The OKX (Okex) trading platform is an excellent choice for anyone interested in trading cryptocurrency assets. Currently, 320 cryptocurrencies and 492 trading pairs are available for trading, including popular ones such as Bitcoin, Litecoin, Ethereum, Tether, USD Coin, XRP, Cardano, Solana, and Dogecoin. The platform officially provides services in 150 countries around the world.

OKX is officially registered as a digital service provider in Bermuda and the Seychelles. It appears that the exchange will soon obtain licenses in jurisdictions such as Dubai and Hong Kong.

The OKX exchange is not just a digital currency exchange, but a full-fledged ecosystem for crypto trading that includes a wide range of services, including P2P exchange, spot trading, margin trading, options, futures, DeFi, lending, staking, deposits, and a number of other useful services.

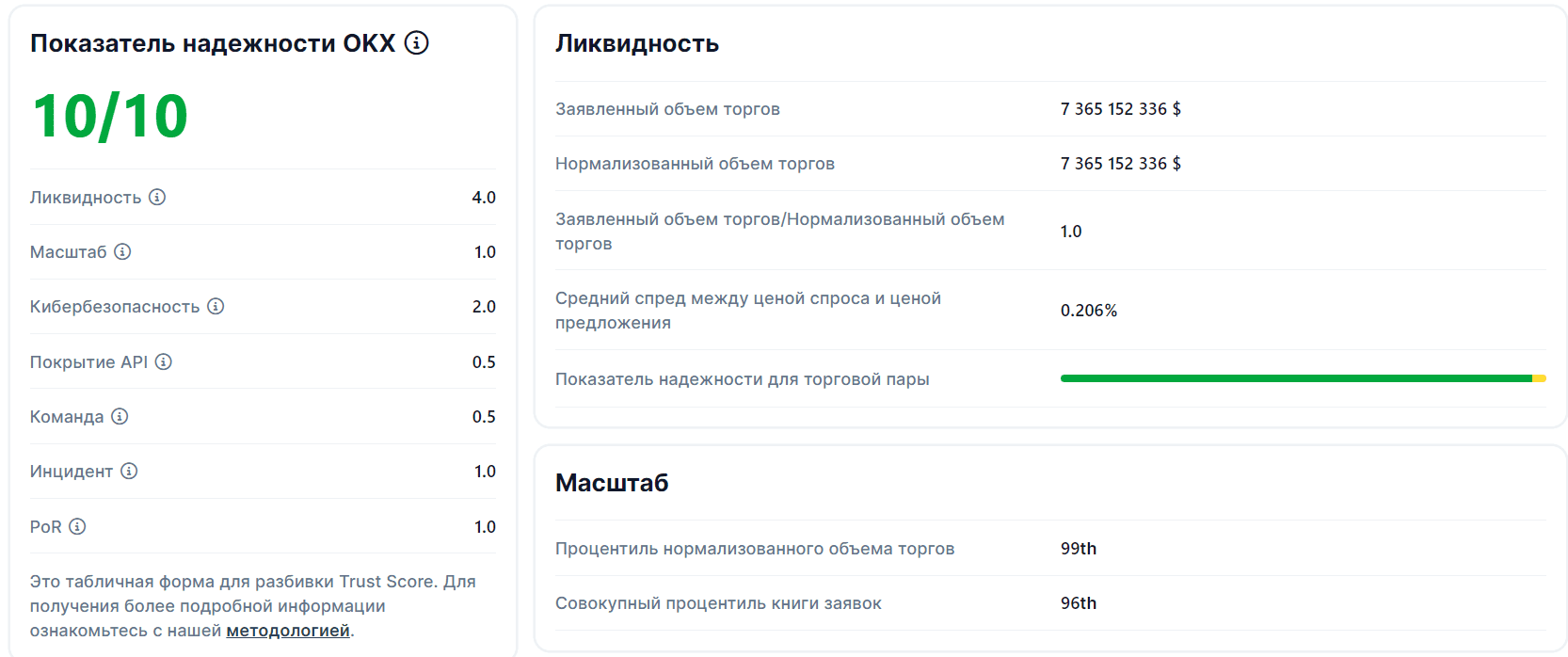

As of March 2024, the exchange ranks third in terms of trading volume on the spot market, behind only such “sharks” as Binance and Bybit. The daily trading volume on the spot market exceeds $7 billion. As for the derivatives market, the exchange ranks sixth, with a daily volume of about $45 billion.

The history of OKEx began back in 2013, when the company became part of OK Group, which focuses on developing blockchain technologies. It is noteworthy that from 2014 to 2015, Changpeng Zhao (CZ), the future founder of the Binance exchange, held the position of CTO at Okcoin. However, in early 2015, he left his post due to disagreements with management regarding the platform’s future development strategy.

In fact, the OKEx exchange was only launched in 2017, when founder and CEO Star Xu (Xu Mingsheng) opened a branch in the Seychelles. His previous trading platform, OKCoin, was shut down as a result of a ban on futures trading by Chinese regulators. The majority of OKX is owned by OK Group, with Xu Mingsheng holding a controlling stake. The daughter of Shi Jin (a major Chinese entrepreneur) holds 13% of the shares. Other major shareholders include Feng Bo, Tang Yu, and Mai Gang.

At the beginning of 2022, the letter “E” disappeared from the platform’s name as a result of rebranding, which included not only a name change but also significant changes and additional features. That’s how OKEx became OKX!

By shifting its focus to developing its own blockchain, native token, decentralized cross-platform wallet, and other innovations, OKEx has expanded its horizons beyond the limitations imposed by regulators. In addition, the platform’s parent company, OK Group, based in Hong Kong, has launched an incubator to support promising blockchain startups. Today, OKEx positions itself as a “portal to Web3,” offering services such as OKEx DEX, an integrated web wallet with private key protection, an NFT marketplace, and other innovations.

In the fall of 2023, the cryptocurrency exchange Okcoin, which is licensed in the US and is also part of the Ok Group holding company, joined the new brand. This merger will likely lead to the creation of a separate division for US users on OKX in the near future.

Security on the OKX cryptocurrency exchange is assessed based on several key parameters. The main factors affecting the protection of customer funds include:

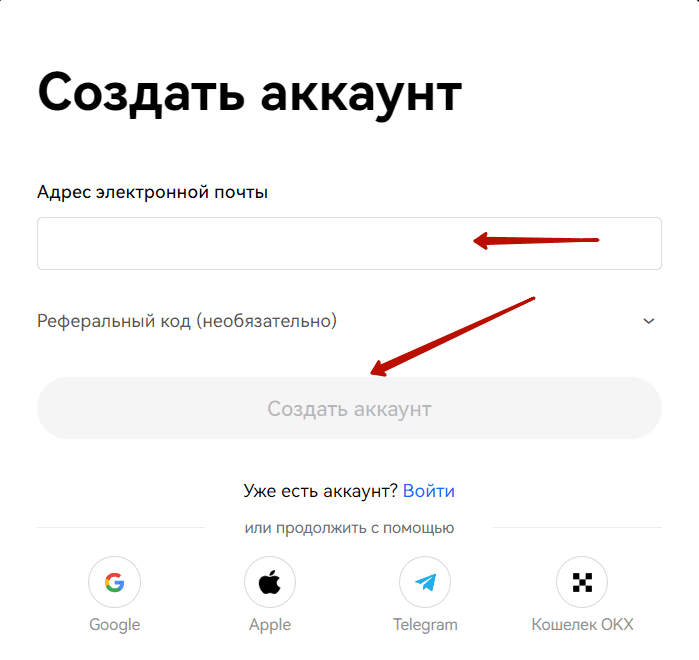

Go to the official OKX website using my referral link

https://okx.com/join/88404434.

Enter your email address and click the “Create Account” button.

