The prop trading market is growing rapidly, and now cryptocurrency traders can also obtain financing without having to invest large amounts of their own funds. One of the new players in this field is CryptoFundTrader. In this review, we will try to analyze in detail what the platform offers, how it works, how much it costs to participate, what commissions are charged, and what risks are involved. In addition, we will separately consider the concept of the CFT affiliate program, because this is where our Feebacker service offers incredibly favorable terms for a 75% commission rebate!

Crypto Fund Trader is a platform that offers traders the opportunity to obtain financing. The concept is similar to traditional proprietary trading firms—traders undergo testing, demonstrate their skills, and, if successful, gain access to large sums of money for trading. In return, the company usually receives a percentage of the profits. The main feature of the CFT project is that it has a strong focus on the crypto market, unlike most similar firms that work with forex or stocks.

CryptoFundTrader provides access to virtual capital after passing one or more verification stages. To receive funding, a trader must pass a test, complying with certain rules (for example, loss limits and minimum profit requirements). Initially, the trader pays for participation in the test (the cost depends on the selected amount of capital). Next, they must comply with the risk rules and achieve the specified profit level. After successfully completing the tests, the trader signs an agreement and begins trading on behalf of the company.

Crypto Fund Trader offers three types of trials for traders with different levels of training and goals. All programs give you the chance to gain access to the company’s capital management and earn money from your trading skills. It is worth noting that, unlike most prop firms, Crypto Fund Trader does not limit traders in terms of the duration of the trials. You can work at a pace that is comfortable for you without the pressure of deadlines.

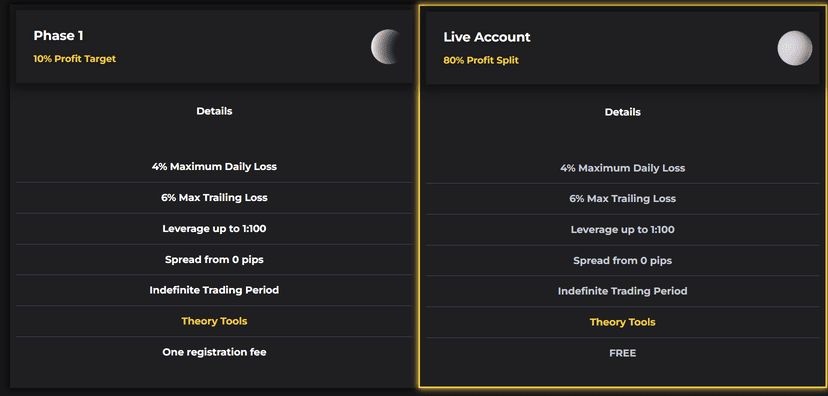

The one-stage program is the fastest way to access the company’s funds. You need to show stable profits within one stage, while complying with risk management rules. There is no minimum requirement for trading days, and the maximum completion time is 30 calendar days.

Basic terms and conditions

Target profit: 10% of the starting balance.

Daily drawdown limit: 4%.

Total drawdown limit: 6%.

Leverage ratio of 1:100.

The level of responsibility is higher, but the speed of access to financing is also maximum.

The cost of packages in this category is based on the size of the trading account:

