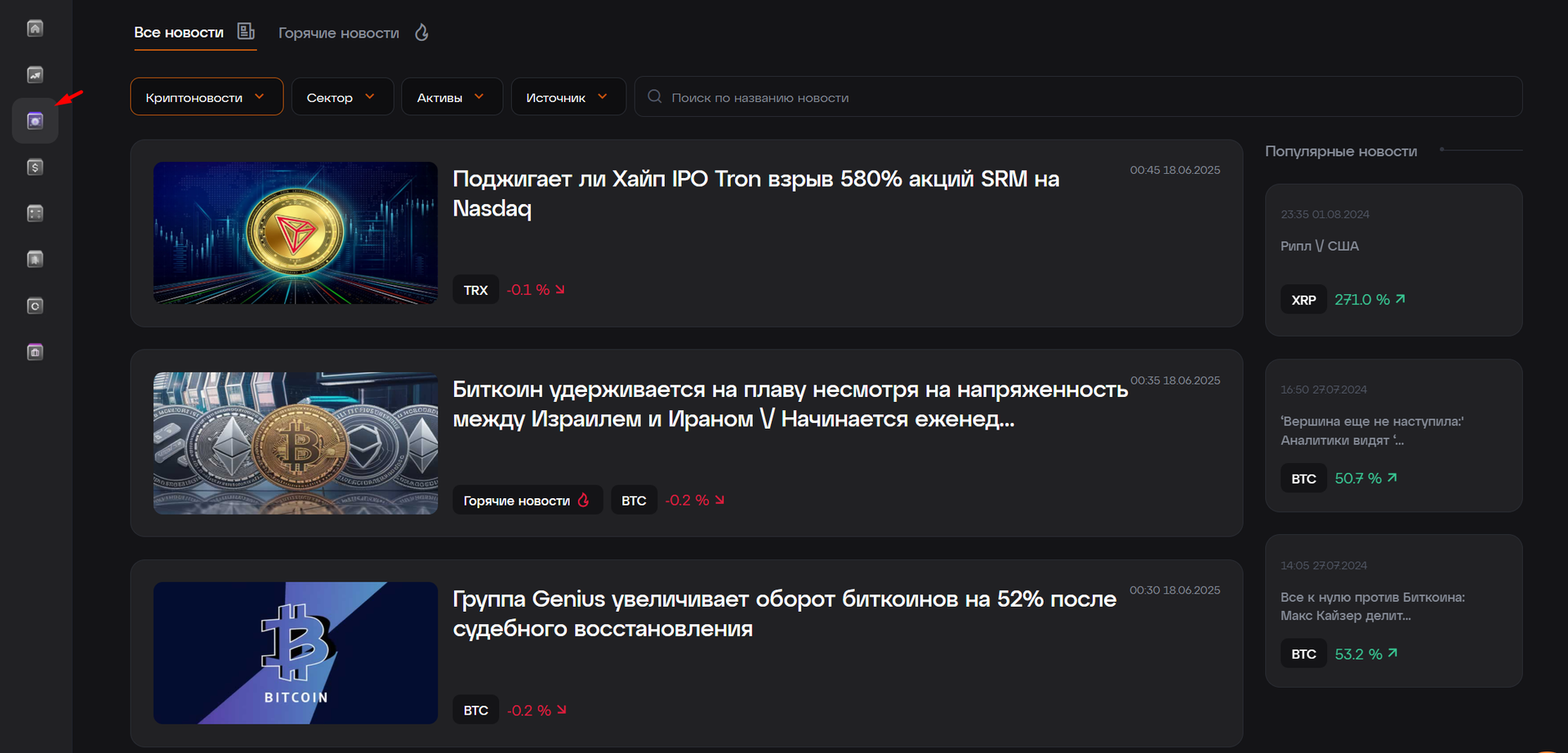

The flow of information in the crypto world is frantic. Every day, hundreds of news stories, tweets, and macroeconomic signals appear. Distinguishing noise from truly important events is one of the main tasks of a trader when analyzing tokens online. The “News Impact” section in Key Screener was created for this very purpose. It allows you to quickly understand which news items can really move the market and which coins will be hit or, conversely, take off.