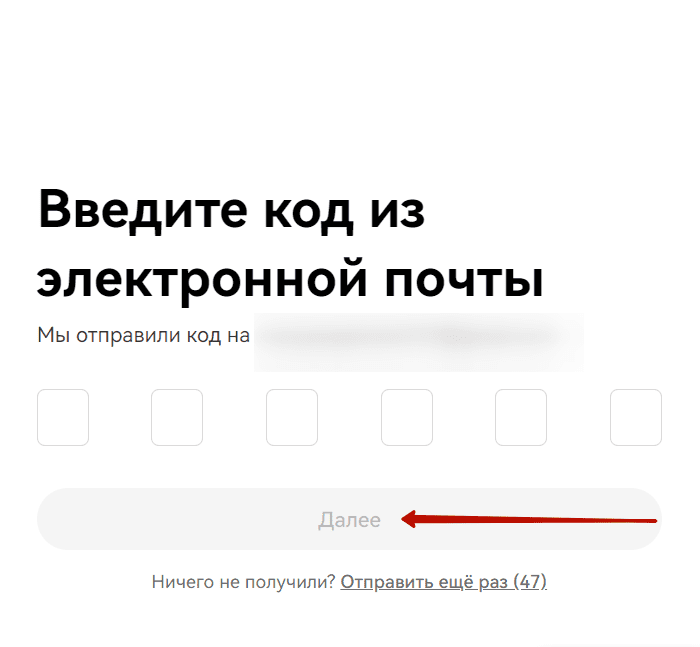

Then we need to check our email inbox for a letter containing a confirmation code. We enter this code on the website and click the “Next” button.

Then we need to check our email inbox for a letter containing a confirmation code. We enter this code on the website and click the “Next” button.

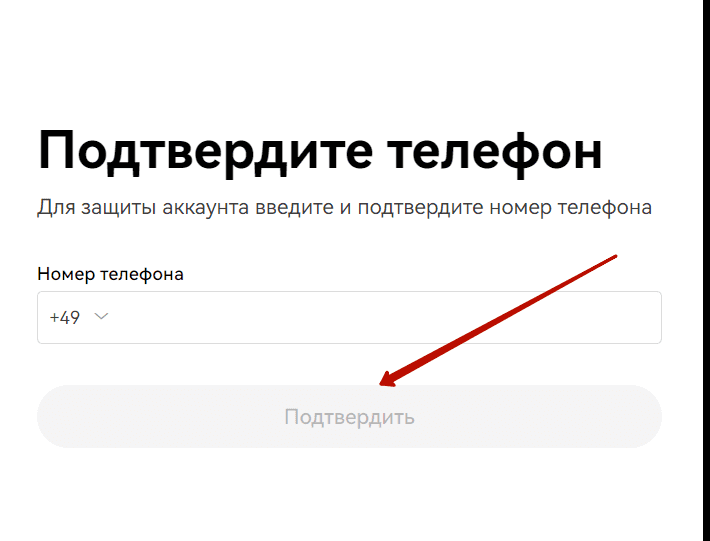

On the next page, enter your phone number and click the “Confirm” button.

On the next page, enter your phone number and click the “Confirm” button.

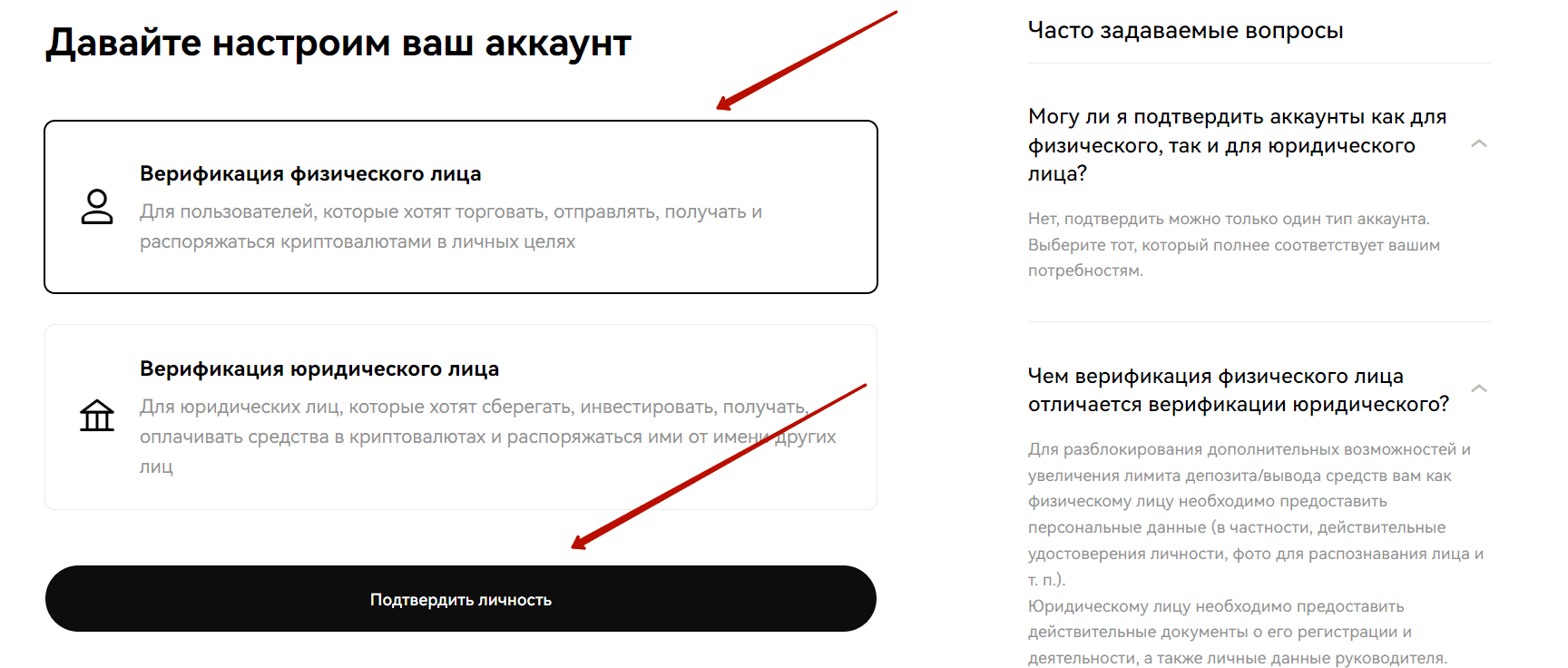

A code will be sent to the specified number, which you will also need to enter on the website for confirmation. After that, log in to your OKX personal account. The system will immediately ask you to confirm your identity, for which you will need to undergo verification. You can explore the financial products offered by the platform without going through KYC, but you will still need to verify your identity in order to deposit funds on the platform; without this, you will not be able to trade on OkEx. Therefore, select “Verification of an individual” and click on the “Confirm identity” button.

A code will be sent to the specified number, which you will also need to enter on the website for confirmation. After that, log in to your OKX personal account. The system will immediately ask you to confirm your identity, for which you will need to undergo verification. You can explore the financial products offered by the platform without going through KYC, but you will still need to verify your identity in order to deposit funds on the platform; without this, you will not be able to trade on OkEx. Therefore, select “Verification of an individual” and click on the “Confirm identity” button.