Account size Cost

$5000 $63

$10000 $120

$25000 $262

$50000 $399

$100000 $656

$200000 $1250

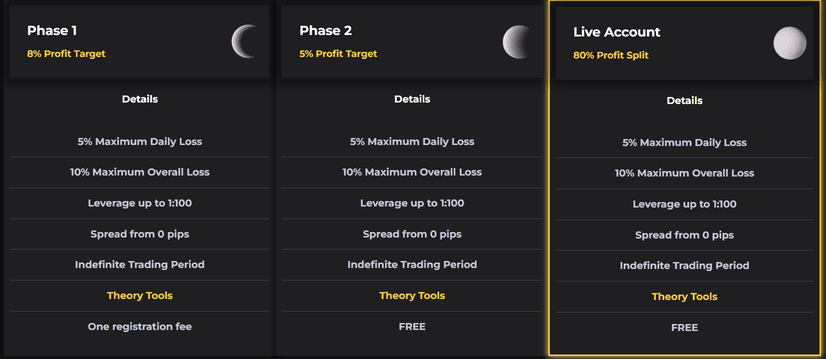

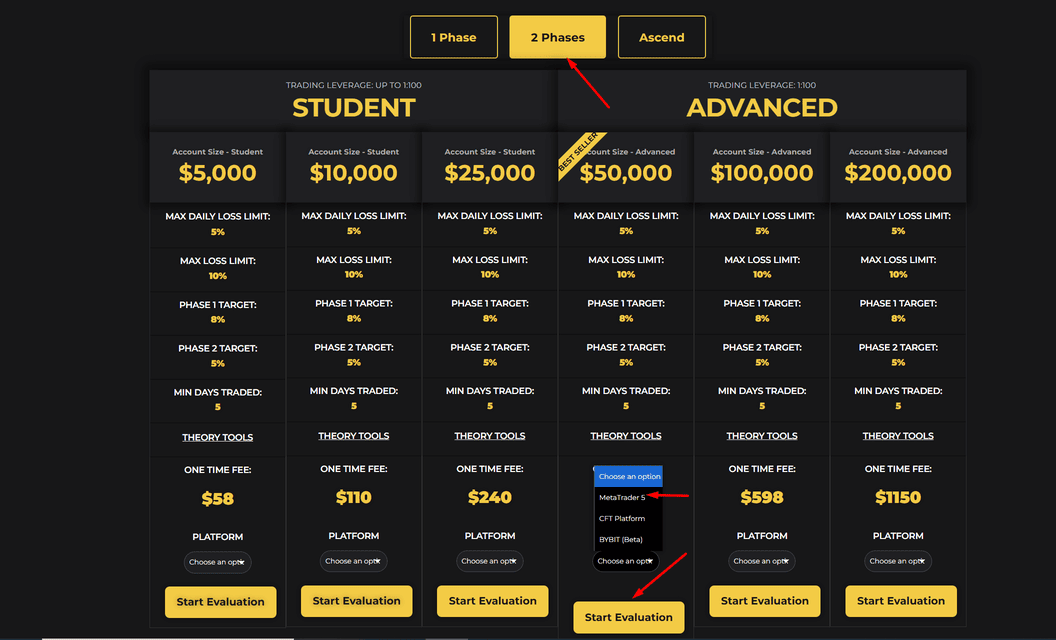

The two-stage program is suitable for traders who prefer a smoother selection process. Here, you need to go through two consecutive stages: first, achieve the initial profit target, and then confirm the stability of your trading in the second stage.

Basic terms and conditions

Stage 1: target profit 8%, daily drawdown limit 5%, total drawdown 10%, leverage 1:100;

Stage 2: target profit 5%, daily drawdown limit 5%, total drawdown 10%, leverage 1:100.

The criteria for passing are slightly less stringent than in the single-stage program to allow more room for careful trading.

The cost of packages in this category is based on the size of the trading account:

Account size Cost

$5000 $58

$10000 $110

$25000 $240

$50000 $360

$100000 $598

$200000 $1150

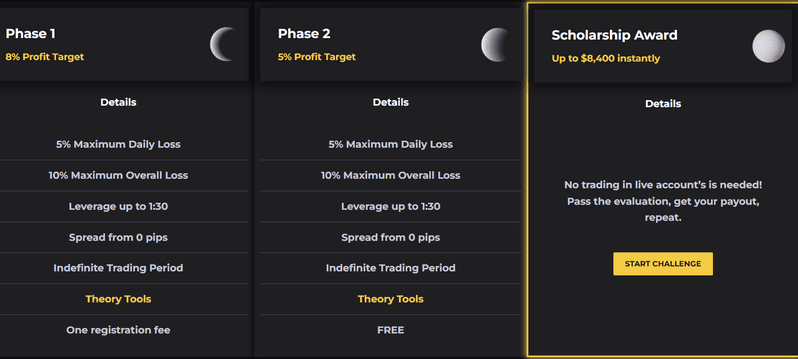

This exclusive program also consists of two phases. However, after completing them, the user receives a one-time payment equal to 4.2% of the account balance. It is not possible to trade on a real account until the next package is purchased.