But it’s not just a headline aggregator. It’s a full-fledged analytical tool that uses artificial intelligence to assess the importance of each news item and its potential impact on the asset.

What this tool can do:

All this gives traders the opportunity to quickly filter out insignificant news items and focus on those that are truly significant. It also helps them understand which assets may react to certain events. In addition, automatic prompts from AI are especially useful when there is a flood of scattered news items and it is difficult to understand which ones are important. As a result, “News Impact” turns the flow of information into a decision-making tool. This speeds up reactions, helps you stay ahead of the curve, and eliminates the need to chaotically read news sites and Twitter.

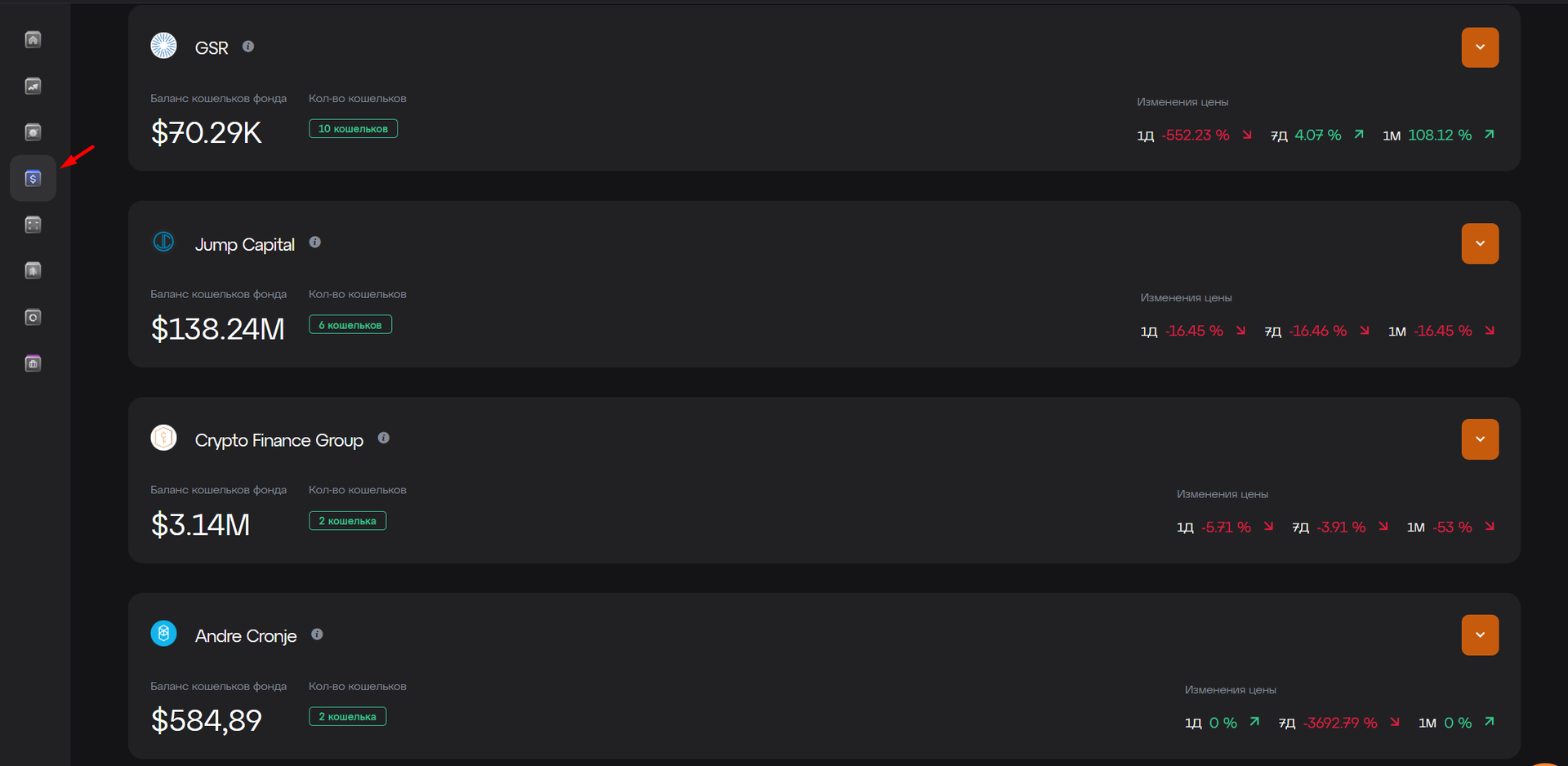

One of the most powerful sources of signals on the market is the behavior of major players. Institutional funds, market makers, and whales do not make random moves. Their transactions are not just numbers; they are hints of future movements. And Key Screener allows you to see them live.

The “Fund Wallets” section is a tool that allows you to track the actions of significant participants in the cryptocurrency market: what assets they are buying, what they are selling, and where they are accumulating positions.

What is available to the user:

In practice, this makes it possible to observe the movements of “smart money,” which is particularly valuable during accumulation phases before growth or sharp unloading before a decline. In turn, filtering by activity and time frames allows us to separate short-term speculation from sustainable investment strategies. Thus, we can build hypotheses about upcoming listings, pumps, and dumps, focusing on the movement of large wallets into rare or illiquid assets.

As a result, “Stock Wallets” is not just a list of addresses. It is a tool that helps you understand the behavior of major players and make decisions based on real capital actions rather than guesswork.