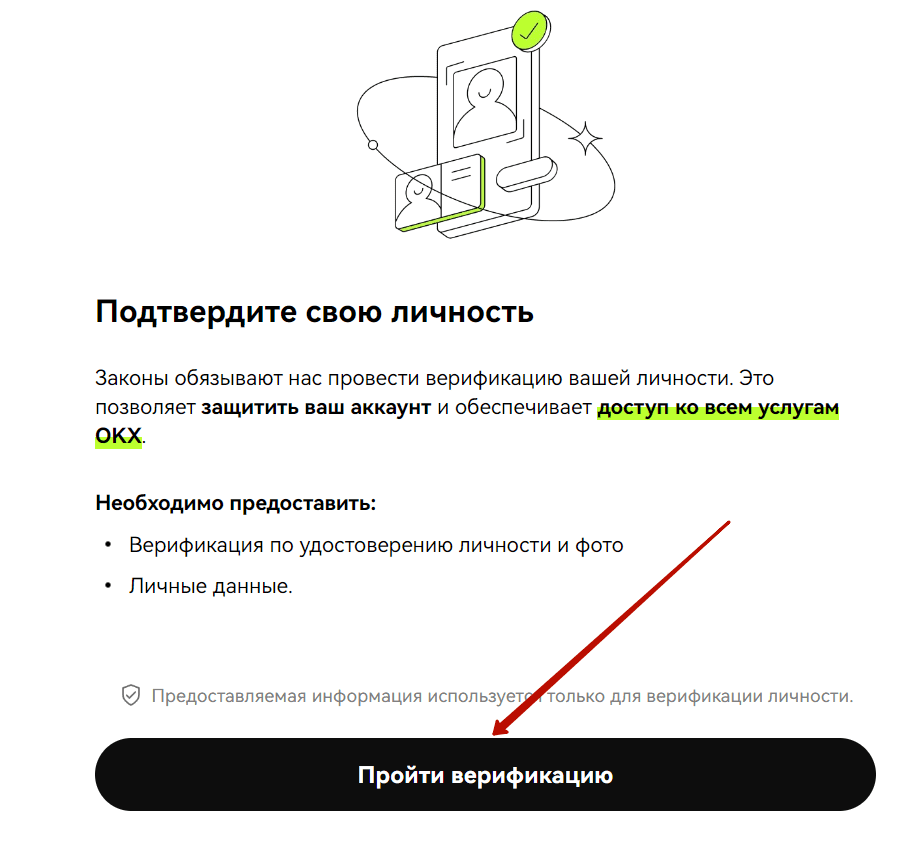

On the next page, simply click the “Verify” button.

On the next page, simply click the “Verify” button.

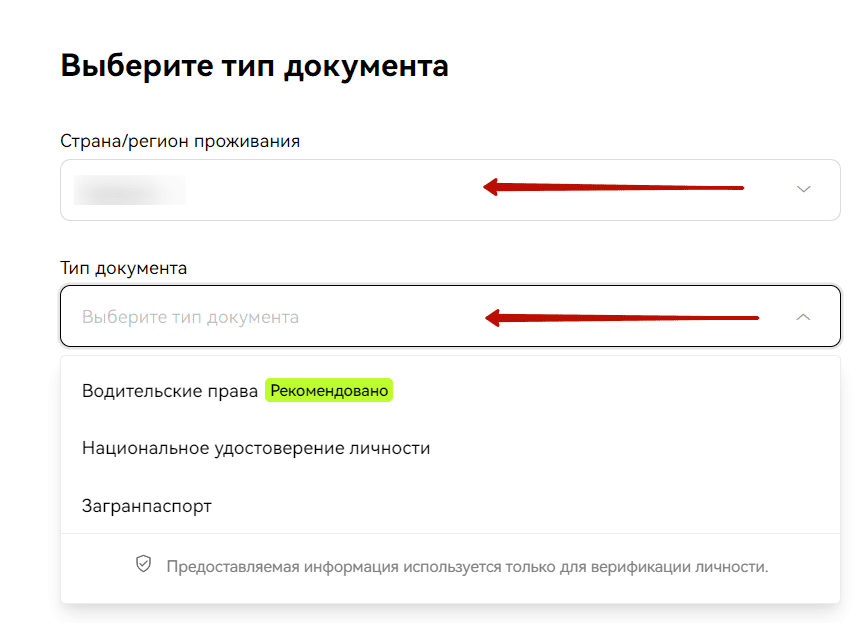

Next, select your country and document type from the drop-down list: driver’s license, national ID card, or passport. It is noteworthy that a driver’s license is marked as the recommended option for passing KYC on OKX.

Next, select your country and document type from the drop-down list: driver’s license, national ID card, or passport. It is noteworthy that a driver’s license is marked as the recommended option for passing KYC on OKX.

After that, a new window will open, and to continue the procedure, the system will ask you to scan the QR code with your mobile phone. In short, without a smartphone, it is simply impossible to complete OKX verification. Not only that, but you will be asked to download the OKX mobile app and continue the procedure directly in it. We need to take and send photos of documents and a selfie from our phone. Document verification usually takes only a few minutes, but this time frame may vary depending on the quality of the photos or the workload of the KYC department staff. Then, on the OKX website, you will need to enter your personal data, such as your full name and address. To confirm your address, you will need to upload a bank statement or utility bill. After that, you will be asked to wait up to 24 hours.

After that, a new window will open, and to continue the procedure, the system will ask you to scan the QR code with your mobile phone. In short, without a smartphone, it is simply impossible to complete OKX verification. Not only that, but you will be asked to download the OKX mobile app and continue the procedure directly in it. We need to take and send photos of documents and a selfie from our phone. Document verification usually takes only a few minutes, but this time frame may vary depending on the quality of the photos or the workload of the KYC department staff. Then, on the OKX website, you will need to enter your personal data, such as your full name and address. To confirm your address, you will need to upload a bank statement or utility bill. After that, you will be asked to wait up to 24 hours.

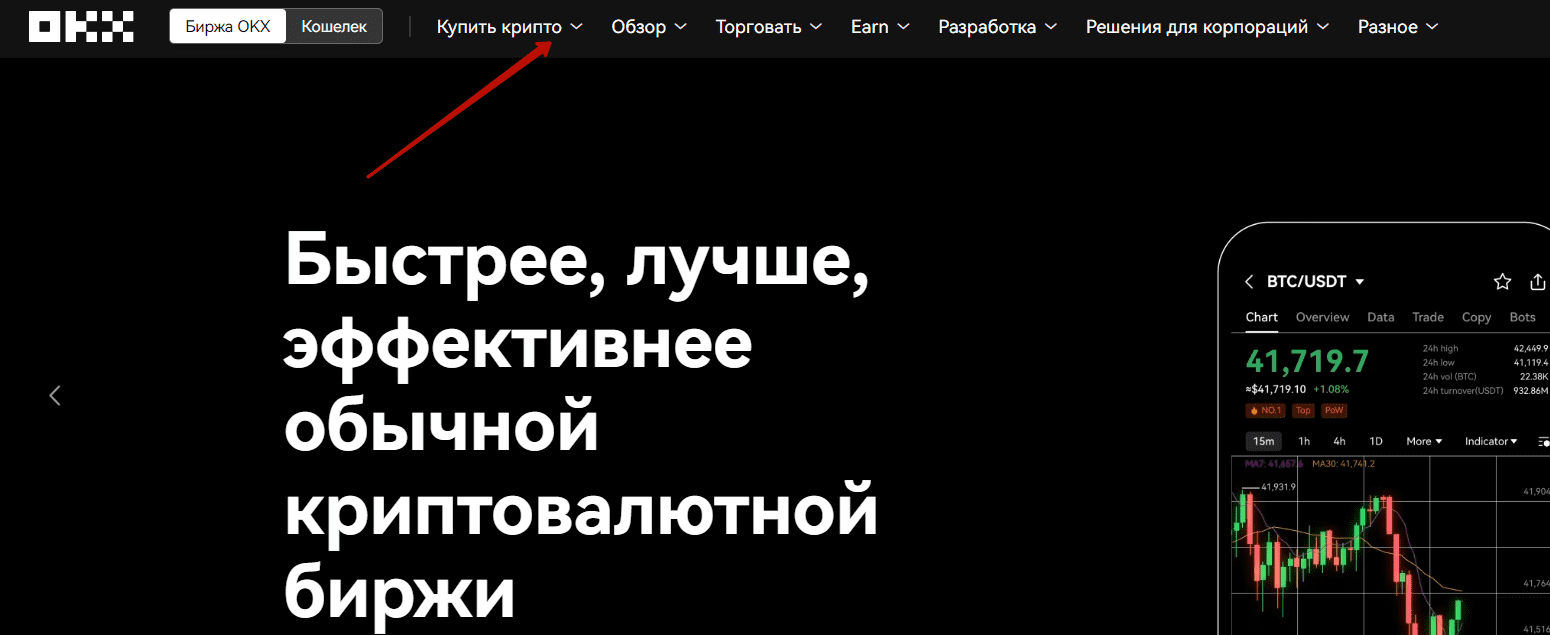

After passing verification and connecting all the necessary security settings, you can start replenishing your account on the platform. To do this, go to your OKX personal account and click on the “Buy crypto” button at the top. Next, choose from three drop-down options: express purchase, P2P trading, and third-party payment.