Main conditions:

Stage 1: target profit 8%, daily drawdown limit 5%, total drawdown 10%, leverage 1:30;

Stage 2: target profit 5%, daily drawdown limit 5%, total drawdown 10%, leverage 1:30.

The highlight of the program is a one-time payment after successfully completing two phases.

The cost of packages in this category is based on the size of the trading account and a one-time fee:

Account size Cost Remuneration

$5000 $39 $210

$10000 $78 $420

$25000 $195 $1050

$50000 $390 $2100

$100000 $780 $4200

$200000 $1560 $8400

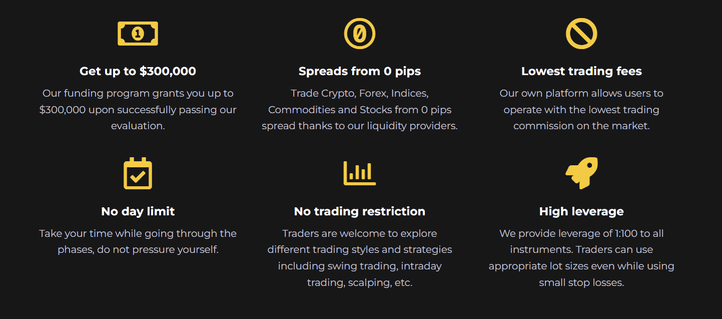

CryptoFundTrader offers a wide range of trading instruments and platforms, flexible conditions, and some of the lowest commissions on the market. Let’s take a closer look at these features below.

Traders can choose between several platforms and work with more than 900 assets.

Bybit platform: over 715 cryptocurrency futures pairs.

The CryptoFundTrader and MetaTrader 5 platforms offer over 200 instruments, including: 125 cryptocurrencies, 39 currency pairs (Forex), 15 indices, 10 commodities, and 25 stocks.

This gives users access to both the crypto market and traditional financial assets.

The size of CFT leverage depends on the account type and selected tariff.

Bybit accounts: up to 1:100, depending on the instrument.

Advanced accounts (CFT platform and MT5): 1:100

“Student” accounts (CFT platform and MT5): for cryptocurrencies – 1:5, for forex – 1:30, for indices – 1:20, for commodities – 1:30, for stocks – 1:5.

The structure of the CryptoFundTrader commission also depends on the selected platform.

Bybit applies standard market commissions (which vary depending on the pair and volume) on the Bybit platform. Crypto Fund Trader does not add any markups.

On the CFT platform and MetaTrader 5: cryptocurrencies – 0.0325% on each side of the transaction, commodities – 0.0005% on each side, equities – 0.002% on each side, Forex – $2.5 per lot on each side, indices – 0.005% per lot on each side.

Trading conditions and permitted strategies

Trading on news: permitted.

Weekend trading: permitted for cryptocurrencies (24/7).

Forex operates Monday through Friday, while commodities and indices have individual schedules.

Opening positions over the weekend: permitted for all accounts.

Any strategies are permitted except: high-frequency trading (HFT), arbitrage, tick scalping, using strategies against the live market, aggressive betting on the entire capital in a single trade, and hedging between accounts. Crypto Fund Trader emphasizes that traders must adhere to reasonable risk management.

Crypto Fund Trader does not set limits on lot size. Restrictions are determined solely by the available margin and the leverage set on the account.

Crypto Fund Trader imposes specific restrictions to prevent unfair strategies. Here are the key points that every trader should be aware of.

Reverse Trading Rule. Traders are prohibited from simultaneously holding trades in opposite directions (buying and selling the same asset) for longer than 60 seconds. This means that if we have opened a SELL trade, in order to open a BUY trade on the same asset, we must first completely close all active sales. The exception is that various cryptocurrency pairs against the dollar (for example, ETH/USD and BTC/USD) can be traded in opposite directions at the same time. However, it is prohibited to open opposite trades on different currency pairs of the same asset (for example, BTC/USD and BTC/EUR). Hedging between different accounts is prohibited, even if they have different email addresses but are actually managed by the same user. If a position is held for 24 hours, then you can open an opposite trade without first closing the first one.