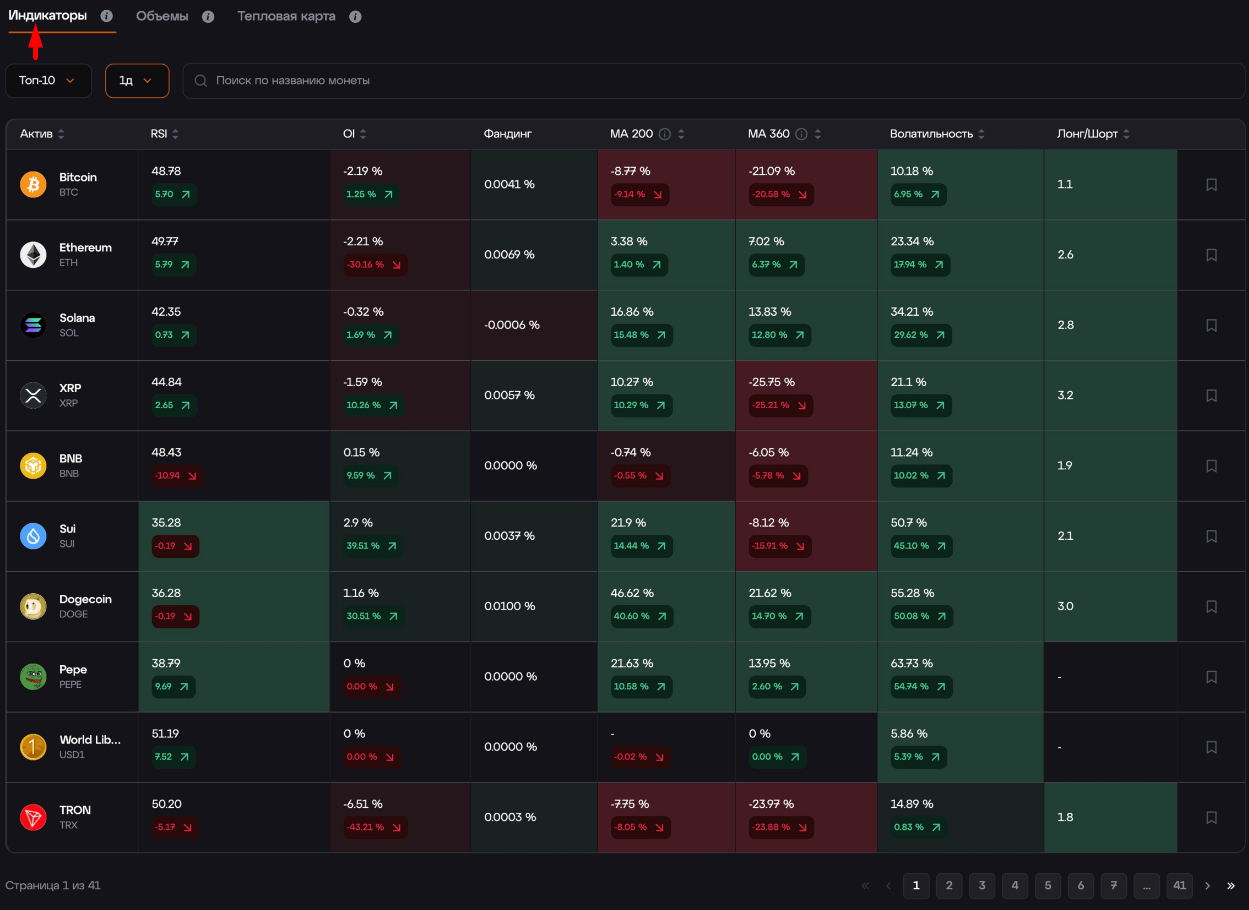

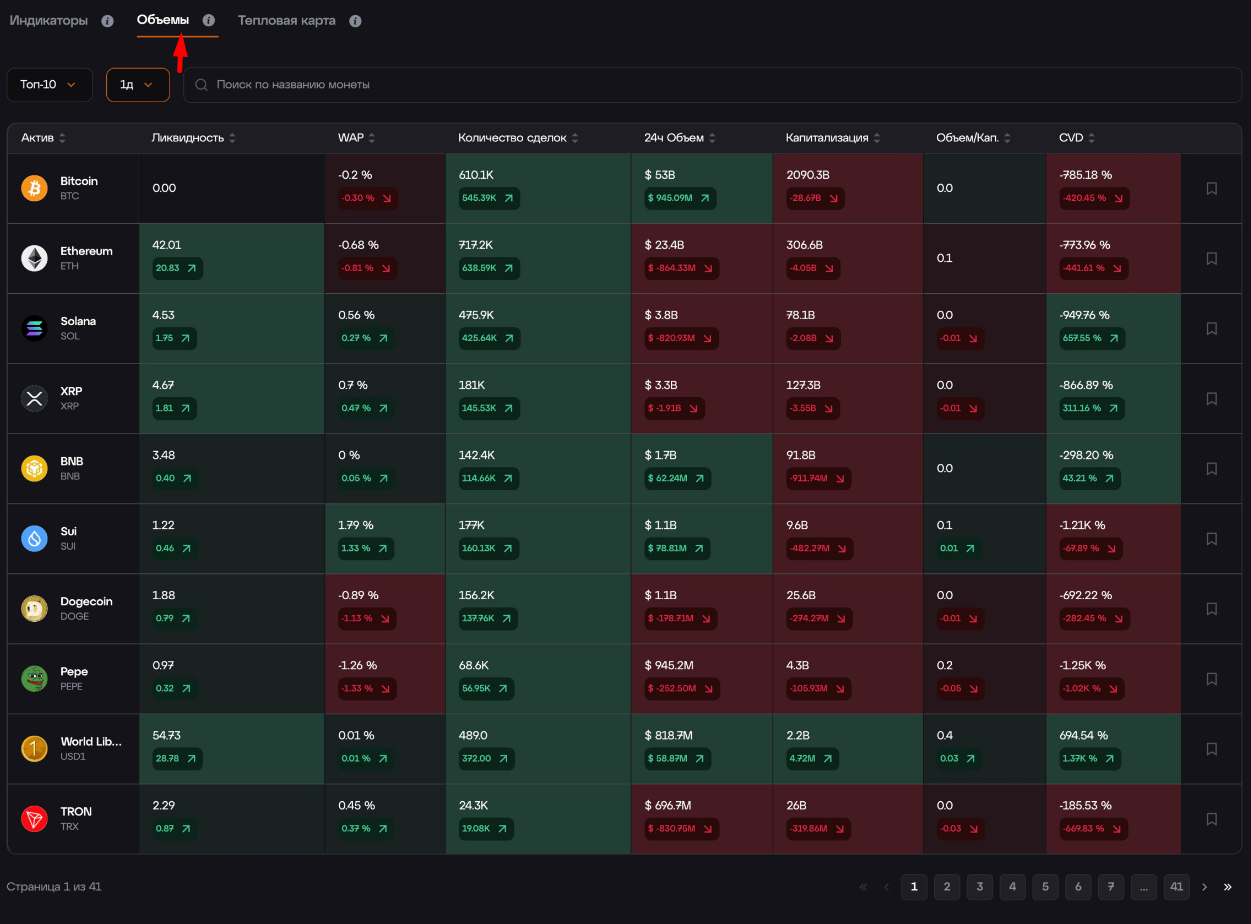

In the crypto market, it is important not only to know what is growing, but also to understand why and with what quality. Liquidity, volatility, and technical indicators all influence how reliable or inflated growth appears to be. The “Liquidity Calculator” section in Key Screener helps you quickly distinguish strong coins from weak ones so you don’t buy hype without fundamentals. Full functionality of this section is only available on the Premium plan. There are three tabs here: indicators, volumes, and heat map. Let’s take a look at each of them.