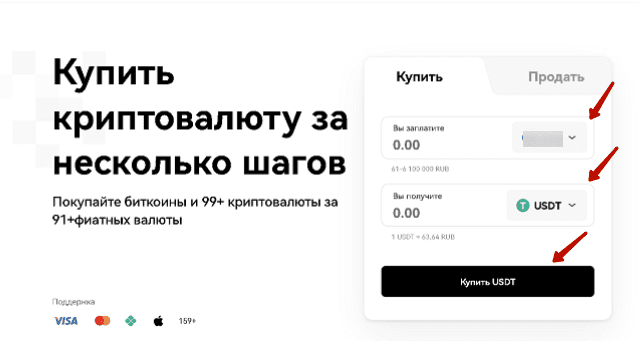

“Express purchase” means buying crypto with a debit or credit card. Currently, you can use about 100 fiat currencies to make a purchase. Everything happens very quickly and without any unnecessary hassle. Select the currency in the “You pay” field, then in the “You receive” field, and click the “Buy” button.

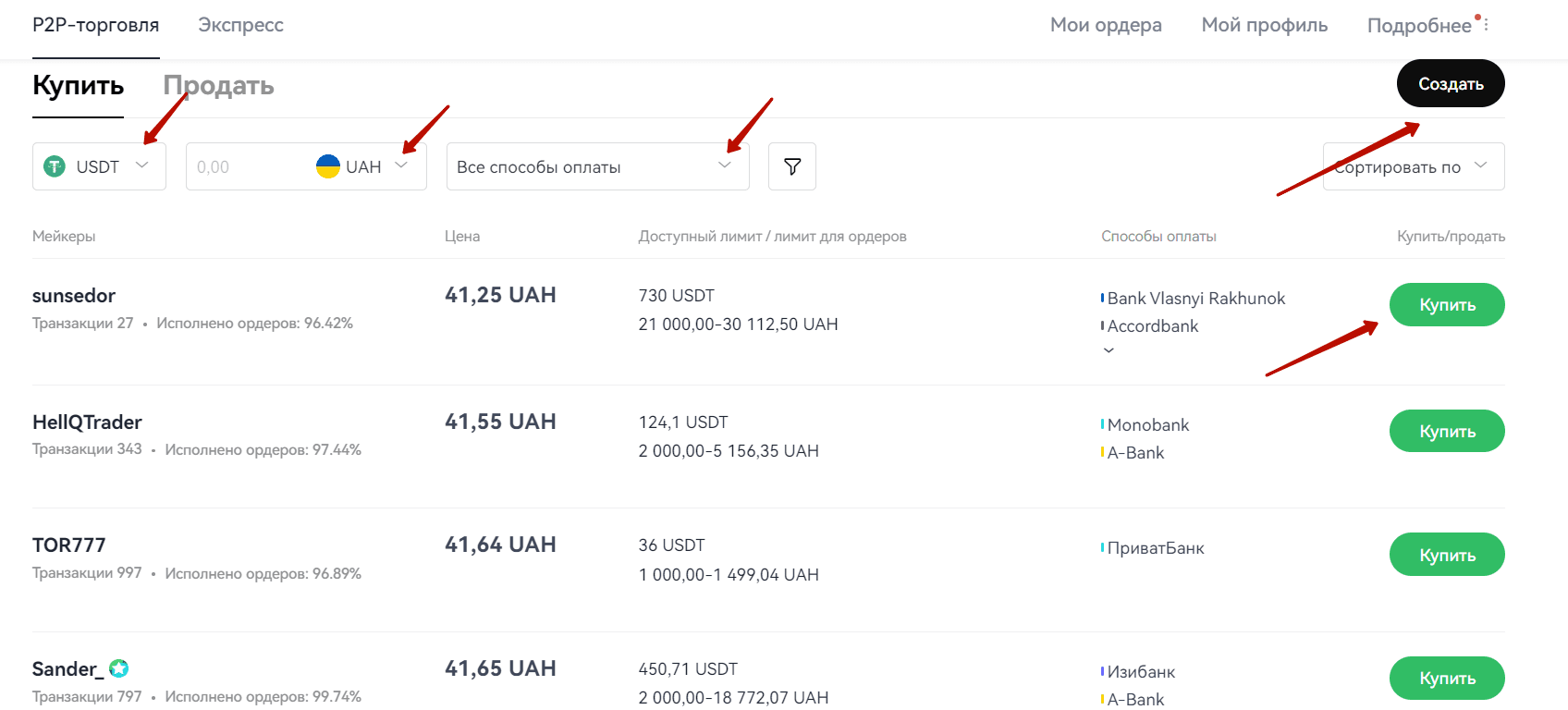

The “P2P trading” option, as you may have guessed, allows you to buy cryptocurrency from other exchange users who have previously placed their sell orders at a certain price. You need to choose what you want to buy, how much you want to pay for it, and your payment method. Then click the “Buy” button next to the listing you want. By the way, to place your own listing, click the black “Create” button in the upper right corner of the same page and follow the instructions.

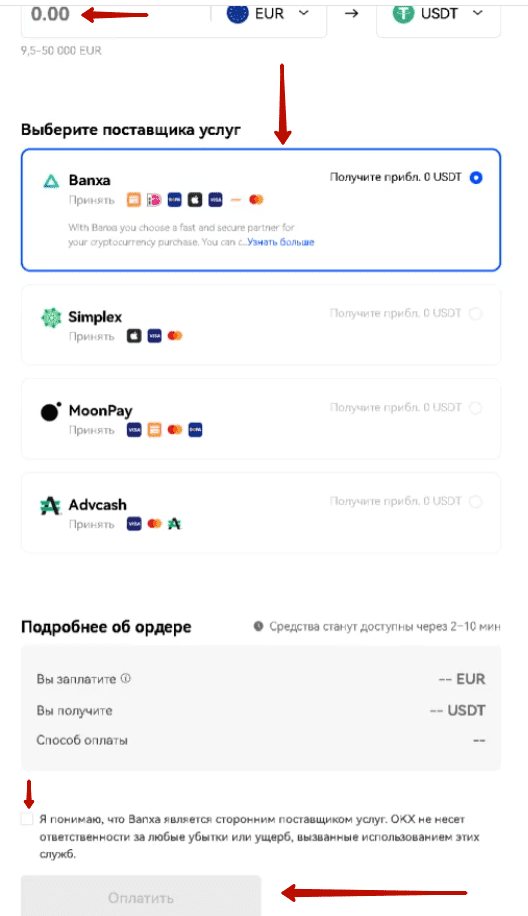

As for the “Third-party payment” option, it offers to use EPS such as Simplex, Banxa, MoonPay, and Advcash to purchase crypto assets with a card. Select the currency in the “You pay” drop-down list and enter the desired amount, select the cryptocurrency in “You receive,” select the service provider, check the “I understand…” box, and click the “Pay” button.