Gambling / All Money in One Trade Rule. Crypto Fund Trader limits the amount of profit in a single trade or per day to prevent high-risk bets. The maximum profit per trade or per day is $10,000. Once the return on open trades reaches $10,000, all active trades are automatically closed. Any amount exceeding the limit will be debited from the account. If a trade is closed in parts or several trades are opened at the same time, they are considered as one trade for the purpose of calculating the limit.

Trading on real accounts with CryptoFundTrader comes with clear profit distribution terms, capital limits, and convenient withdrawal methods.

Profit distribution: the trader receives 80% of the profit, and the company receives 20%. The share is calculated based on the amount requested for withdrawal.

Maximum account size: The size of a single user’s real account must not exceed $300,000. Please note that this restriction applies only to allocated capital, not profits. Earned profits may exceed the limit.

Number of challenges: there is no limit to the number of challenges that can be completed simultaneously; users can have several active challenges under one email address.

When can you withdraw funds: the minimum requirement is to trade for at least 15 trading days. Alternatively, you can request a withdrawal after 30 calendar days, even if you have traded less frequently.

Withdrawal request process: submit a request via your personal account, after which you will receive an email with confirmation instructions. Next, you must sign a contract and complete the KYC procedure. All transactions on the account must be closed at the time of the withdrawal request, otherwise they will be closed automatically by the system.

There is no minimum withdrawal amount; the system allows you to withdraw any amount.

The withdrawal processing time is divided into two stages. Application verification takes up to 48 business hours. Funds transfer after confirmation takes up to 24 hours.

CryptoFundTrader offers convenient methods of receiving profits: bank transfer in EUR or USD, or cryptocurrency transfers in USDT (ERC20), USDT (TRC20), Bitcoin (BTC), and Ethereum (ETH). Traders can choose the most convenient method of receiving payments when submitting their application.

If a trader violates the rules and their real account is suspended, but there is still profit in the account, they will still be able to receive a portion of the funds they have earned.

The conditions for receiving 50% of the profit after blocking are quite simple. All trades on a real account must have a set Stop Loss. No trade should exceed 2% of the total account size. Trading must be conducted for at least 15 days. All conditions must be met simultaneously. The trader must submit a request to receive 50% profit within 7 days after the account is suspended.

Crypto Fund Trader offers flexible withdrawal terms with no minimum limits and convenient payment options, but requires strict adherence to trading rules on real accounts.

In addition to services for traders, Crypto Fund Trader is actively developing its affiliate program. The company offers traders, bloggers, and agents the opportunity to earn money by attracting new customers. The terms of the program are designed for both individual referrals and those who are ready to build a full-fledged network. Let’s take a look at the bonuses and rules offered by the Crypto Fund Trader affiliate program.

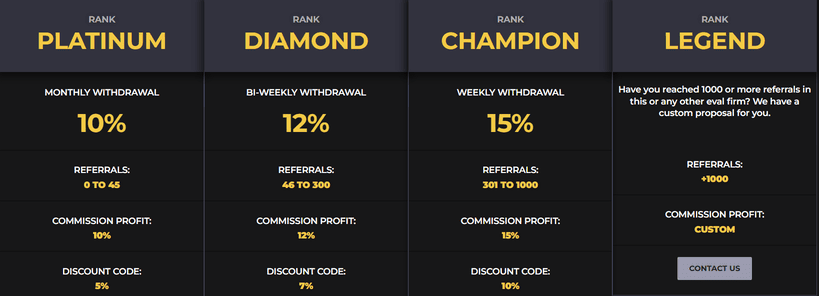

The CryptoFundTrader affiliate program offers several levels of cooperation with different payment and commission terms. The more referrals a partner attracts, the higher their profit percentage and the more frequent the payments. Here is how the levels are distributed:

– Platinum Level

Number of referrals: from 0 to 45

Commission fee: 10%

Payment frequency: monthly

Promo code for referrals: 5% discount

– Diamond Level

Number of referrals: from 46 to 300

Commission fee: 12%

Payment frequency: every two weeks

Promo code for referrals: 7% discount

– Champion level

Number of referrals: from 301 to 1000

Commission fee: 15%

Payment frequency: weekly

Promo code for referrals: 10% discount

– Legend Level

Number of referrals: over 1,000

Commission fee: individual terms and conditions

Payment frequency: to be discussed separately

To obtain the terms and conditions, please contact the Crypto Fund Trader team.