The platform analyzes each coin based on a set of metrics that provide a complete picture of activity and movement stability:

In addition to the indicators, in the adjacent tab you get analytics on:

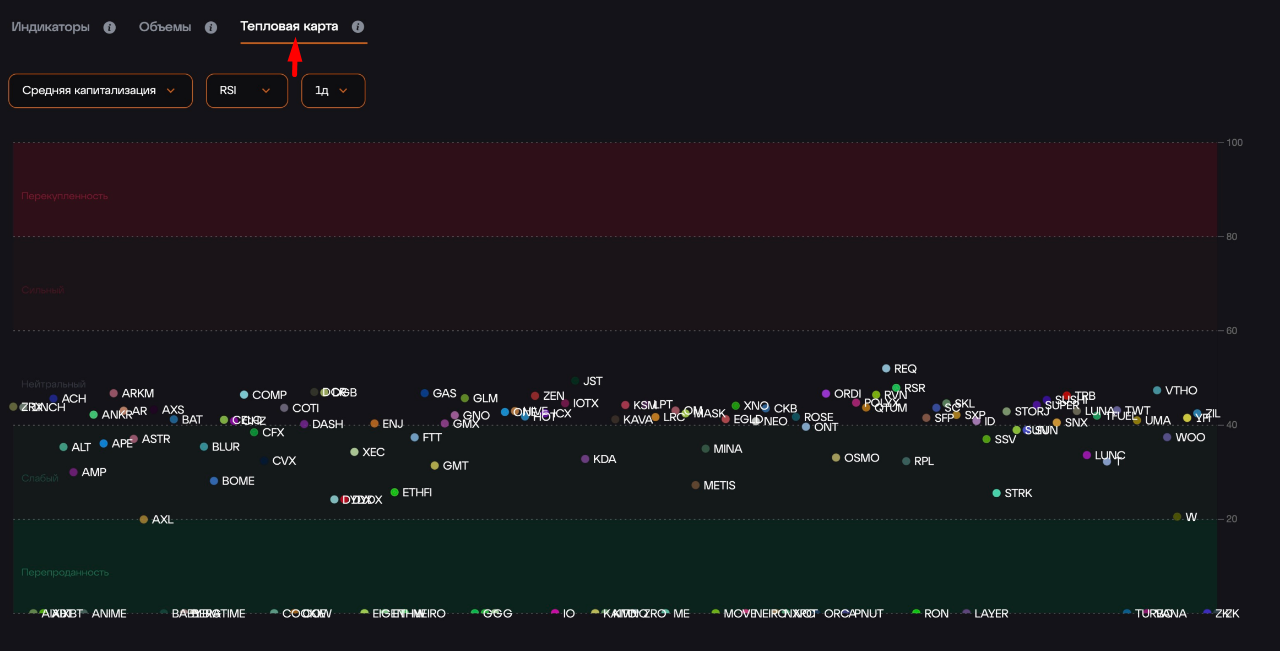

All this data can be displayed in the form of a heat map, where assets are ranked from weak to strong. The lower part represents weakness, overheating, and possible exit. The upper part represents strength, sustained interest, and movement potential. This allows you to assess the market structure at a glance, without having to manually sift through tables.