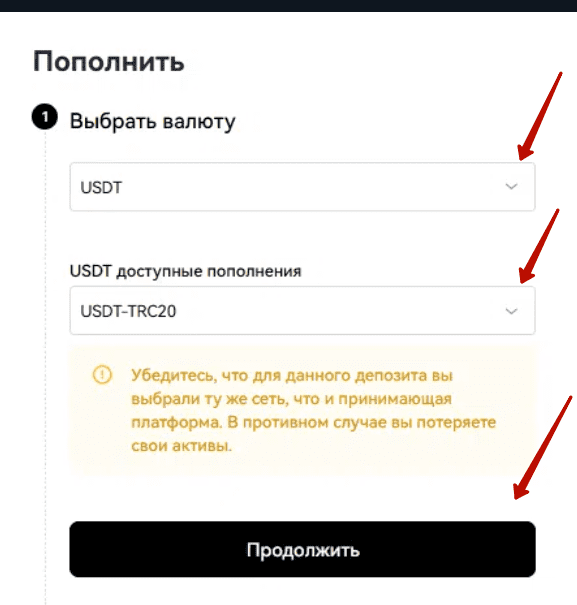

If you already have crypto assets on other exchanges or wallets, you just need to transfer them to the OKX platform. To do this, go to “Assets” in your personal account and click “Deposit.” Next, select the desired cryptocurrency and network, and click “Continue.” Be careful when choosing a network, because tokens sent through the wrong network cannot be returned!

After that, copy the wallet address provided by the system and transfer coins from your wallet to it. After a certain number of network confirmations, the funds will be credited to your OKX wallet.

As we mentioned earlier, OKX has a very advanced and extensive trading ecosystem, so it’s no surprise that it supports virtually all types of trading. The platform gives us access to markets such as:

Below, we will take a closer look at the most popular trading areas on OKX and provide instructions on how to trade them.

The spot market is exactly what is recommended for beginners in the cryptocurrency market due to its simplicity and lowest risks. Currently, OKX spot trading offers 320 cryptocurrencies and 495 trading pairs. Here, traders can execute trades at current market prices, create limit orders, or place pending orders (such as Stop Loss and Take Profit). To start trading, you need to transfer your crypto from your main account to your trading account using the “Assets” section in the menu.

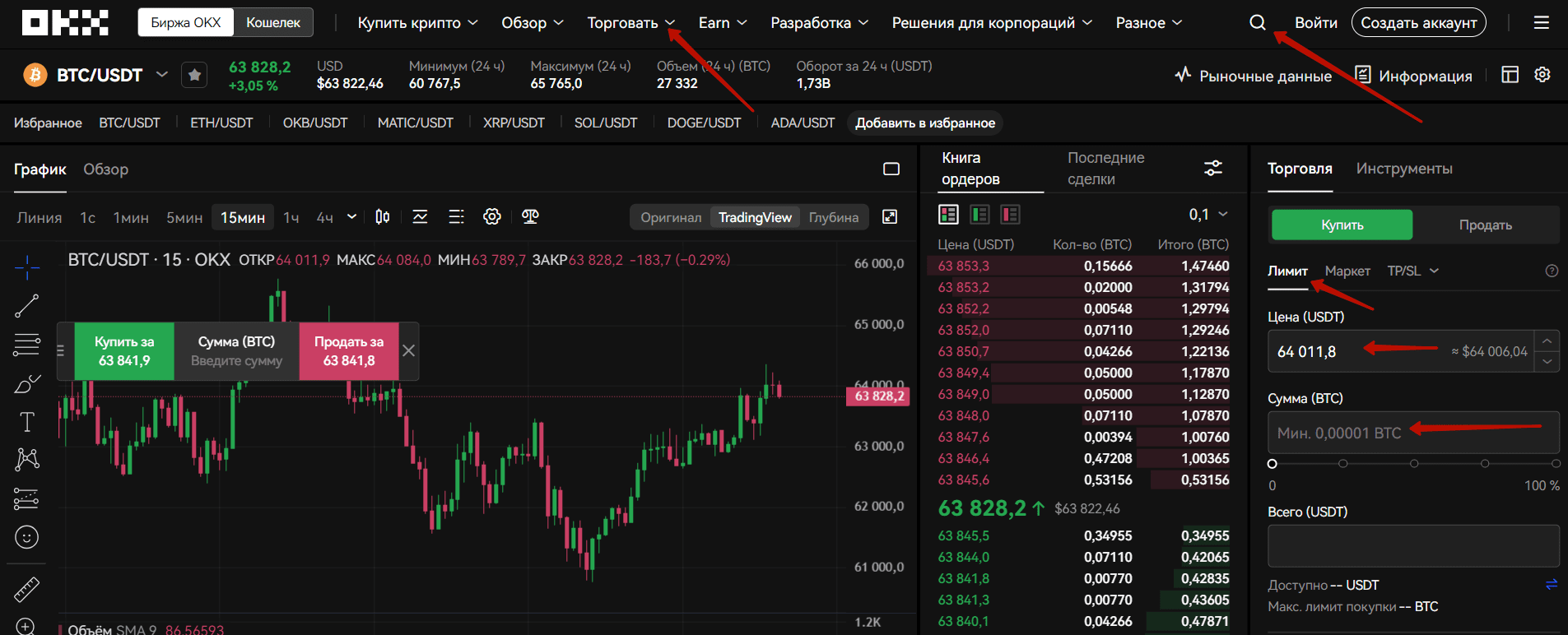

After that, in your personal account, hover your mouse cursor over the “Trade” button and select “Spot” from the drop-down list. The working area of the trading terminal contains the following elements: trading pair selection menu (at the top); chart (in the middle); drawing tools (to the left of the chart); order creation form (on the right); order book (on the right); open orders and history (at the bottom of the section).

Next, in the upper right corner, use the search button to select the trading pair you are interested in. Select “Limit”, set the desired purchase or sale price, then enter the required number of coins and create an order.

When the market price reaches the level we specified, the order will be executed. If we don’t want to wait and monitor market movements, instead of “Limit,” we select “Market,” specify the amount, and instantly buy at the current price.

The third type of TP/SL spot is pending orders, which will be placed automatically, even if we are offline at some point. To understand how this works… Let’s say you bought a coin for $10 and are willing to lose no more than 20% in case of a drawdown, then you should set a Stop Loss so that the system creates an order to sell the coin at $8 when the coin price reaches, say, $8.5. And if the price goes up and you don’t want to miss out on the profit, then you need to set a Take Profit order according to the same principle in line with your strategy.

Margin trading involves the use of borrowed funds, known as leverage, by the trader. Leverage on OKX can reach a maximum value of 10x. This means that with $100 of our own money, we can open an order for $1,000. If the price moves in the right direction, we can earn 10 times more profit. But if the price goes in the other direction, our order will be liquidated as soon as the loss reaches $100. This means that we cannot get into debt here. However, if the forecast is incorrect, our deposit will burn up 10 times faster, and it should be noted that this is a fairly high risk. Without special training, margin trading is very risky!