Want to get a 5% coupon? Here’s a real way to do it—no strings attached. By registering via our link, you immediately receive 5% that can be used to pay for any fare. Then, request a refund in our app and receive 7.5% of the fare you paid.

First, go to the official CryptoFundTrader website via our referral link

https://cryptofundtrader.com?_by=feebacker_com and click the yellow “START CHALLENGE” button at the bottom of the screen.

First, select the tariff that interests you most from the drop-down list, click on the trading platform you prefer (e.g., MetaTrader 5), and then click on “Start Evaluation” below it. Please note that there are also three clickable buttons above the table: “1 Phase,” “2 Phase,” and “Ascend.”

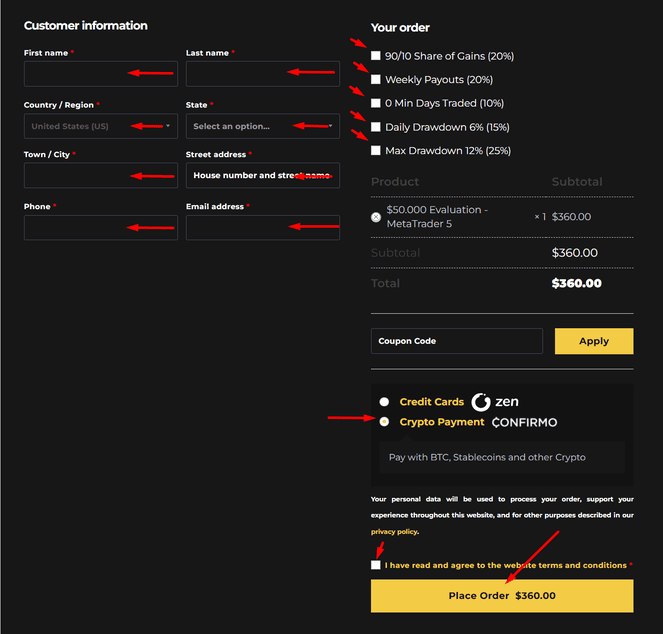

In the next step, fill out the form with your contact information: first name, last name, country, region, city, home address, phone number, and email address. Please note that you must enter accurate personal data, as it will be used for verification later on! To the right of the contact form, you can select various paid privileges for our package: increase the profit share to 90%, weekly payments, reduce the minimum trading days from 5 to 0, increase the daily drawdown from 5% to 6%, increase the maximum drawdown from 10% to 12%. These options are quite useful, but if you order them all, the cost of the package increases by 90%, but that’s up to you to decide. Below, select the payment type: “Credit Cards” or “Crypto Payment.” Check the “I have read” box to agree to the public offer agreement and click the “Place Order” button.

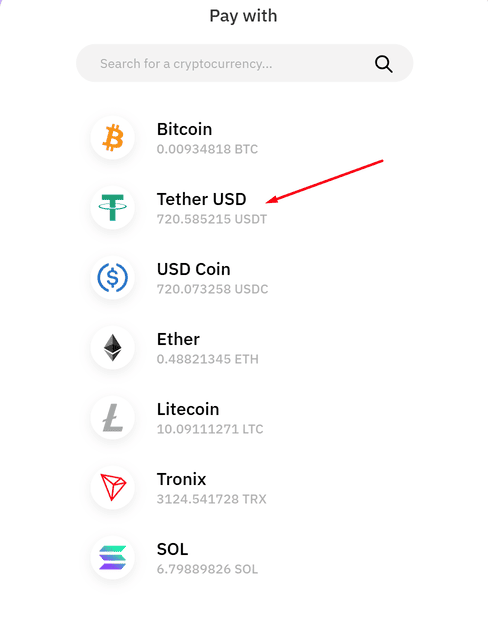

Next, select the type of cryptocurrency for payment and click on it. There are currently 7 options available: Bitcoin, Tether, USD Coin, Ether, Litecoin, Tron, Sol. We will make a payment using USDT as an example.