You can filter assets by criteria such as sector (e.g., GameFi, DeFi, L2), RSI, OI, 24-hour volume, number of trades, and volatility. This allows you to build your own selection strategies, whether you are looking for overbought tokens to short or undervalued coins with growing interest.

The Key Screener liquidity calculator is like a health scanner for cryptocurrencies. It shows who is really strong and who is just riding the wave of emotions, instead of dozens of tabs and tables — all analytics on one screen. The tool allows you to make decisions based on facts, not noise. The tool works with data from Binance for the last 30 days, allowing you to track the distribution of liquidity and strength between assets.

When there are hundreds of signals and dozens of directions on the market, it is important to have only what is really important at hand. The “Favorites” section in Key Screener solves this very problem, helping traders avoid getting lost in the flow of data and focus on priority assets and strategies.

Favorites is not just a list, but a personalized tracking panel where you can add: tokens and coins you are interested in; active trading ideas; wallets of funds or whales you are tracking; assets selected based on specific metrics from other sections (for example, from “Growth Leaders” or “Liquidity Calculator”).

The Favorites section displays all important metrics for selected assets—volume, open interest, price changes, CVD, and other parameters. This allows you to react quickly and accurately without wasting time searching. The Favorites section turns Key Screener into a personal trading dashboard. It’s not just a convenience — it’s a concentration tool that helps you stay focused and not miss important movements or signals.