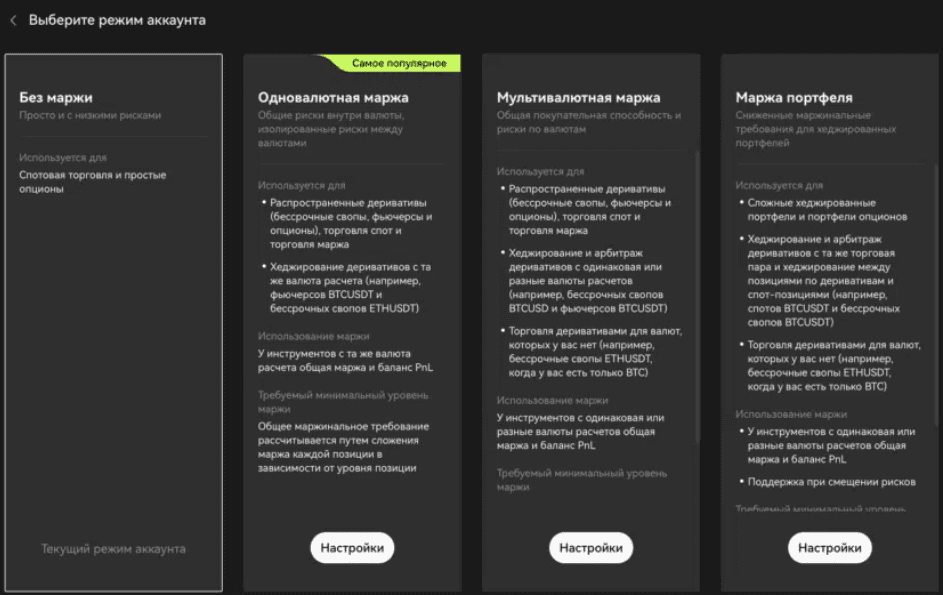

To start trading in your personal account, hover your mouse cursor over the “Trade” button and select ‘Margin’ from the drop-down list. Then, go to the settings by clicking on the gear icon in the upper right corner and find the “Account Mode” option. The OKX platform offers four types of accounts: “Simple,” “Single Currency Margin,” “Multi-Currency Margin,” and “Portfolio Margin.”

If you are an ordinary trader and want to trade on margin, you should select the “Single Currency Margin” type. The “Multi-currency margin” and “Portfolio margin” account modes offer more trading opportunities. However, to activate these modes, you need to have a deposit of $50,000 or $100,000, respectively.

The further algorithm for creating an order does not differ significantly from the actions in the “Spot” section. Except that you also need to select the margin type and leverage size.

Two types of collateral are available on the OKX platform: isolated and cross margin. When choosing cross margin, traders can use funds from one position to partially or fully collateralize another position with the same asset. Multi-currency cross margin allows you to move collateral between positions with different crypto assets. Isolated margin, on the other hand, is fixed and does not allow for the distribution of funds between positions.

In the futures section, traders can choose between weekly, biweekly, quarterly, and semi-annual contracts. This section also includes perpetual futures. The exchange offers contracts for BTC, ETH, LTC, XRP, and other cryptocurrencies, available in USDT, USDC, and cryptocurrency. The maximum leverage in this section is 125x.

The main information about spot futures is encoded in the name of the contract itself. Take, for example, ETHUSDT-29MAR24: ETH indicates the underlying asset, USDT indicates the currency used, MAR indicates the expiration month, and 29 indicates the delivery date. The standard commission for futures is 0.02% for the maker and 0.05% for the taker, with no funding rate.

As for perpetual swaps, they have no expiration date. The base commissions for them are the same as for futures contracts. However, there is a funding rate. This means that traders who have opened positions will pay or receive a commission for this. If the funding rate is negative, those who are short pay traders with long positions, or vice versa if the rate is positive.

The leverage size is selected in the order settings. By moving the slider, you can see the maximum position size for the selected leverage and the margin required to open it. Just below are the position builder and calculator, which help you calculate PnL (profit and loss), target price, and liquidation price.

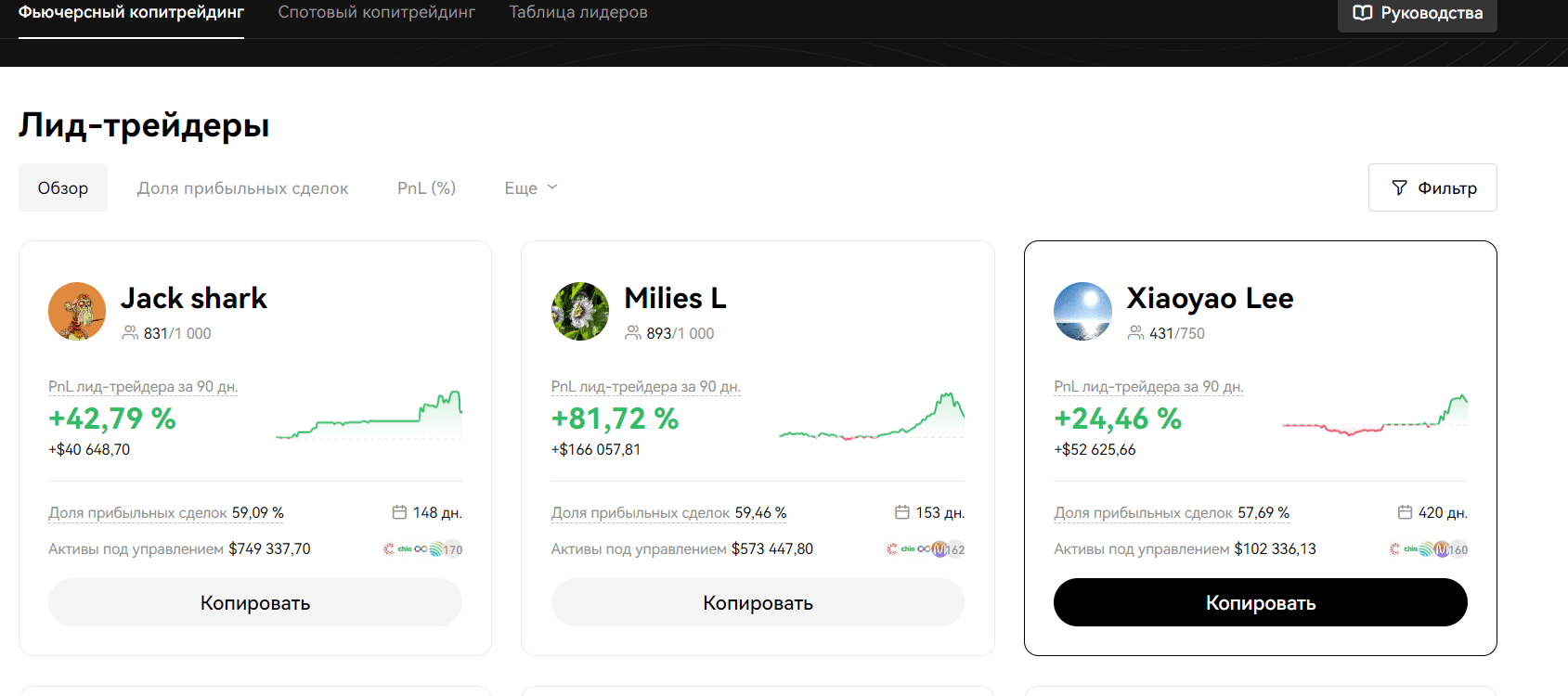

During copy trading, the system automatically replicates the trades of public traders for regular users. It is possible to configure some copy trading parameters manually. These parameters can significantly affect the results of copy trading. Beginners need to carefully study all the details before diving headfirst into following a trader with very stable and positive statistics. At a minimum, the trader’s deposit amount may be several times larger than yours, and therefore able to withstand a much larger drawdown. Meanwhile, your deposit will simply be wiped out!