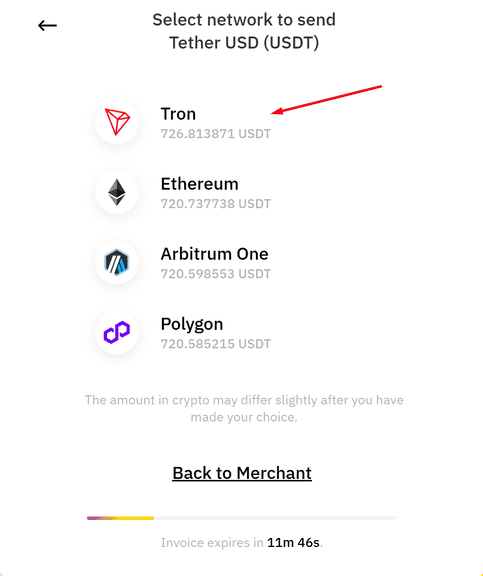

Next, select the network to which you want to send your USDT and click on it.

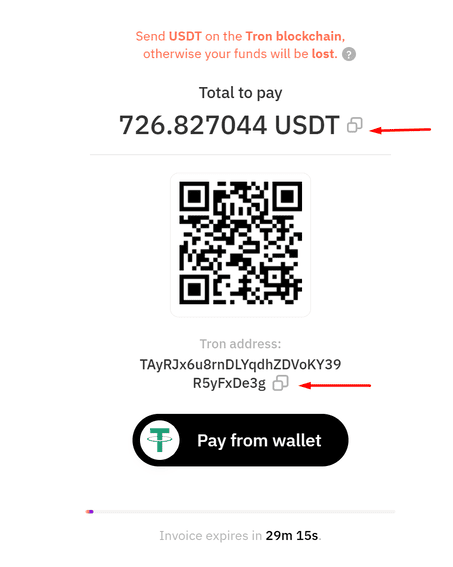

In the next window, copy the exact amount and wallet for payment. Or make a payment using the QR code.

After payment, we wait for a while until the network confirms the transaction and the system automatically redirects us to the CryptoFundTrader personal account.

A new feature aimed at optimizing the trading experience allows traders to automatically complete CryptoFundTrader KYC procedures as soon as they reach the final stage of their assessment. The verification operator in this case is a third-party company, CoinScope, which has many years of successful experience in this field. Previously, the CFT KYC process was manual, which often led to delays in withdrawals. With the updated system, traders no longer have to wait several days for their CFT KYC to be verified; now it happens in real time, providing faster access to their earnings.

Choosing a prop firm is an important step for any trader, especially in the cryptocurrency sector, where the market is unstable and competition is high. Crypto Fund Trader programs may seem attractive: affordable participation, good trading conditions, high profit distribution. All this makes the platform interesting for those who want to work with large volumes without risking their own funds.

However, behind the outward simplicity, there are always details that can affect the final result. CryptoFundTrader is a young company without a license, with virtual accounts and a limited track record. To objectively assess all the opportunities and risks, let’s take a closer look at its strengths and weaknesses. Below are the main pros and cons to consider before starting cooperation.

Pros:

Minuses:

Crypto Fund Trader is a young but ambitious prop firm that offers traders access to a wide range of instruments, low commissions, and flexible working conditions. The ability to trade without time restrictions during the verification stage and use real market data makes their offer particularly attractive to experienced crypto traders.

CryptoFundTrader is suitable for those who value freedom in choosing a trading strategy, know how to control risks, and are willing to work within established rules. For conservative traders or those seeking full legal protection, licensed companies may be a more suitable choice.

Before you start working, we recommend that you carefully read all the rules and conditions, complete KYC, and start with a small test to evaluate the convenience of the platform and the quality of service.

PLEASE NOTE! 5 things to do before you start working with Crypto Fund Trader

Write or call us. We will help you quickly re-register your accounts. Enjoy a new level of trading with cashback every month.

You are used to trusting professionals in your everyday life. Trust us with your interactions with exchanges. You won't want to go back to trading without Feebacker.com.