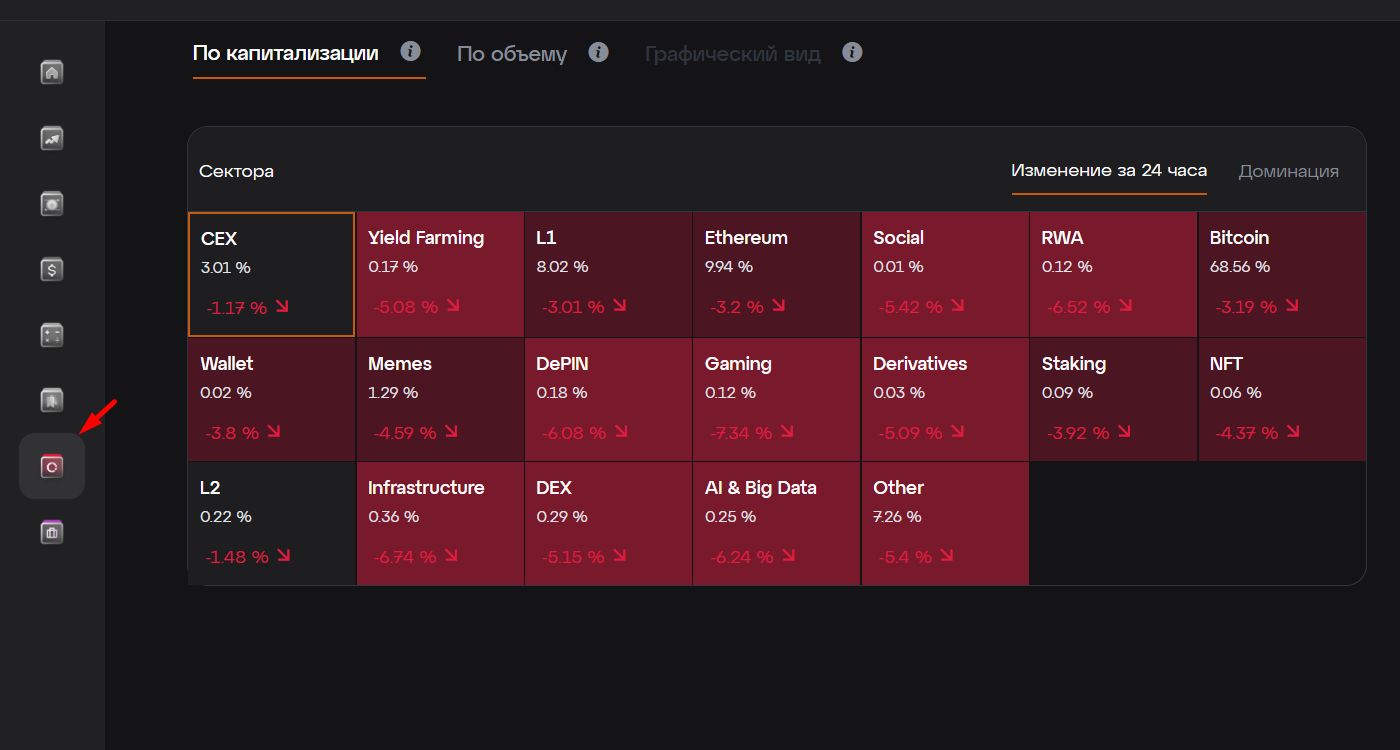

The “Dominant Sectors” section of the Key Screener service clearly shows the distribution of the crypto market by sector, taking into account their share in capitalization and changes over the last 24 hours.

The image shows:

Virtually all sectors are currently in the red zone—the market downturn affects Bitcoin, altcoins, and niche areas such as NFTs and memes.

The color palette emphasizes dynamics: the darker and more saturated the red, the stronger the decline. This gives the user a quick visual reference point for loss-making and relatively stable sectors.

This section helps you quickly understand where capital is flowing, which sectors are losing relevance, and where entry or exit points are possible for traders and investors.