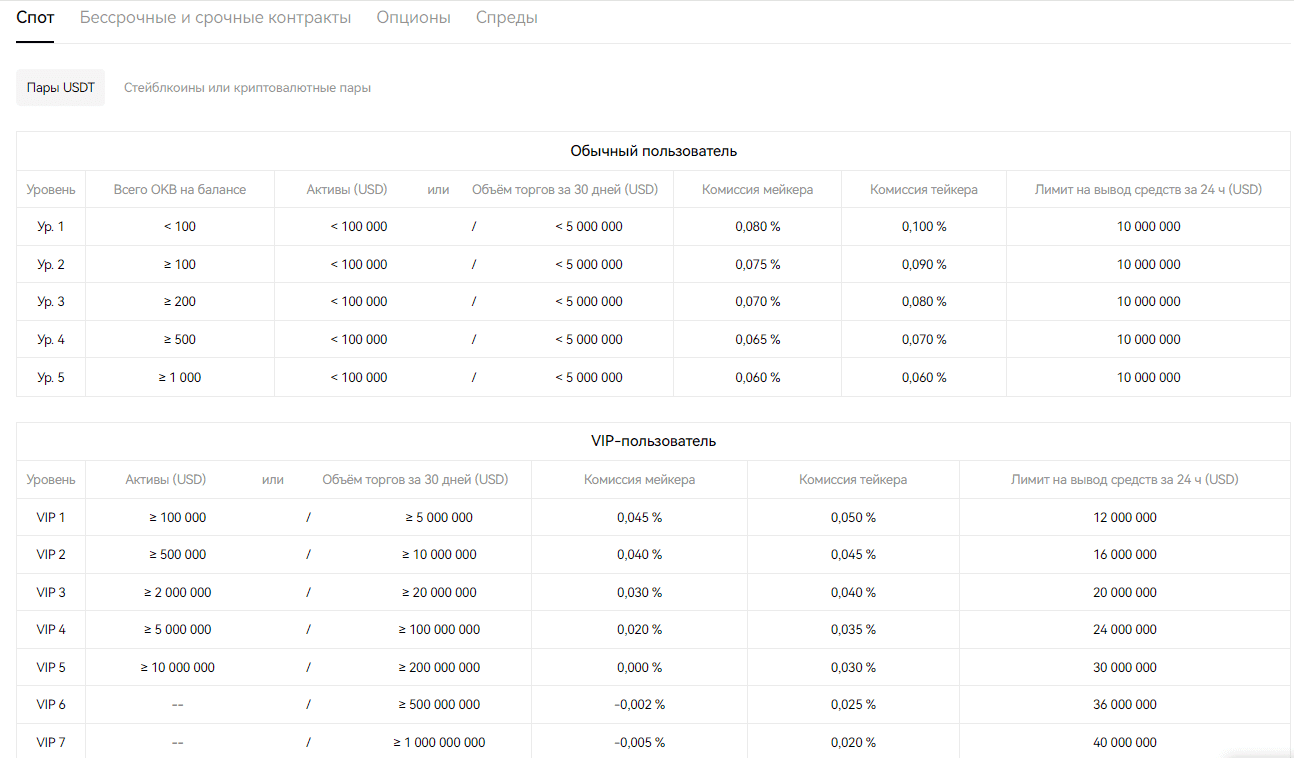

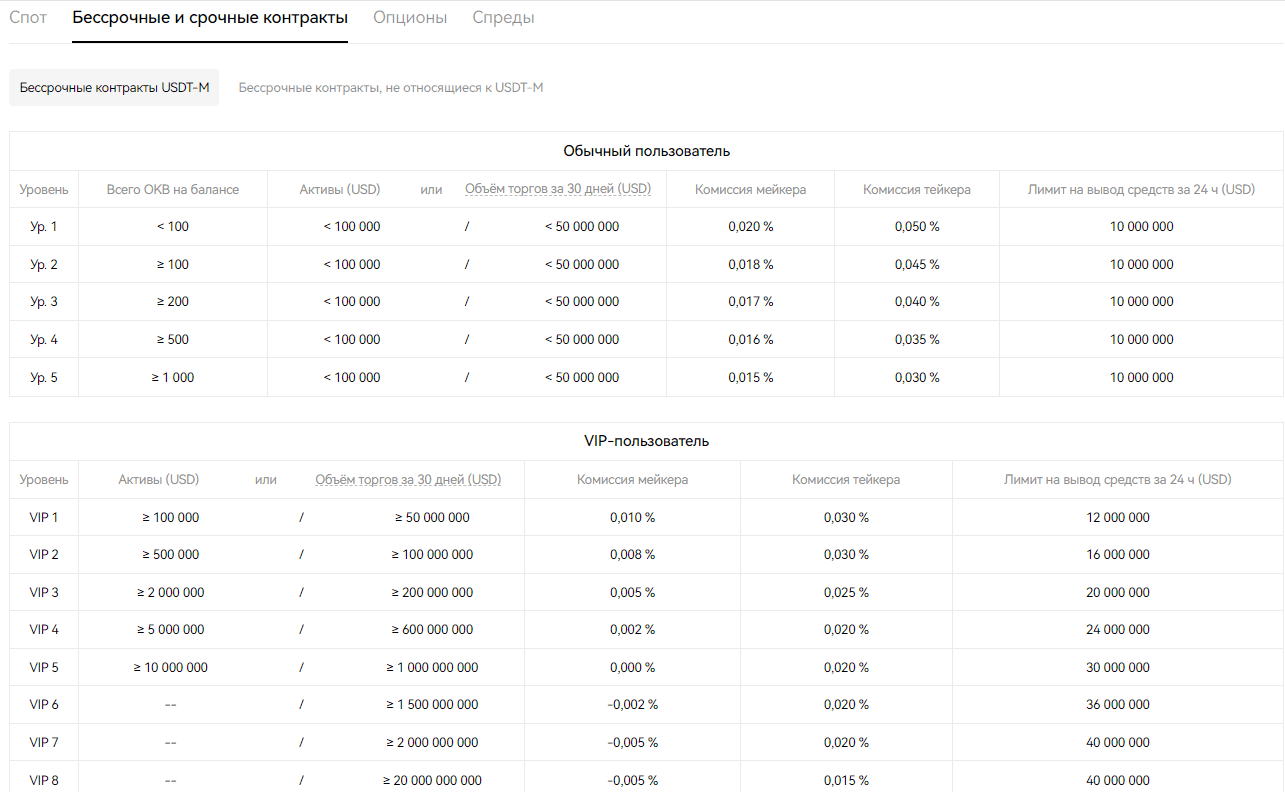

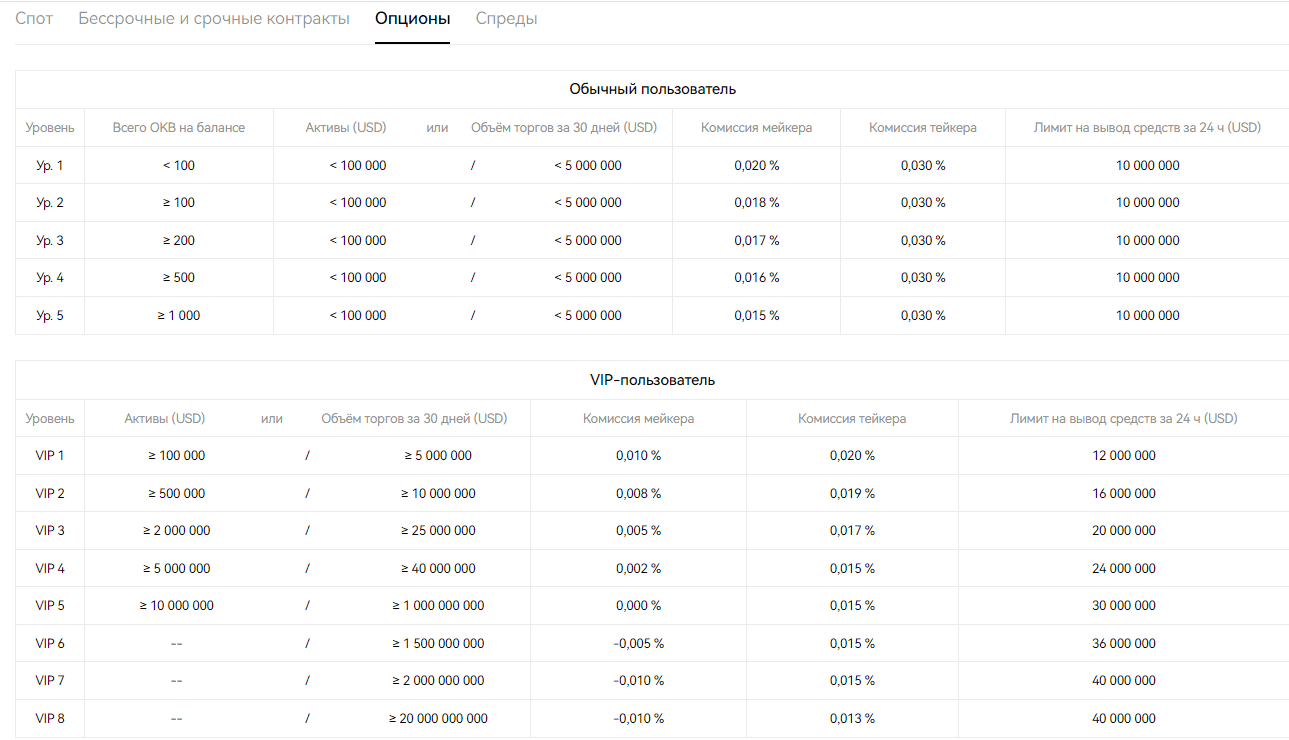

Exchange fees can vary significantly depending on trading volume and the amount in the client’s balance. Regular users are divided into levels based on OKB (total amount held in the account), while VIP users are divided into levels based on monthly trading volume and daily asset balance. Users whose balance exceeds $100,000 or whose monthly trading volume exceeds $5,000,000 are eligible for VIP status. For a more detailed breakdown of levels, please refer to the images below or follow the link

. Please note that the conditions are different for spot, futures, options, and spreads markets.

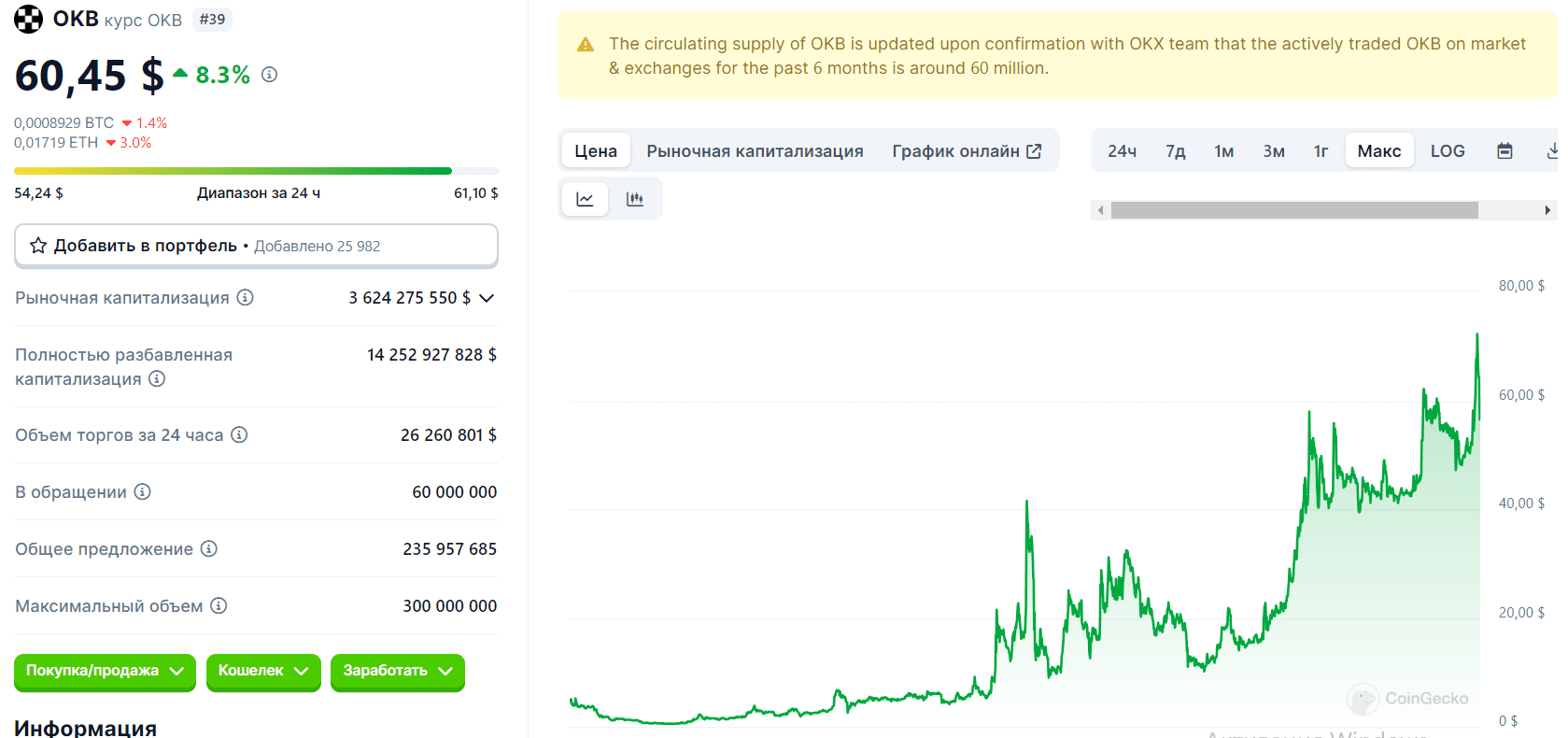

In 2018, the Okex exchange introduced its own coin, OKB. Initially, it was created on the basis of Ethereum (ERC-20), but two years later, it migrated to its own blockchain network, OKChain. Currently, OKB ranks 39th with a market capitalization of approximately $3.5 billion. Of course, the token did not show the same growth results as BNB, but still, the TOP 50 is also a significant level.

Jumpstart OKX is a launchpad that provides users with the opportunity to invest in new blockchain technologies. In this section, anyone can view information about current and completed launchpads, including a brief description of the project, its team, and fundraising terms.

The benefits of OKX Jumpstart include regular launches of new projects, the ability to stake OKB tokens for potential rewards, and the choice between minting or purchasing models depending on the event.

OKX guarantees complete transparency of its launchpads, in accordance with the previously announced rules. To participate in the event, you must have an OKB token and pre-stake it to participate in the launchpad.

Naturally, such a powerful trading platform offers the opportunity to earn interest on crypto assets. There are three types of services in this section: simple Earn, structured products, and on-chain Earn. In turn, structured products include the following subsections: double investment, seagull strategy, Snowbal, and Shark Fin. In these sections, you can choose additional conditions for asset price movements and thus earn additional profit. As for on-chain Earn, here you can stake ETH to receive BETH.

It is safe to say that OKX’s high rating and positive reviews among crypto enthusiasts are well deserved. After all, this cryptocurrency exchange provides an extensive selection of high-quality trading services and tools, as well as offering passive income opportunities and the chance to participate in initial coin offerings. In addition, OKX’s fees are among the lowest on the market. The platform meets high security standards, remaining one of the most secure centralized exchanges on the market, which for many is a key aspect when choosing a trading platform.

Write or call us. We will help you quickly re-register your accounts. Enjoy a new level of trading with cashback every month.

You are used to trusting professionals in your everyday life. Trust us with your interactions with exchanges. You won't want to go back to trading without Feebacker.com.