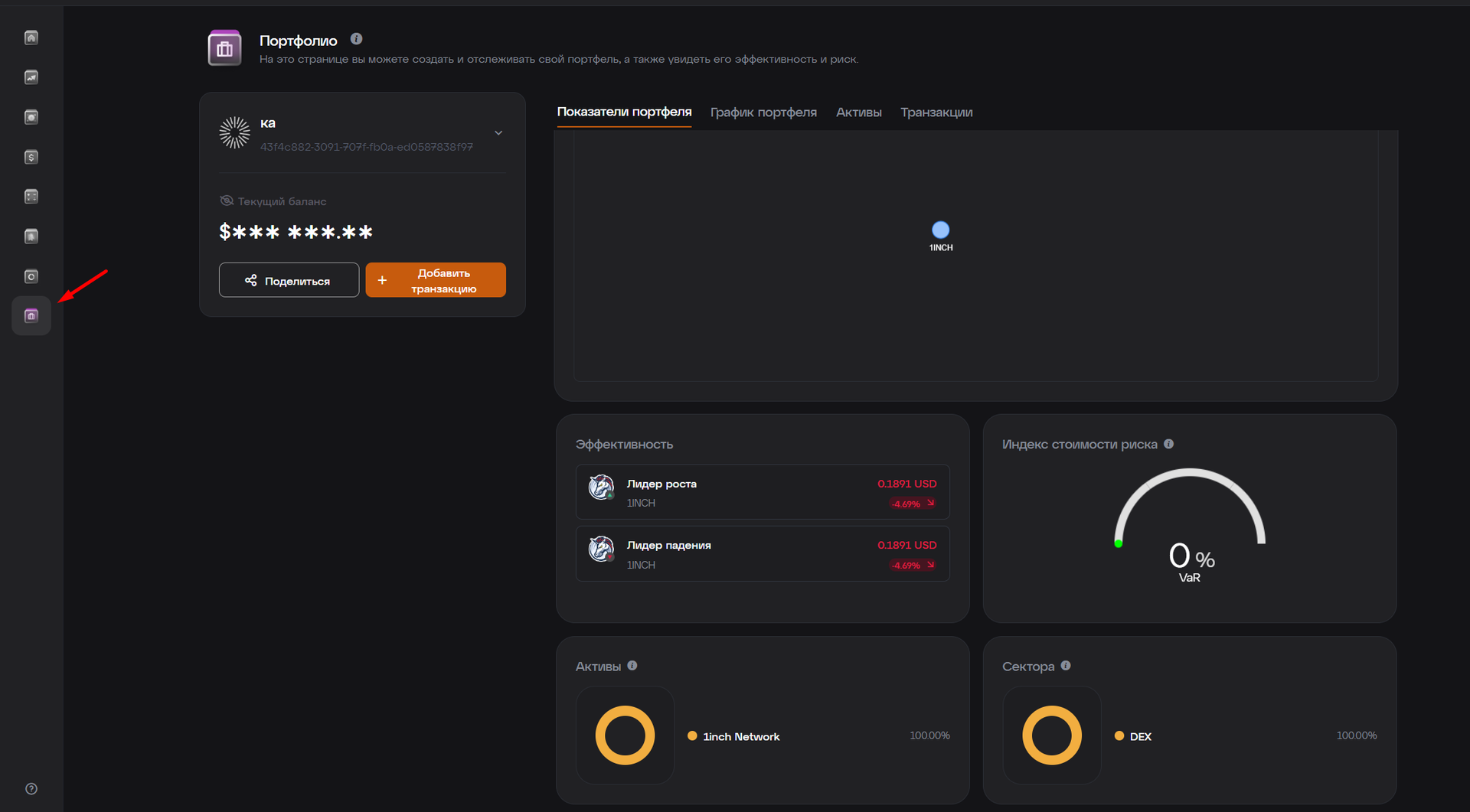

On this page, you can create and manage your crypto portfolio, tracking its dynamics, profitability, and risk level in real time. Simply select a cryptocurrency, specify the amount, date, and time of purchase, and the system will record the transaction and automatically begin:

What you see on the screen:

This section is especially useful for those who want to: keep records manually, but without Excel; see visual reports and analytics; control risks and make decisions based on data, not emotions. Portfolios in Key Screener are simple, clear, and under your complete control.

Key Screener is a modern analytical platform for those who want to make quick decisions based on facts rather than guesswork. Below is a complete overview of the strengths and weaknesses of the service.

Pros

The platform aggregates and processes data arrays for users. You don’t need to open dozens of tabs — everything from news to on-chain metrics is already structured.

Data is updated instantly, so you always work with the latest information. This is especially important for quick responses during periods of high volatility.

Monitoring funds, whales, institutional wallets—all of this is built into the interface and helps you navigate the global flow of capital.

AI assigns influence ratings (from 1 to 10) to news items, giving traders a quick guide to the significance of an event. This is a unique tool in crypto analysis.

Favorites, watch lists, filters by sector, capitalization, indicators — everything can be tailored to a specific trading strategy.

The service combines indicators, charts, transaction monitoring, macro data, and news. It is a full-fledged working tool, not just a showcase with charts.

The interface is intuitive, yet offers enough depth for experienced users and professional traders.

Cons

The platform works exclusively with cryptocurrencies. The stock market, commodities, and forex are not supported.

It is not always clear to users how individual indicators are calculated. This reduces the confidence of advanced traders in them.

At the time of review, there is no clear distinction between free and paid features. We would like to see a more transparent subscription model.

Although the project is actively developing, it has not yet stood the test of time. Some users may find the lack of reviews and community cases disappointing.

Key Screener is not just another crypto dashboard, but an attempt to bring together in one place the factors that really influence decisions: fund actions, capital behavior, market reaction to news, liquidity, and volatility. Moreover, the platform does this not in theory, but in a convenient, understandable, and customizable format—without overload, as is often the case with crypto tools. It accomplishes several tasks at once: searching for trends, analyzing major movements, assessing the news background, monitoring activity, and filtering out noise. The platform makes the market cleaner and more understandable, giving it an advantage over classic screeners.

The platform is designed for those who value speed, quality of information, and consistency. This is especially noticeable in sections such as “Stock Wallets,” “Growth Leaders,” and AI news ratings. You get a snapshot of the market and the behavior of key players—not through emotions, but through data.

It is also important that Key Screener allows traders to focus. Thanks to favorites, filters, heat maps, and customization, you work not with the entire market, but with its relevant part. And this is the key to accurate trades—less noise, more signals.

The service is not perfect, of course: in some places, there is a lack of transparency in the formulas and calculations, and the subscription structure does not yet look fully finalized. However, it already has everything it needs to become a fully-fledged working tool for traders, especially when combined with other Cryptology solutions.

Write or call us. We will help you quickly re-register your accounts. Enjoy a new level of trading with cashback every month.

You are used to trusting professionals in your everyday life. Trust us with your interactions with exchanges. You won't want to go back to trading without Feebacker.com.